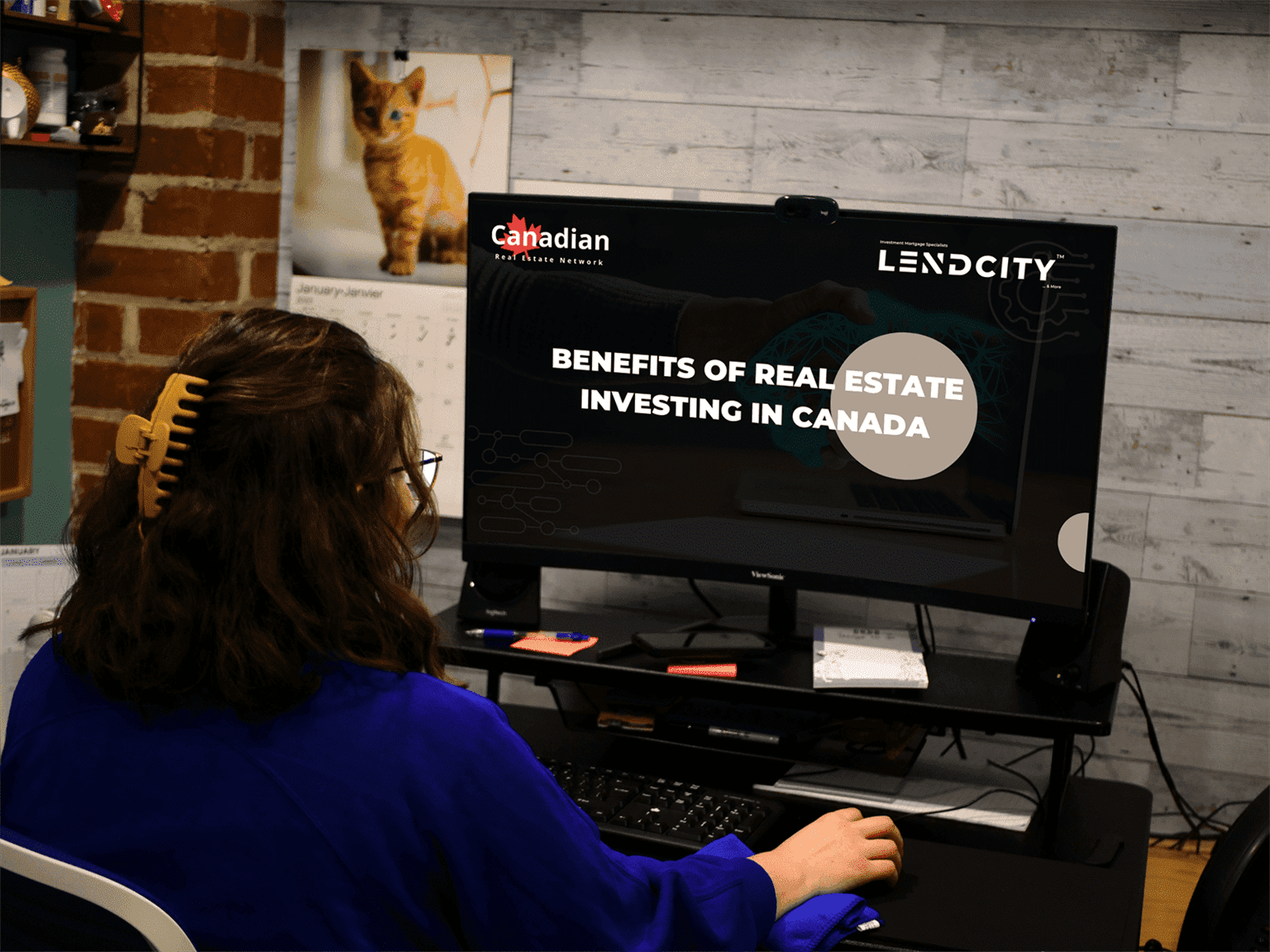

Are Real Estate Investors Canada's Savviest Investors? 4 Key Benefits and Success Tips

Real estate investing can be incredibly rewarding, but it is also difficult for first-time investors to make decisions about how to approach investing and develop a portfolio that offers the best returns possible. While a lot of information and advice on real estate investing is focused on the market in the United States, there’s a lot to be said for investing in real estate in Canada. In fact, with so many benefits to consider the question is:

Are real estate investors Canada's savviest investors?

