3 Reasons Rent to Own Homes Why Make Strong Investments

There are plenty of real estate investing niches that you need to keep an eye on. From buying distressed properties, to pursuing luxury commercial housing, your options are open. However, one option that many investors wind up overlooking is how rent to own homes come into play.

However, how do these properties become great real estate investments? The value of the rent to own process is clear for home owners, but from an investment standpoint it is a little more unclear. So, in order to show you how rent to own homes can serve a powerful role in your investment portfolio, here are three ways you can incorporate them while seeing a meaningful benefit.

But first, if you would like to learn about mortgage products that work well for both private and government rent to own programs, click the link below for a free strategy call with our mortgage team at LendCity today.

What Are Rent to Own Homes?

First, lets establish what exactly rent to own homes are. Essentially, these are properties in which a tenant and the property owner come to an agreement for the tenant to eventually buy the property they are renting and assume ownership.

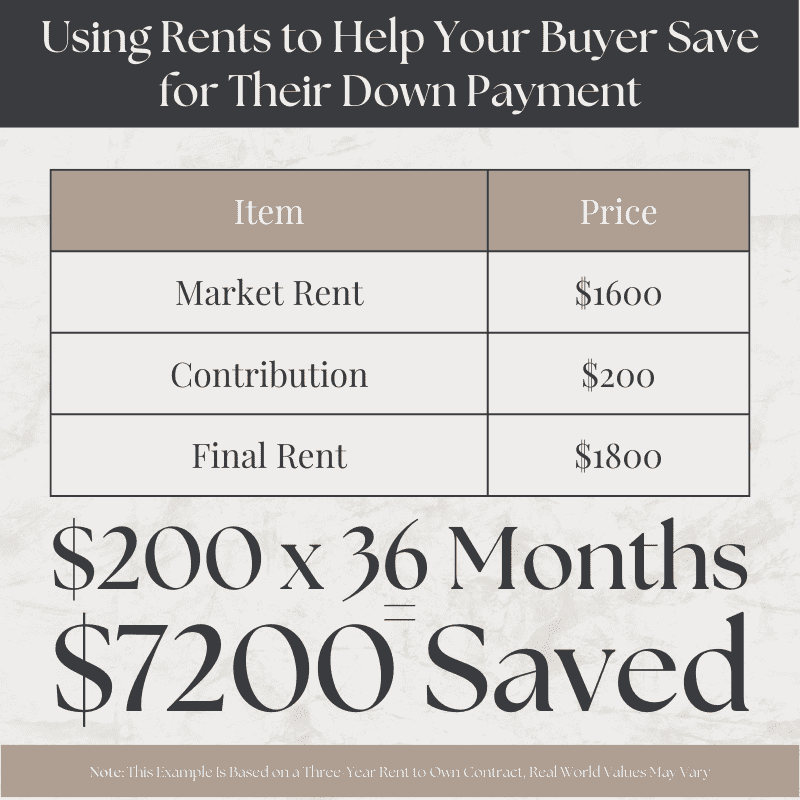

However, instead of immediately buying the property as they would with a traditional purchase, they continue renting while making gradual payments and contributions to their down payment so that when the agreed upon period concludes, they can have both the down payment and financing lined up.

