5 Smart Tips for Maximizing Cash Flow and Increasing the Profitability of Your Rental Investments

When you are investing in rental properties, cash flow is key. So, naturally you are going to want to find a way to maximize your cash flow in order to get the most out of your investment.

In case you do not already know, cash flow is the difference between the rental income made by a property and the monthly expenses for the property. This means if a property costs $1400 per month to own and maintain between mortgage payments, insurance, utilities and other recurring expenses, and the rent is set at $1700, you can expect $300 in cash flow from the property each month.

However, while most properties will net you some degree of cash flow, it is important that you know what to do in order to get the most out of each property. So, to help you get started, here are five tips to help you maximize your cash flow.

But first, if you want to learn how to maximize your potential cash flow by reducing your monthly mortgage costs, click the link below to book a free strategy call with our team at LendCity today.

Stay on Top of Rent Payments

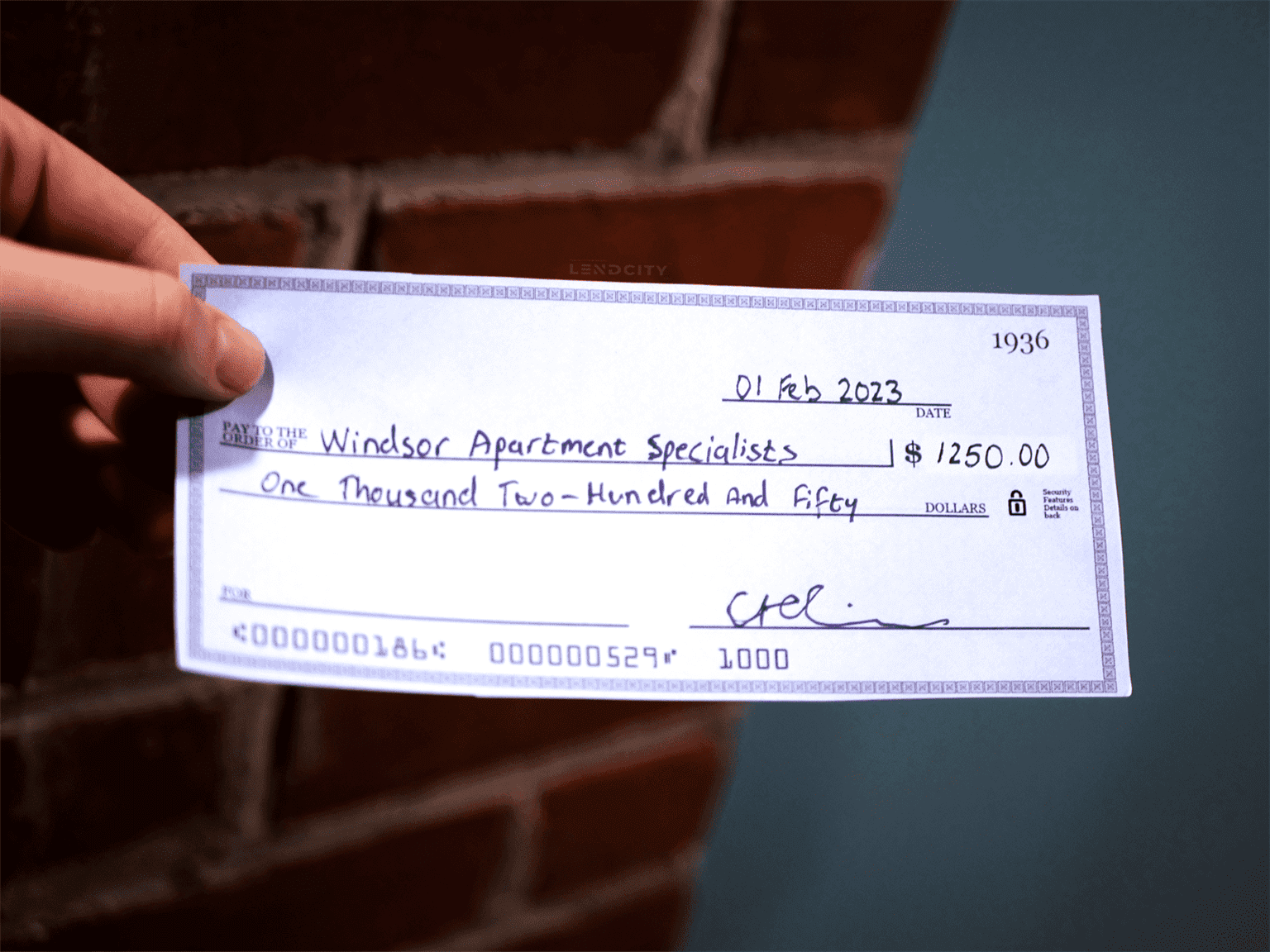

Late or missed rent payments are the bane of every investor. After all, by allowing your rent payments to come in late, or being forced to chase down tenants for missed payments, you are running the risk of losing a ton of money. That is why you need a method to stay on top of your rent payments to ensure they are all coming in on time and in a timely fashion.

This can include setting reminders for your tenants when rent is due – typically the first of the month or setting up direct rent deposits with your tenants so that payment can occur automatically. Automatic rent deposits also frequently come with the added benefit of being reflected in the tenant’s credit score. This can help reward tenants for making payments on-time and incentivise tenants who may miss a payment or wind up paying late to try and make the payment on-time.

Focus on Property Improvements

Another way you can maximize the cash flow on a property is by taking the time to focus on improving the property. This can be through renovations or other quality of life improvements that tenants will appreciate and be willing to pay more for.

If you are improving a property in order to increase your cash flow by raising the rent, take some time to look at which improvements bring the highest return on investment. Often some of the most popular are fresh paint and kitchen and bathroom improvements.

However, if you are not looking to renovate your properties, there are other things you can do to improve the property for your tenants and increase the value of the home. For example, you can update the heating and cooling system to improve the climate and air quality in the unit, or you can provide high-speed internet so that your tenant does not have to worry about setting up a separate internet plan on top of their current expenses.