While here are pros and cons to consider no matter where you decide to invest, but there are some places that offer more opportunities in others. For real estate investors Canada can be an incredibly rewarding place for investors of all experience levels to invest in.

In fact, at LendCity we believe that with the help of real estate investors Canada's future is going to be bright with plenty of new developments and housing opportunities on the horizon.

That is why we want to offer you a free strategy call, so that we can work with you to make all of these projects a meaningful success. All you need to do is click the link below to get started today.

Are Real Estate Investors Canada's Savviest Investors? Here Are the Advantages.

No residency requirement for investing

One of the biggest benefits of real estate investing in Canada is that there is no residency requirement. This enables investors who are not residents of Canada to invest throughout the country. Even investors who don’t intend to live in Canada and who want to invest in properties remotely can benefit from investing in the Canadian real estate market.

However for these real estate investors Canada's foreign buyer ban may temporarily impose limits on this advantage.

Access to financing options

Another significant benefit of investing in Canadian real estate is that there are lots of financing options available to investors. A couple of the most common options available to investors are home equity lines of credit (HELOC) and reverse mortgages. Reverse mortgages are available to homeowners who are 60 years old or older and enable them to collect monthly payments from the equity in the home. A HELOC is a second mortgage that is popular for its flexible repayment options. Homeowners can use the funding from a HELOC to pay for improvements to investment properties and pay off the principal at any time without penalties.

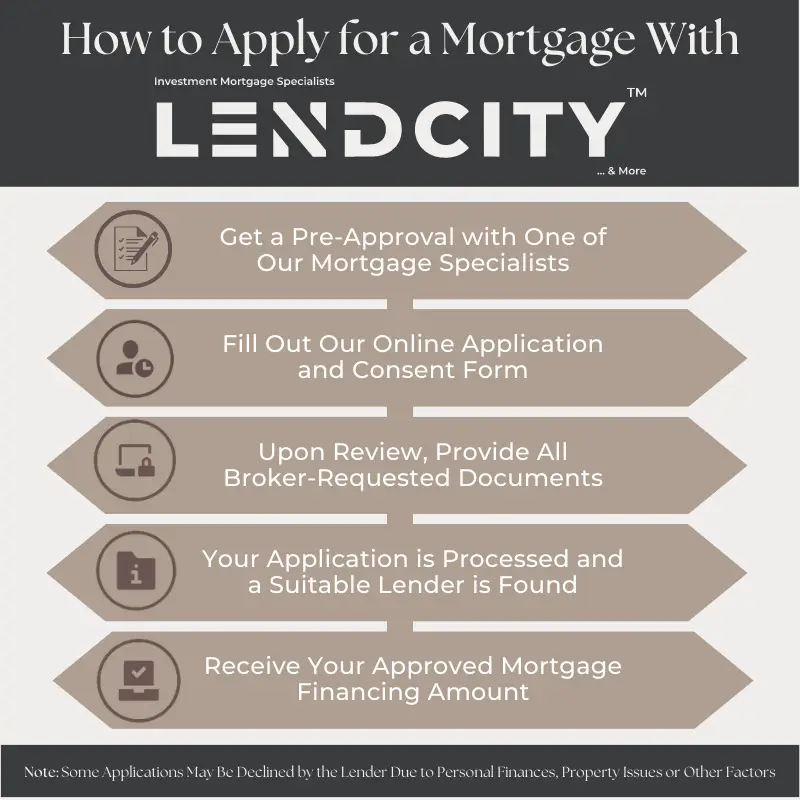

We recommend our time LendCity Mortgages for financing investment properties as the majority of our clients are real estate investors.

