5 Major Investing Mistakes Real Estate Investors Need to Avoid

While the real estate market can be unpredictable at times, many would be surprised to find out that the majority of real estate failures do not occur due to sudden market shifts or suboptimal conditions. Instead, the majority of real estate investors who find themselves out in the cold do so by making small investing mistakes that can result in expensive failures.

So, it is important to be careful about your approach towards the real estate investment market. Otherwise you may find yourself lost in a sea of fast-moving sales and high-budget flips without a clear route forward and plenty of investing mistakes behind you.

If you want to learn how to be a cautious investor and avoid five of the most common investing mistakes that investors make, this is the article for you.

But first, if you want to avoid making some of the most common investing mistakes with your financing, click the link below to book a free strategy call with our team today.

Investing Without a Realtor

When you dive into the world of real estate investing, your realtor is your eyes and ears while you are navigating through potential properties, complicated sales and more, so skipping out on one can be a huge investing mistake. It is not reasonable to expect every investor to know the ins and outs of each and every market they are entering on top of all of their other responsibilities. However, it is a realtor’s primary job to research and understand their local real estate market so that their buyers can find the best properties and the best deals to suit their goals.

As well, using a realtor can make it significantly easier to sell a property than if you were trying to sell one yourself. While it is true that it is cheaper to sell a property by yourself with a FSBO (For Sale By Owner) approach because you will not need to pay your realtor a commission, you wind up massively limiting your ability to get your market out there.

Realtors have the ability to list your property on the MLS (Multiple Listing Service) where everyone can see that it is available. As well, they have connections with other realtors in their offices and their network of clients to potentially bring a buyer directly to you instead of spending countless dollars and hours on marketing your property.

Skipping Out On Tenant Screening

If you are operating a rental property, one of the first steps you should take before renting your property to a prospective tenant is tenant screening. This is the process of qualifying your tenants for a property to ensure that they are personally and financially responsible enough to pay their rent on time consistently while also taking good care of the property.

While this may seem like an extra step that only adds time onto your process of finding a tenant, it is crucial to long-term success. After all, a tenant may have a decent job and the rent deposit ready, but their previous landlord may have evicted them for refusing to pay rent or causing excessive noise and disturbing the community. Skipping out on tenant screening means throwing out all potential caution and accepting an unpredictable level of risk that a tenant may not be the one you want.

This investing mistake can compromise both the short-term and long-term success of your investment if you make a poor enough choice.

