5 Tips to Help New Real Estate Investors Find Achieve Financial Freedom

The goal of achieving financial freedom and living off of passive income is the dream of many real estate investors. However, simply buying and selling property is not enough to make that happen.

Real estate is a complicated market with plenty of twists and turns that can greatly impact the success of any individual investor. Additionally, while one type of investment may be perfect for a specific style of investor, it may be totally wrong for someone else’s portfolio and will not provide them with the same success. That is why it is important you are well-informed and prepared before you begin investing.

So, in order to ensure that you succeed as a new real estate investor, or if you are looking to take a new approach at real estate investing. Here are five tips that can help you achieve the financial freedom you have been seeking.

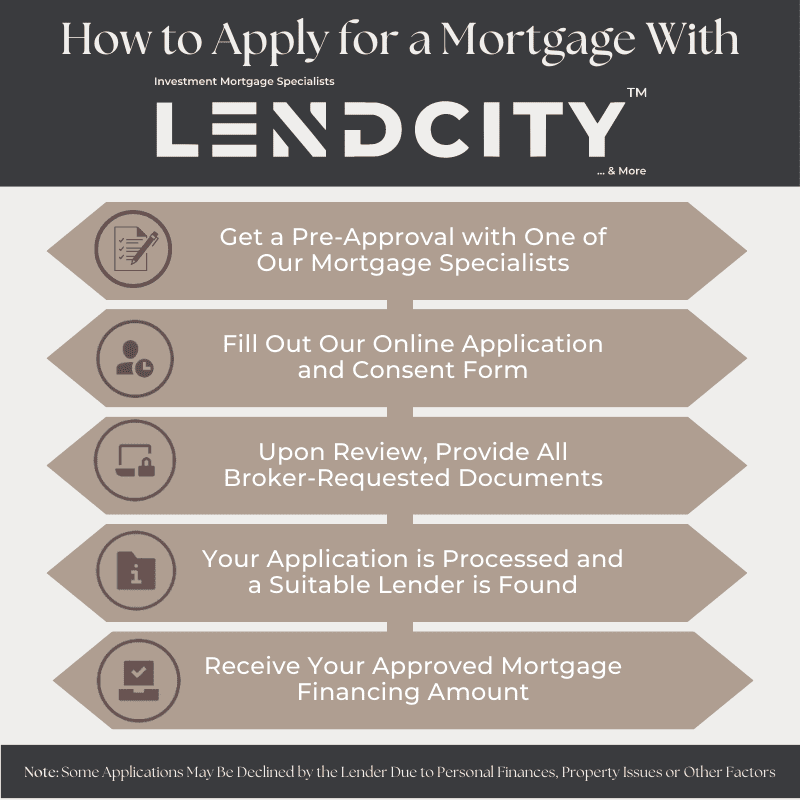

However, before we get started, if you want to start achieving success in real estate early, get started by equipping yourself with a pre-approval from an experienced lender.

That is why at LendCity, we want to offer you a free strategy call to help kickstart your investments. All you need to do is book your call at the link below and a member of our team will gladly help you kickstart your investing career.

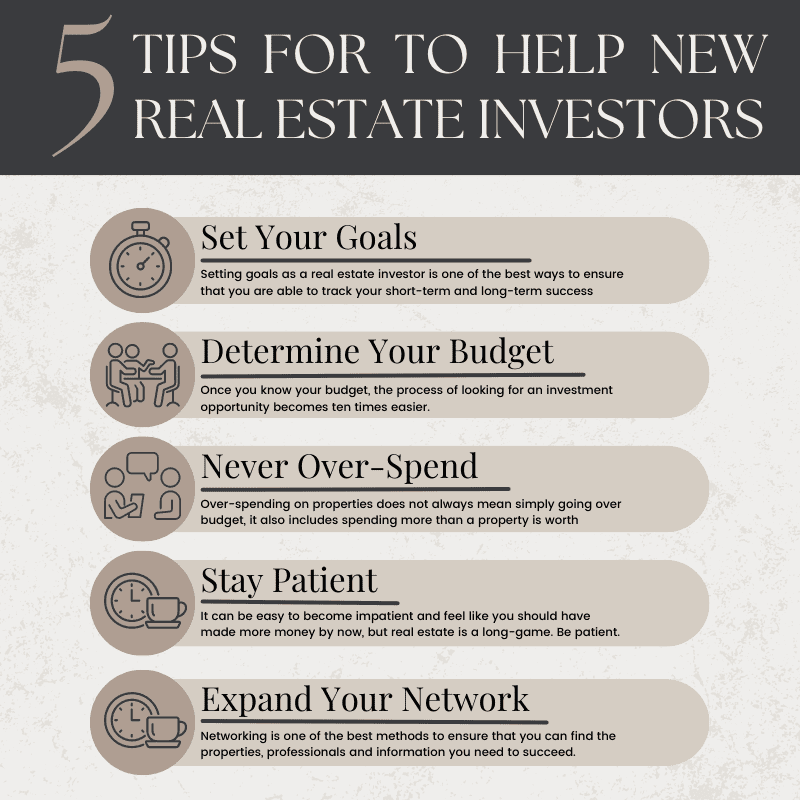

Set Your Goals and Develop a Strategy

First things first, never go into the market without a plan. If you start blindly buying properties without first setting your goals and strategy, you may easily find yourself spending additional time and money on properties that are not going to help you achieve any sort of long-term success.

