A Strong Property Management Strategy is the Key to Passive Income in 2023

For real estate investors, passive income is the pot of gold waiting at the end of the rainbow. Many investors enter the market with the dream of someday being able to leave their jobs behind and live off of the returns they make from their investments.

The key to making this dream a reality is a strong property management strategy.

Passive income is, by definition, passive. This means that quitting your day job and collecting rent is not going to be enough to achieve this dream. Instead, you need someone who can step in and offer you a hands-off experience where you do not have to work every single day in order to make money and enjoy your life. This is where a strong property manager comes into the picture.

However, before you begin hunting for a strong property manager, maximize your budget by getting a strong mortgage that helps you keep your costs low. To learn more about how you can do that, click the link below to book a free strategy call with our team today.

The Dream of Passive Income

Passive income in real estate can be achieved in a few different ways, but the most common form of passive income is in the form of cash flow from operating rental property. In essence, cash flow is the difference between the amount of money the property generates in rent or other forms of income, and the total expenses of the property each month. As you expand your investment portfolio with cash flowing properties, you increase the amount of income you are generating through primarily passive cash flow.

Of course, this still leaves the question of how you can turn this income into purely passive income.

Strong Property Managers Offer a Hands-Off Experience

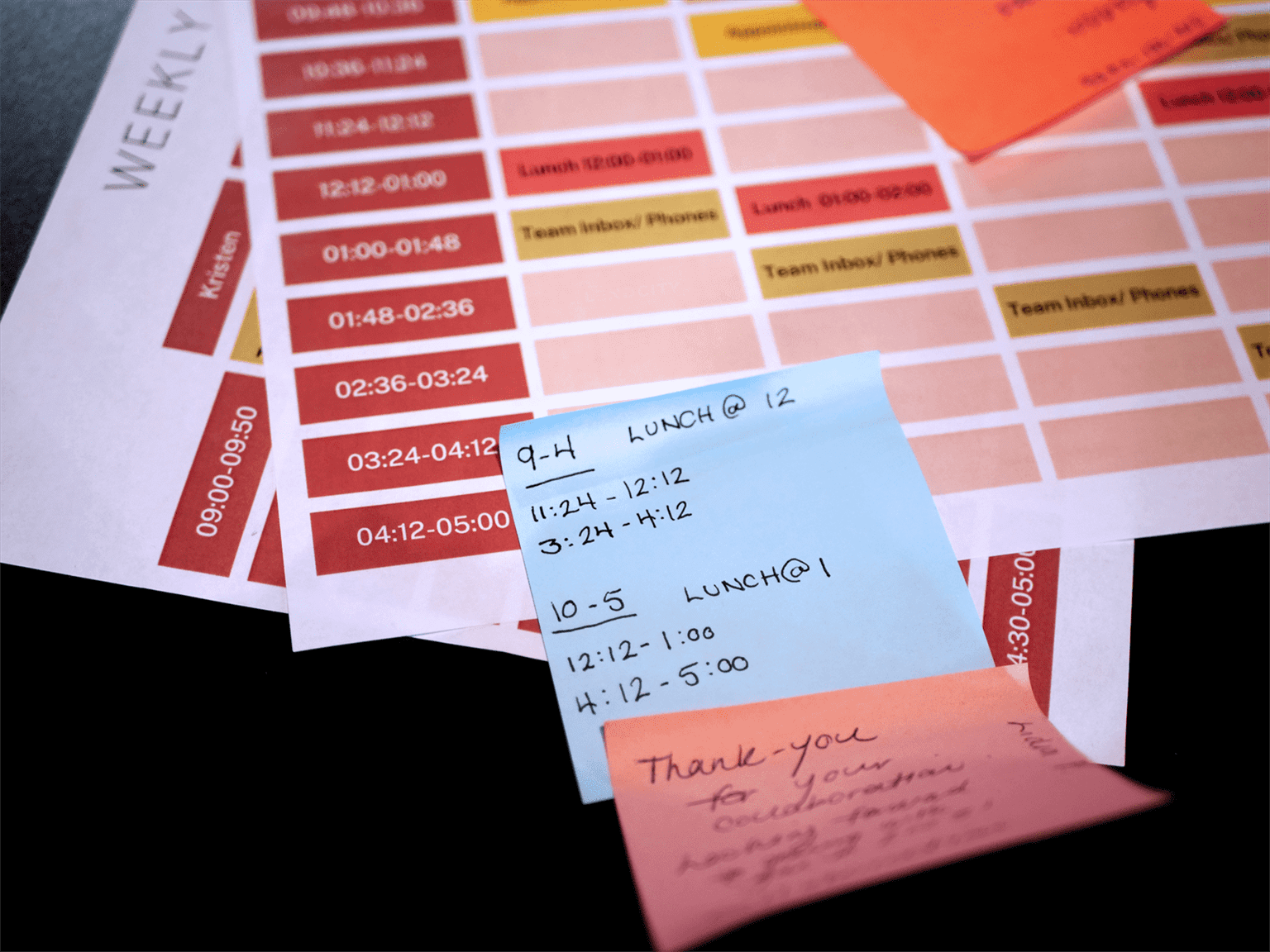

Most real estate investors start out managing their own properties. This is a valuable and affordable option for qualified beginners and investors with smaller more manageable portfolios, but in the long run this strategy is not manageable if your goal is to live off of passive income.