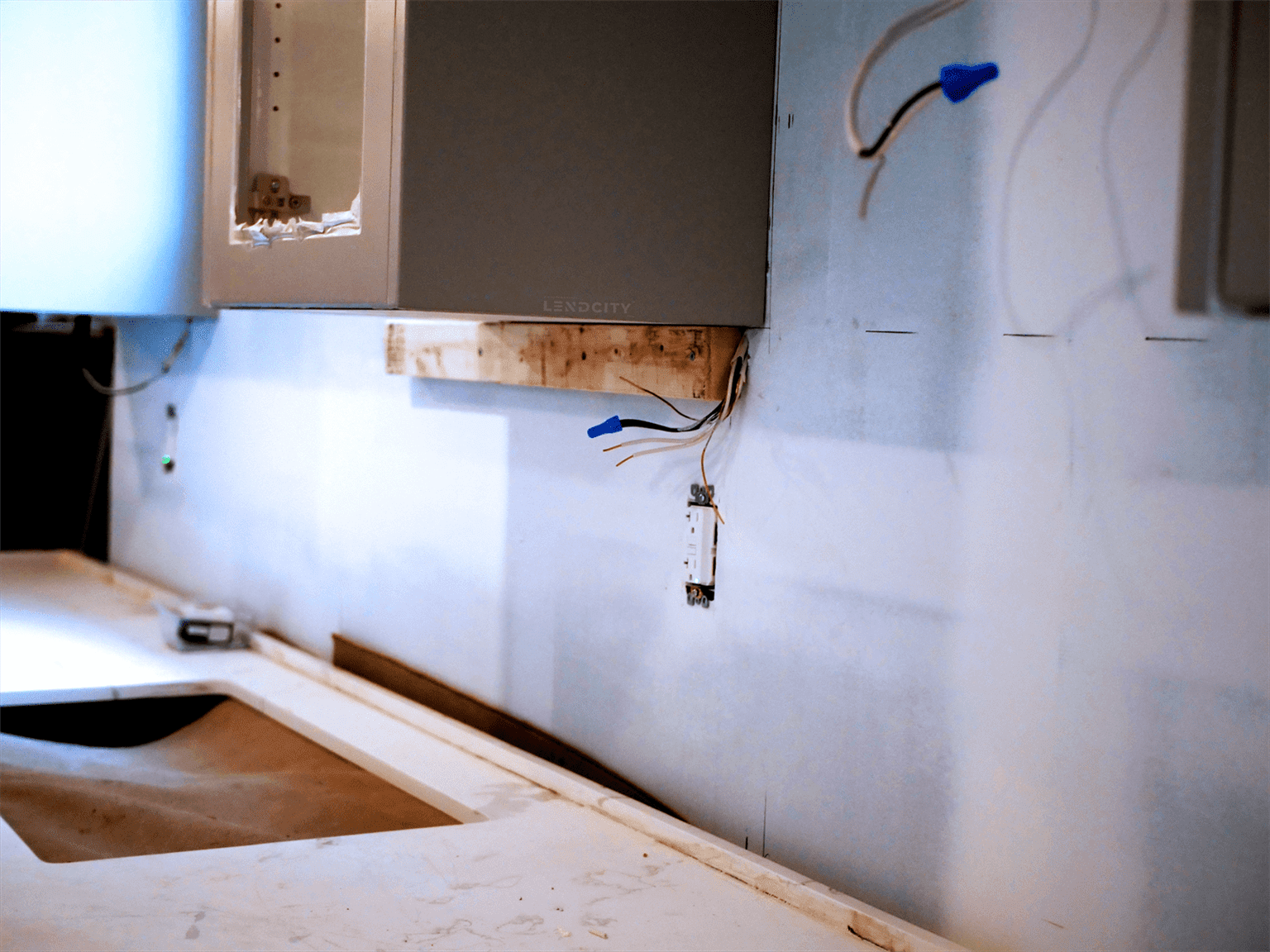

Failing to Budget For Maintenance and Repairs

Another detrimental investing mistake that investors can make when working on their investments is failing to set a proper budget for maintenance, renovations, and repairs.

Some new investors who do not have experience in managing maintenance requests and urgent repairs go into their properties with the impression that they will simply cover expenses as they happen. However, this makes it incredibly easy to overspend on expensive, overpriced contractors or excessive updates that the property does not need.

Instead, you should be setting aside a portion of your profits from all of your properties to build a dedicated renovation and repair fund so that you can always have funds available for your renovations. As well, you should be pricing out contractors and materials for all of your jobs so that you can get the top-quality work and product for the most manageable price.

Discover How To Buy Unlimited Rental Properties With This Step By Step Guide

Overpricing and Underpricing Properties

Pricing is one of the most important things you will need to master when it comes to real estate. If you set your rents too high or ask too much for a property, absolutely no one is going to want to look at your property listing. However, if you set your price too low, you are likely going to wind up losing money on sales, leaving money on the table, or generating negative cash flow on your rentals.

Instead, you need to be able to balance a property’s market value with your own property expenses to avoid making an investing mistake that will grind you cash flow to a halt.

Not Doing Your Research Before Trying an Investment Strategy

Not all investment strategies are built equally, so it is important that you have a strong foundation and understanding of any approach you want to take towards your portfolio. Otherwise, you can walk into a variety of the worst investing mistakes.

For example, while Airbnb may sound like an easy way to earn high amounts of money off of a property, the careful regulations and management requirements for these properties are much higher than people would typically expect. This single investing mistake could derail your entire plan for the property - thus you need to research.

Bonus: Not Getting The Best Mortgage For The Job is an Investing Mistake

Another investing mistake that people make all the time with their investments is getting the wrong mortgage for their strategy. If you are a flipper, you want a mortgage with minimal penalties for breaking your term. If you are selling one property to buy another, you want to get a bridge loan instead of a normal mortgage.

However, instead of getting caught up trying to understand all of the different nuances of mortgage financing and finding the best lender, you can always turn to a mortgage broker like LendCity to get the job done for you. By calling LendCity, you gain access to our network of experienced lenders in order to lock down the best available mortgage for your investments every single time.

So, if you are ready to get started, visit us at LendCity.ca or give us a call at 519-960-0370. Alternatively, click the link below to book a free strategy call with our team at LendCity.