Rent to Own Agreements

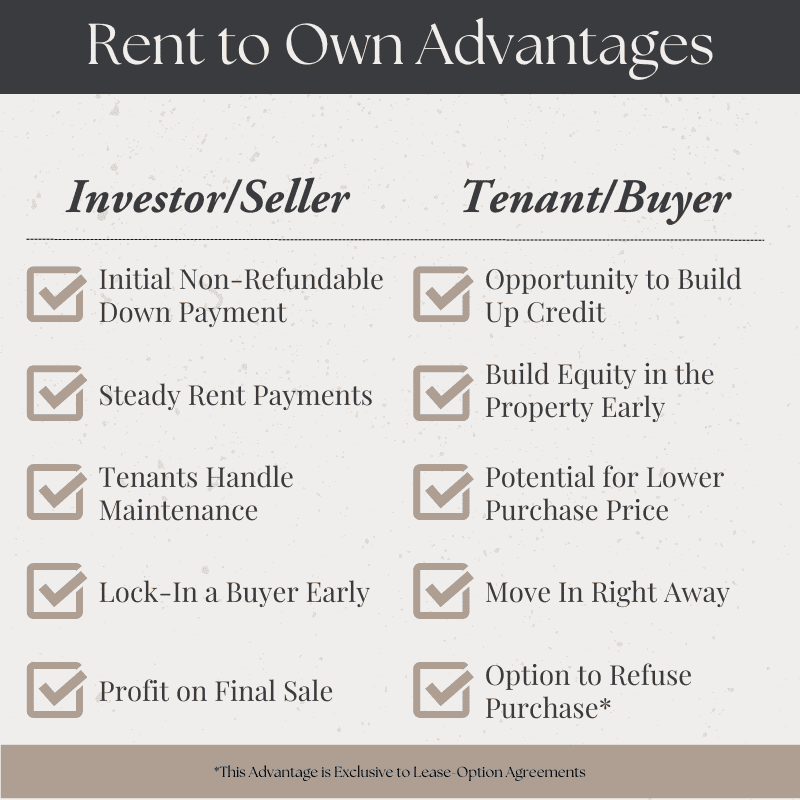

Rent to own agreements are typically structured in one of two ways - a lease-option or a lease-purchase agreement.

A lease-option agreement means that at the end of the period, the renter has the option to purchase the property, but is not obligated to do so. However, if the renter chooses not to buy, they surrender the funds they spent towards the down payment.

A lease-purchase agreement means that when the period is over, the renter is obligated to buy. This typically comes at a lower rent cost for the prospective buyer because the property owners knows that they will be purchasing at the end of the period. However, it does run the risk of the renter taking on more debt than they can manage to hold up their side of the agreement if they are not prepared to buy at the end.

1. Buy Your First Investment With Rent to Own Homes

One of the first advantages of rent to own homes for real estate investors is the fact that they serve as a manageable point of entry for new investors looking to buy their first property.

After all, one of the primary struggles for anyone who wants to invest in the real estate market is buying their first property and making the first down payment. With a rent to own property, this struggle is reduced by giving you the ability to build that down payment with your rent, while also working on your own savings or existing investments.

One of the best ways to use rent to own homes to buy your first investment property is by finding a property that you can potentially use to house hack and using the rent to own strategy in order to acquire the property.

This way, once you take possession you can both own your own home, and begin operating your first rental property with a single purchase.

Discover Rent To Own With This Step By Step Guide

2. You Can Sell Rent to Own Homes to Maintain Cash Flow

Sometimes, it can be hard to sell a cash flowing property - even if you know you want to get rid of it. This is an understandable struggle because the passive income from the rental property can be great, but you also need to know when to move forward.

One way to walk the line between maintaining your cash flow and moving on from a property is through rent to own homes. This way, for the duration of the rental period before the tenant goes to make the final purchase, you can still collect rent and earn the cash flow you want - often in higher amounts than you were before entering the agreement. Then, when that period is over, you get the benefits of selling the property and collecting the equity you built.

3. Rent to Own Homes Are Often Low Maintenance

Often, because the tenant is set to assume ownership of the property, rent to own real estate is very low maintenance for the property owner. This is because as the person contracted to buy the property, the tenant has a personal interest in maintaining the property and keeping it in good condition.

This means that not only are you making more cash flow on the property during the rental period, but you are also likely to save money on property management and property maintenance as well.

Financing Rent to Own Homes

Whether you are buying or selling rent to own properties, it is always important to take the time to ensure that the mortgage lender understands your agreement and has a product that is best-suited to all parties involved.

This is why you should always go to a mortgage broker that they can help you connect with their network of lenders and get the best available product for your investment strategies and goals.

So, in order to help you get started today, we would like to offer you a free strategy call with our mortgage team at LendCity. All you need to do is click the link below and book your call, then, we can help you get the financing you need for your rent to own investments and other investment strategies.