4 Great Ways To Make Raw Land Investing Work for You

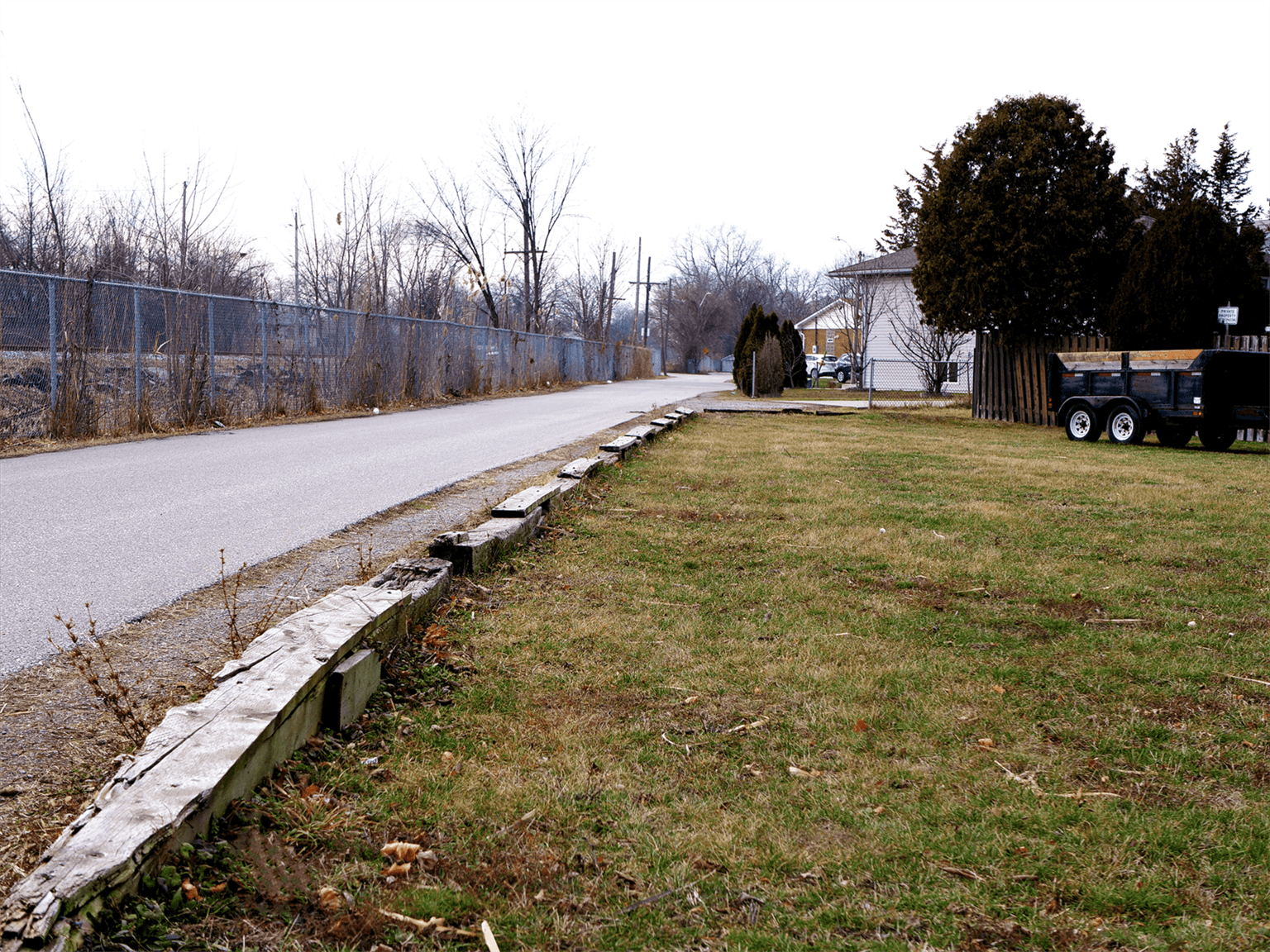

When looking for real estate opportunities, you may have come across something is known as raw land investing. “Raw land” refers to land that hasn’t been touched, meaning there have never been homes or other structures built on the property or used to grow crops.