We can be reached at 1-519-960-0370 or you can book a free strategy call at the link below.

Alternatives to traditional investing

For investors who are interested in real estate, but are hesitant to dive into traditional real estate investing options, Canada offers non-traditional opportunities. Canadian real estate investment trusts (REITs) are publicly traded companies that invest in real estate investment portfolios. These trusts distribute most of their taxable income to shareholders. These trusts are ideal for investors who want to benefit from the real estate market but don’t have the capital necessary to purchase an investment property outright.

Rising values

Another benefit for real estate investors Canada' is that's property values have steadily increased over the past several decades. In 2000, it cost an average of $351,575, accounting for inflation, to purchase a house in the Toronto area. Today, that average home price has expanded to $843,115. Accounting for inflation, that’s a 140 percent increase in home value. That increase in property value isn’t limited to the Toronto area: it’s a trend throughout Canada. With booming development and diversified economies throughout the country, there are countless opportunities for investors to find properties within their budget and preferences that are slated for value appreciation.

Discover How To Develop Real Estate With This Step By Step Guide

Real Estate Investors Canada is Ready - Let's Get Started

Now that you know more about some of the benefits of real estate investing in Canada, you might be wondering If you are interested in taking advantage of all the benefits of real estate investing, but aren’t sure where to start, here are some of the different options for getting into the Canadian real estate market:

Start with REITs

To get started with real estate investing as a beginner, it’s a good idea to test the waters with investment in Canadian REITs. REITs are popular because they don’t require the kind of time, effort, capital or maintenance that traditional real estate investing requires. These trusts hold all kinds of different types of properties including residential, commercial and industrial buildings. They trade on the stock exchange like any normal security, which makes it an attractive option for investors of many different backgrounds and levels of experience.

Maximize existing investments

For something a little more hands-on than investing in REITs, try maximizing an existing investment. Investors can do this by renting out a room in their home or adding a basement unit or addition to rent out. This is a great choice for investors who want to generate income and get experience with the rental process without the time, capital or energy necessary to purchase and rent out an entire investment property.

Try house flipping

House flipping is a great real estate investment option for investors who aren’t afraid of a hands-on investment project. With house flipping, investors buy properties for a low price that need significant improvements before they are ready to be rented out or sold. This investment strategy has the potential for huge returns on investment, but it isn’t the best choice for investors. Because of the amount of time commitment, knowledge and strategy required to make a house flipping investment worthwhile, it’s best to leave this type of investment to the experts.

Buy property and rent it out

Another tried-and-true investment option is to purchase a residential or commercial property that can be rented out to generate monthly income. This type of investment requires some active management, but there are also property management companies that can take on some of those tasks if you don’t have the bandwidth to do it on your own. Slowly building a portfolio of investment properties over time is a great way for investors to work towards financial freedom and establish a consistent form of passive income that can take them through retirement.

No matter which real estate investment option you choose, there are fantastic benefits for real estate investors Canada is full of. With strong property values and a friendly market for investors, there’s no reason not to get started with Canadian real estate investment. From REITs to fixing and flipping, the sky is the limit when it comes to investing in Canadian real estate and there are countless opportunities for investors to make big returns.

Real Estate Investors Canada's Industry Professionals

We have searched high and low for real estate invesors Canada-wide. Below, you can find professionals we have researched and can confirm they specialize in working with Real Estate Investors.

To ensure the maximum success in real estate investing in Canada, or any city, you should always use professionals who understand and work with investors, your income depends on it.

This list may not fully list all the professionals in the area, but the ones we have personally investigated and that we would refer our clients to.

If you’re a real estate professional and would like us to consider adding you to the list, please contact us.

Mortgage Broker

LendCity Mortgages – Website – Click to Email – Click to Call

Real Estate Investors Canada's Top Strategies Are Waiting

To all of the real estate investors Canada's top investing strategies are waiting for you to take advantage of them and leverage them to suit your needs.

Learn more about how you can utilize them by booking a free call at the link below.