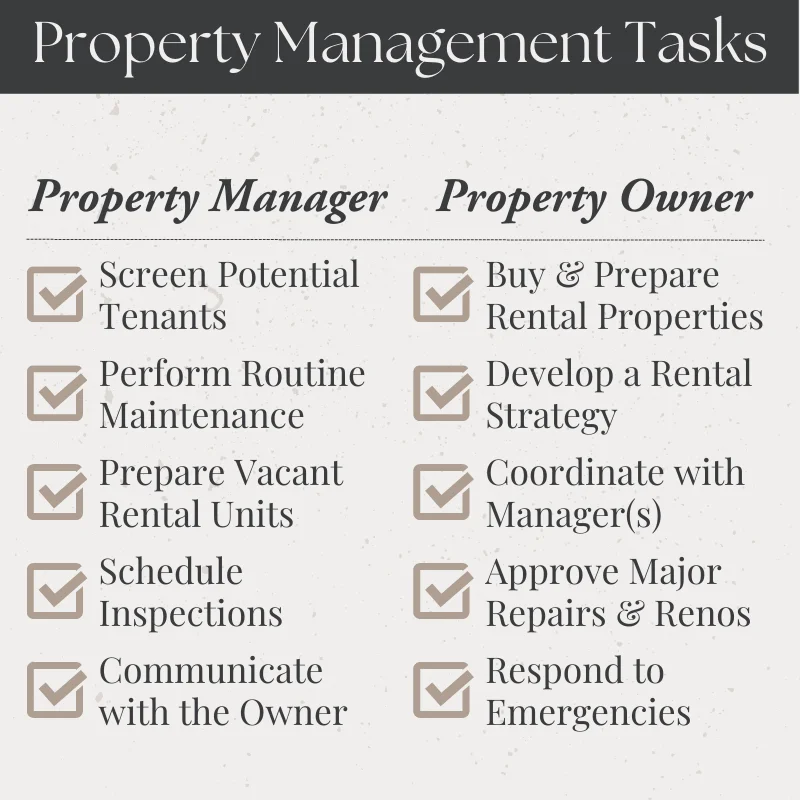

However, by hiring a strong property manager to take on some of your responsibilities, you gain the ability to take a step back and make the income you are earning truly passive. Of course, this does come at a price. Many strong property management services will take on responsibility for taking care of your investment portfolio in exchange for a percentage of the rental income. This means that some of your profits will be surrendered in exchange for time in order to continue living your life freely – a trade that many investors would gladly make.

Discover How To Develop Real Estate With This Step By Step Guide

Passive Income Mistakes to Avoid with Your Property Managers

Of course, achieving passive income is not as simple as strictly hiring a strong property manager. In fact, there are plenty of points along your investing journey where you can risk losing money if you do not coordinate your finances and property management strategy in order to maintain your passive profits.

Not Having Enough Cash Flow

The largest mistake that people can make when trying to live off of passive income in real estate is quitting your job without enough passive income to support the lifestyle change. Remember that markets fluctuate, and your tenants are occasionally going to move out or require maintenance on their units, this means that in order to be ready to live on passive income, you need to earn enough to support your lifestyle as well as set money aside to cover any unexpected expenses.

If your monthly expenses come to approximately $3500 per month, then ideally you should be making double that in passive income before you are fully prepared to walk away from your job. Otherwise, a poor month can quickly become a serious financial hardship as your investments suddenly require more money to operate and remain well maintained. This will also allow you to set money aside for future investments as well.

Not Staying on Top of Rent

When hiring strong property managers, you need to make sure that the person you hire can stay on top of rent collection and will not simply allow tenants to miss payments or get away with consistently paying late. So, when you are interviewing property managers, take the time to ask them about rent collection and how they plan to ensure tenants pay on time as well as what they plan to do in the event of late or missed payments.

Ideally, you want to find someone who is understanding of tenant hardships but also has a plan to reliably get the rent as soon as possible. That way you know your property manager is fair, but still results oriented.

Poor Tenant Screening Processes

Another property management failure that could result in losing your passive income is hiring a manager who cannot property screen tenants. A strong property manager will be able to ensure that you are only accepting careful, well-intentioned tenants who will take good care of the unit.

Take the time to ask each prospective manager about their screening process and aim to hire the one who is the most thorough.

Being Too Passive

Finally, the largest mistake when it comes to trying to achieve passive income is hiring a strong property manager who is too passive and allows you to remain overly passive as well. While you primarily want to be able to sit back and enjoy the returns you earn on your investments, you still need to be able to step in whenever there is a problem that requires you as the property owner to be present.

As well, your property manager should be involved enough to minimize these scenarios, but still be capable of notifying you when they need your help as quickly as possible.

Passive Income Starts with a Strong Mortgage

Before you can begin hiring property managers to manage your income properties, you need to be sure that you are receiving the highest possible cash flow from your investments and that starts with a great mortgage.

If you are ready to secure a mortgage with the best monthly payments in order to ensure a strong cash flow, visit us at LendCity.ca and apply online today or give us a call at 519-960-0370. Alternatively, click the link below to book a free strategy call with our team to discuss making strong property investments today.