Raw land investing is enticing to investors because these properties present several different ways to make money. This type of property can be utilized in many ways, including development opportunities. Some investors also choose to buy raw land when it’s a bit cheaper and then sell it after property values go up. There is always a way to make money with raw land investing as long as you make a solid plan.

Another great benefit of raw land is that it’s usually much cheaper compared to developed land. So, if you don’t want to buy an expensive property and risk losing a lot of money, then raw land investing could be a great option!

If you would like to learn how to secure property financing for raw land investing, click the link below for a free strategy call with our team at LendCity today!

Getting started with investing in raw land

It’s important to determine whether raw land investing is right for you in the first place. Sure, it’s an easier method of investing than many other options, but that doesn’t mean raw land investing won’t take a lot of work. The research on raw land properties in your area alone could take a lot of time. The only way you’re going to make money on a raw land investment is by choosing a good piece of land.

Raw land investing could also take more time to show profits than other methods. If you’re looking for a quick return on your investment, then raw land investing might not be the right opportunity. That said, if you are willing to put in the time and work, then raw land investing can be quite lucrative. Read on to learn about four of the best ways to make money with raw land investing.

Wait for the property value to rise

As mentioned above, many investors choose to buy raw land properties, then hold onto them before selling at a higher price. This might seem a bit risky but could pay off in a big way if you wait for the perfect moment to sell. The “buy and hold” method of investing, as it’s often called, is frequently utilized by investors wanting properties that don’t require much maintenance.

Using the buy and hold method with raw land investing has several benefits, including that you might be able to save money on property taxes. Buy and hold investments are also much easier to deal with than other types of property investment. It is, however, extremely important that you pay attention to market changes when using the buy and hold method. If you miss the window of opportunity to sell your property at a higher value, then you might be sitting on it for a long time.

Make it rentable

Some people choose to lease their raw land property out to certain businesses as a way to make money. Check and see if there is any interest in leasing raw law properties in your area. Businesses that commonly lease raw land properties include agriculture companies, livestock owners and many more. Allowing a business to rent your property means that you’ll have a constant income until they decide to move on. Depending on where you live, finding someone to lease your property can be surprisingly easy.

It’s important to determine how much you will charge someone leasing your property. Do some research on average leasing amounts. It’s commonly recommended that you charge individuals leasing your property around one percent of the total property’s cost per month, but this can vary. A real estate professional can offer great advice when it comes to leasing costs. Research the real estate professionals in your area and contact them for guidance.

Discover How To Develop Real Estate With This Step By Step Guide

Build something on the land

Raw land investors sometimes choose to do the inaugural development on a piece of land. You could build anything from single-family homes to apartment buildings to business centers. Depending on the size of your raw property, you may be able to have several different structures constructed. After building said properties, you can start renting them out to tenants and business owners. Rental fees from these structures alone could provide you with plenty of income.

It’s important to remember that developing structures takes a lot of time and money. With the price of construction crews, materials and more, you could find yourself in a lot of debt by trying to develop your raw land. That’s why you should always keep your budget in mind. Your budget will help you determine how many structures (if any) that you can build.

Divide the land into smaller properties

If you’ve purchased a large piece of raw land, then you might consider dividing it and selling various pieces to buyers. Buyers looking to buy their own piece of raw land will probably be more willing to invest in a smaller piece of property. Selling smaller pieces of raw land can potentially make you more money than selling one large piece.

Before selling the land in sections, however, it’s important to be aware of all local regulations. You don’t want to end up in legal trouble down the line just because you didn’t do proper research. This is another situation in which it’s best to have a real estate professional on your side. A good real estate professional will have the right resources to check land regulations in your area. They can also take care of the paperwork, which will help save you some time!

Investing in raw land can be a great option for certain types of investors. Both experienced and new investors will see the benefits of making a raw land investment for the right property. Just do plenty of research on the property in which you’re interested and recruit a team of professionals who can help you make the right decisions. With the right plan, making money from a raw land investment will be easy!

If you would like to learn how to secure property financing for raw land investing, click the link below for a free strategy call with our team at LendCity today!