Start by setting your goals. These can be anything that you want to achieve through real estate investing. For example, let’s say your monthly expenses are currently about $2500. You may decide that within the next five years you want to be able to cover those expenses strictly through the cash flow you can generate from rental properties. Or you could decide that within ten years you want to be able to quit your job and support yourself entirely off of your real estate investments. By setting these goals you allow yourself to actively track how much progress you are making with your portfolio, and you can use these goals to help you stay motivated.

From there you can build your own strategy in order to achieve those goals. For example, perhaps you live in a city with a blossoming tourism industry and a high demand for vacation rentals. One of the best strategies for you may be offering short-term rentals in prime locations through services such as Airbnb or VRBO. Alternatively, perhaps you find yourself looking at properties in a wealthier neighbourhood that is quieting down with an older population, then you may wish to consider senior rentals with attractive accessibility features.

Determine Your Budget

Whenever you are walking into a real estate deal, you need to be fully aware of exactly how much money you can afford to spend on a given property. Otherwise, you can find yourself wasting time and pursuing deals you will not be able to close. If that is the case, you can potentially find yourself out on the cash required for things such as inspections or appraisals that you could potentially have paid for in order to satisfy a lender.

One of the best ways to figure out exactly how much you can afford is to get a pre-approval from an experienced lender so that you can lock down the lowest available interest rates and learn the highest financing amount you can be approved for at a given time. This way you can narrow your search to exclude properties that are outside of your price range and assess properties you may wish to buy with an accurate idea of what your monthly payments will be.

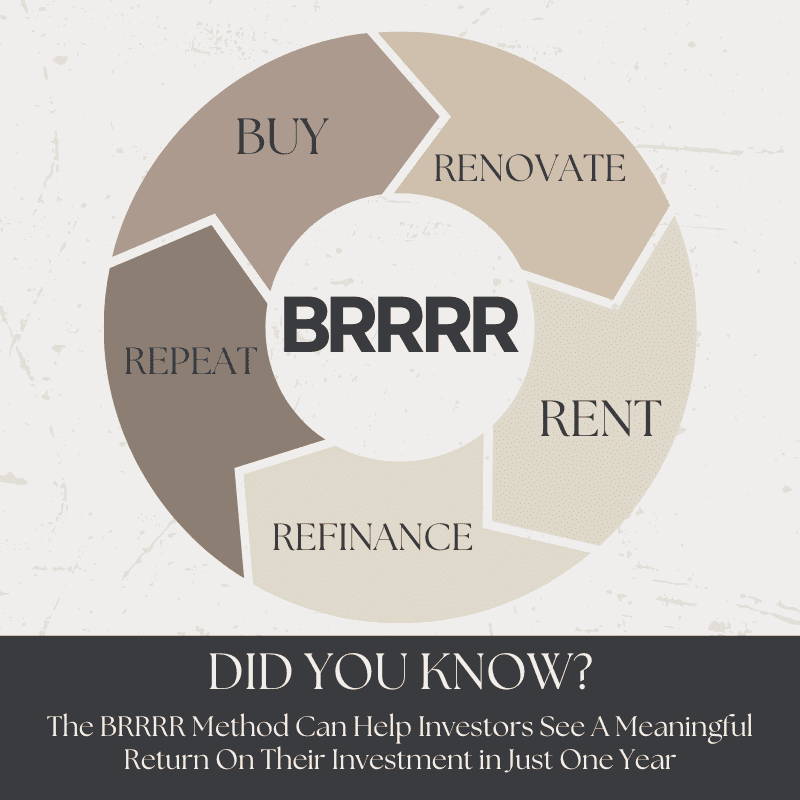

Discover How To Buy Unlimited Rental Properties With This Step By Step Guide

Never Over-Spend on Real Estate

Sometimes it can be tempting to spend the maximum amount you are approved for on a property in order to ensure you can lock down an attractive deal, but this is not a reliable strategy. If you always spend the maximum amount of money, you have been approved for on a property, that means you are living at the absolute limits of your means and could find yourself carrying much more debt than you can manage.

Instead, you should always thrive to spend less than your maximum approval amount, when possible, in order to minimize the amount of debt you need to take on. This also can help you hold on to move of your cash and credit in order to spend it on things such as property renovations and furniture.

Mortgage Financing for Real Estate Investors

One of the best tools that both commercial and residential real estate investors can use in order to avoid overspending on real estate is a pre-approval from a well-connected mortgage broker.

That is why at LendCity, we remain connected to a wide network of lenders in order to ensure that real estate investors such as yourself have access to the financing they need every step of the way. To learn more or to get started today, all you need to do is book your free strategy call at the link below.

Stay Patient

Sometimes the urge to continue investing can lead investors to get carried away and rush into things. Impatience can appear in a few different ways. Whether you are getting worried about a downturn in the market and selling a property early, only to watch the market recover soon after, or buying a property during a downturn expecting things to bounce back only to witness the average home price continue to fall.

If you remain patient and pay close attention, the ideal moments will present themselves to you. However, do not let yourself get distracted and miss those opportunities while waiting for a sweeter deal to arrive.

Expand Your Network

Finally, whether you are a seasoned investor or are brand new to investing, do not underestimate the value of your network. By connecting with a variety of realtors and real estate professionals, you can gain access to leads and deal that otherwise may not have been available. You may also be able to form consistent working relationships with contractors and trades workers who can potentially cut you better deals in exchange for recurring business.

Taking the First Step

If you are ready to take the first step and dive into the world of real estate, let us help you by getting you set up with a pre-approval from one of our experienced lenders. Here at LendCity we pride ourselves on helping you secure the most financing at the best available rates for your real estate deals. So, to get started today give us a call at 519-960-0370 or visit us online at LendCity.ca to fill out our easy online mortgage application. Alternatively, you can book your free strategy call at the link below.