5 Ways to Ruin Your Fix-and-Flip Strategy Without Realizing It

The idea of purchasing a run-down home or building isn’t all that appealing. But, getting it at a fraction of its true value and spending a few months refinishing it—to sell it at a tremendous profit—is the ultimate dream. Unfortunately, it’s often a pipe dream for investors who don’t have realistic expectations.

Often, investors view fix-and-flip opportunities as “get rich quick” schemes. They don’t see these properties as investments, but rather cash-outs for capital to fuel their next purchase. This mindset is detrimental. It can quickly push you from being an investor to become a gambler.

Before we dive in, if you are ready to start a fix-and-flip or would like some more information about the financial side of these investments before you get started, click the link below to book your free strategy call with our team at LendCity today.

Be aware of what you’re getting into

Fix-and-flip opportunities can be lucrative. But investors need to be aware of the various hazards associated with the fix-and-flip strategy. Even the smallest miscalculation or error could lead to major losses.

While it’s possible to make a lot of money flipping properties, if you’re not an experienced investor or real estate professional, it’s even easier to lose a significant amount of capital on a fix-and-flip deal gone awry.

The most important thing you can do to ensure you successfully reap a profit while trying to fix-and-flip a property is to prepare for every possible catastrophe. If you have contingencies in place for any problems that might arise, you’re much more likely to succeed.

Property fix-and-flip mistakes

Both experienced and novice property flippers tend to run into problems, despite their best intentions. Here are some of the most common property flipping errors people are likely to make:

1. Failing to understand the market

At the end of the day, your ability to successfully fix-and-flip a property depends on your understanding of the real estate market and the local sub-section in which you’re operating. You’ll need to conduct a lot of market research before buying a property to fix-and-flip, and predict with some level of accuracy where the market will be in a year.

2. Not crunching the numbers

Most flipping failures have a common cause: the investor didn’t understand the necessary math. To successfully fix-and-flip a property, you have to calculate the initial investment and the cost of rehabilitating the property against the property’s fair market value in six months to a year. Many people don’t fully understand the costs of renovation or the state of the market well enough to make the transaction work.

3. Borrowing too much

Rather than taking out a mortgage, most house flippers rely on the services of hard money lenders. While these types of loans are lucrative for experienced flippers, first-time investors can find themselves struggling to keep up with the aggressive loan scheduling.

4. Completing rehab work yourself

Under no circumstances should you ever attempt to complete rehabilitation work exclusively on your own. Trying to handle things yourself in the interest of saving some money will almost always result in more expenses than if you’d just hired a contractor in the first place.