Just remember, whenever you are doing something with the intent to raise the rent in Ontario, you cannot exceed the maximum rent increase on an occupied property each year without approval from the landlord tenant board. So, you should either make these improvements between tenants or after first discussing them with the tenant to make sure they are on board with the rent increase beforehand.

Discover How To Analyze a Properties Cash Flow With This Step By Step Guide

Handling Tenant Turnover

Tenant turnover and vacancies are cash flow killers. After all, if there is no one in your properties in order to pay rent, you are not going to be making any money. So, in order to maximize the cash flow you need to be able to cut down on how long tenant turnover takes and the amount of time your properties stay vacant.

The first key to this is marketing. If you want to get a tenant into your property, you need prospective renters to see the unit and decide they would like to live there. You can list your rental property yourself on places such as Facebook Marketplace or Kijiji or go through a property management service and have your property listed professionally. Either way, try to make sure the listing has a clear description of the property and bright, clean photos that show the unit at it’s best. Ideally, you will do this as early as you know you will need to find a new tenant so you can minimize the time that the unit is empty.

You also may want to consider hiring cleaners between tenants so that you can make the unit more presentable to anyone who would like to view the home.

Bundle Property Expenses to Save Money

Whenever possible, you should consider bundling property expenses together in order to save money and increase cash flow. Often, by bundling your payments into a single payment you can get better deals from insurance providers and utility companies. This can also simply the process when you need to make an insurance claim on a property because all of your plans are bundled through the same provider, saving you time as well as money.

Keep up with Rent Increases

Finally, another key trick to maximizing the cash flow on a property is keeping up with the rent increases. In Ontario, there are limits on how frequently you can increase the rent and how often you can do so. If you do not take advantage of these increases, you do not get to catch up on them later. So, in order to prevent your cash flow from slowly being eroded by inflation and rising property costs, you need to stay on top of the increases when you are able to make them.

Bonus: Maximizing Cash Flow with Lower Monthly Payments

If you truly want to maximize your monthly cash flow, get started with a mortgage with the lowest available monthly payments. At LendCity we work with a variety of lenders in order to ensure you get the lowest rates and the best monthly payments available for your income properties so you can get the highest returns on your investment. To learn more or to get started, visit us at LendCity.ca or give us a call at 519-960-0370. Alternatively, click the link below to book a free strategy call today.