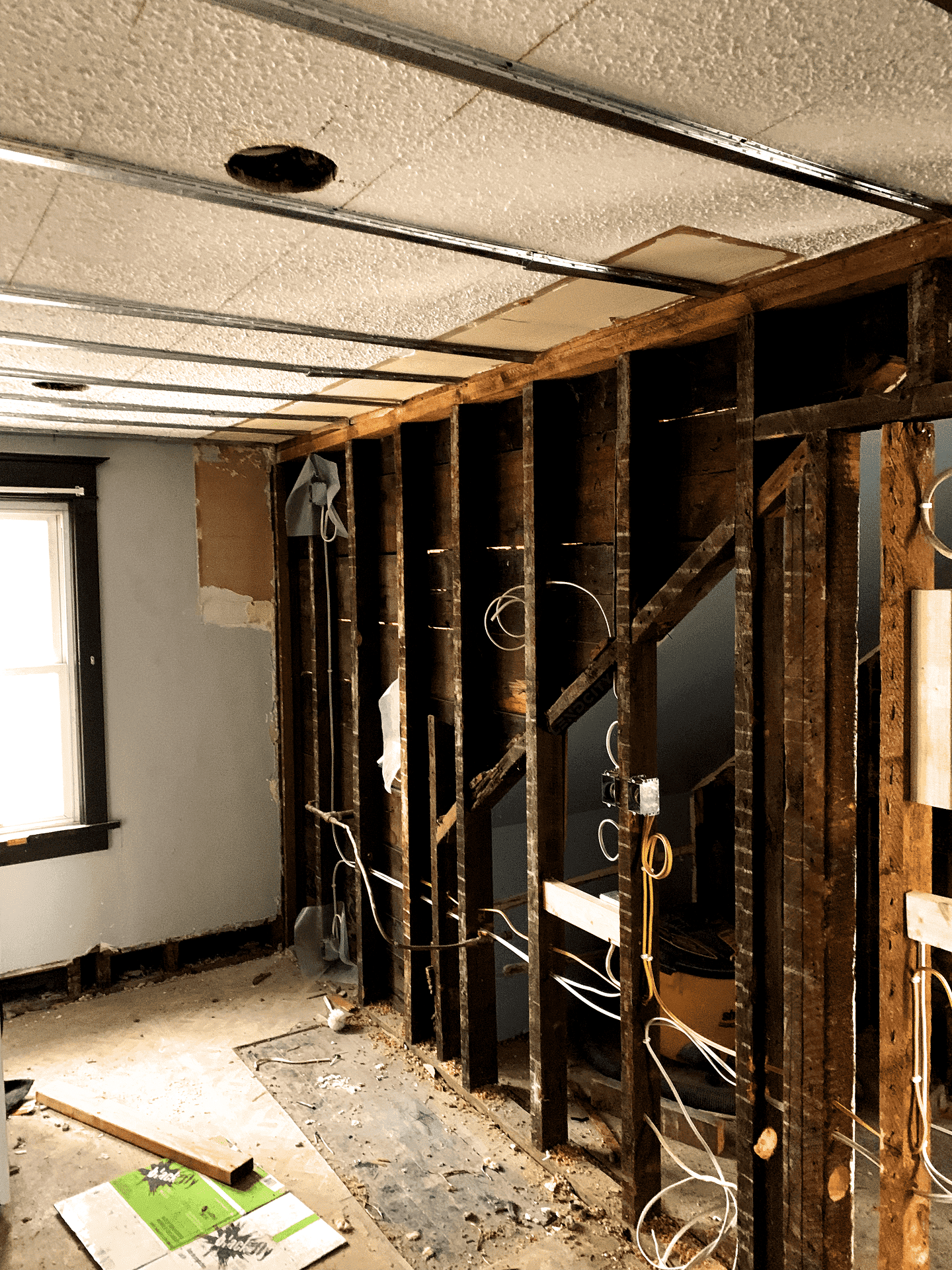

5. Undertaking a huge renovation

When you’re viewing a property, consider how much work is really necessary to get it up to its true market value. If you’re going to strip the asset down and rebuild it from the ground-up, you’re better off looking for another flipping opportunity elsewhere.

Discover How To Flip A House With This Step By Step Guide

Fundamental for successful flipping

Successful real estate flippers know there are common traits and fundamentals necessary for executing a profitable fix-and-flip.

You should have these things figured out before you attempt to buy a distressed property. For instance, you shouldn’t buy a flipping opportunity because you need cash to complete your next transaction. Instead, only purchase a flipping property when you already have the cash necessary to see this opportunity through.

Here are some of the fundamentals necessary to successfully fix-and-flip a home or building:

You need a lot of cash-on-hand

Many people think it’s possible to flip an asset without a lot of cash-on-hand. You can buy a property at dirt-cheap prices and fix it up yourself. Property flipping rarely actually turns out this way. Make sure you have enough cash to complete the fix-and-flip, regardless of what happens.

You have to have good credit

Even the most well-prepared investor might run into unforeseen challenges while attempting to flip a property. They might have to open a line of credit to complete the flip and still recoup their investment. You must have good credit before you start the flipping process for this very reason.

The property must be in a great location

Just because a property is cheap doesn’t mean it’s worth buying and flipping. The asset has to be in a great location with strong market growth, or else you’ll end up saddled with a nice building nobody wants to buy.

Never pay market value

The purchase price of the property, plus the cost of the renovations, has to be less than the current market value of the asset. If it’s not, you’ll end up pouring more capital into it than it’s worth. When it comes time to sell your property, you’ll end up taking a loss. Always try to predict the value of the property at the time your flip is complete, as well.

If you’ve never flipped a property before, don’t try to do it on your own. There are a lot of local real estate associations offering classes and support networks for people hoping to fix-and-flip their first piece of property. These seminars and networking opportunities are essential. You’ll learn about factors impacting your specific sub-market, and connect with other flippers who may offer you recommendations on the best contractors to hire.

Don’t gamble; invest instead

While fixing and flipping can be a lucrative opportunity for the right person, it’s important to enter the transaction with your eyes wide open. Never view property flipping as a way to quickly and easily pad your pockets. If you enter a transaction with the right fundamentals and the proper mindset, you’re much more likely to succeed. No flip should feel like a gamble. If it does, consider it a red flag. Instead, invest with calculated confidence.

So, if you are ready to start a fix-and-flip or would like some more information about the financial side of these investments before you get started, click the link below to book your free strategy call with our team at LendCity today.