Avoid these 8 Property Features to Ensure Investing Success

Real estate investing might feel like gambling at times: you lay your wager and hope the odds are in your favor. Unlike gambling, real estate investing allows you to conduct extensive research on your "bet" to assess your chances of winning big.

There are various indicators you can look for before closing to see if your investment is beneficial. Property features that influence the price per square foot and resale value will impact your bottom line in the long run. Here are eight to be on the lookout for:

But first, if you would like to learn more about how to finance the purchase of a property that has all of the property features you want - and none of the property features you don't - click the link below to book a free strategy call with our team here at LendCity.

1- Awful layout

When renting or reselling your investment home, a strange layout can be challenging to overcome. By placing restrictions on the tenants, a particular property design limits your prospective rental or selling pool. Families may be put off by a home with no master bathroom and a shared bathroom. For anyone with roommates or who wants to welcome visitors, however, having to walk through the master bedroom to get to the single bathroom in the house is not ideal. Do not choose a plan that will limit your resale value.

How do you decide whether a floor layout and property features are excellent or bad? "Does this feel natural?" ask yourself as you walk through the house. If you do not like the layout, chances are your future tenants or buyers will as well.

2- Houses with a 1/1 or 2/1 ratio

Do not buy a house with only one bedroom and one bathroom. Only people or extremely tiny families will fit, severely limiting you resell potential. Few individuals want to buy a house that does not allow them to expand. If the house is on a large enough lot, it might have some market value as a tear-down project, but not much else.

There are only two-bedroom/one-bath residences in some older markets. Your investment is safer if that is all that is available in a subdivision. Potential purchasers would prefer to wait for one of the 3/2 houses surrounding the property if there are three of them.

Only homes with unfinished areas are exempt from this rule. Do the math, and if your repair budget allows, buy to add a second bedroom, bath, or both. You might even be able to lowball a 1/1 or 2/1 seller who is looking to sell, then flip your investment for a great return by simply adding the missing bedroom or bathroom.

3- Conversions and additions

If you are considering a 1/1 or 2/1 house, you might be tempted to add on or convert to increase the amount of livable space. Do not be tempted to extend or alter the room to make the home appear more functional than finishing unused space. This way of thinking is a waste of time!

Additions have little effect on the price per square foot; adjacent homes built with an extra bedroom will continue to outperform. Conversions also have no impact on the market value of your home. Converting a garage to a living space will not increase the price per square foot because the garage had value before it was restored.

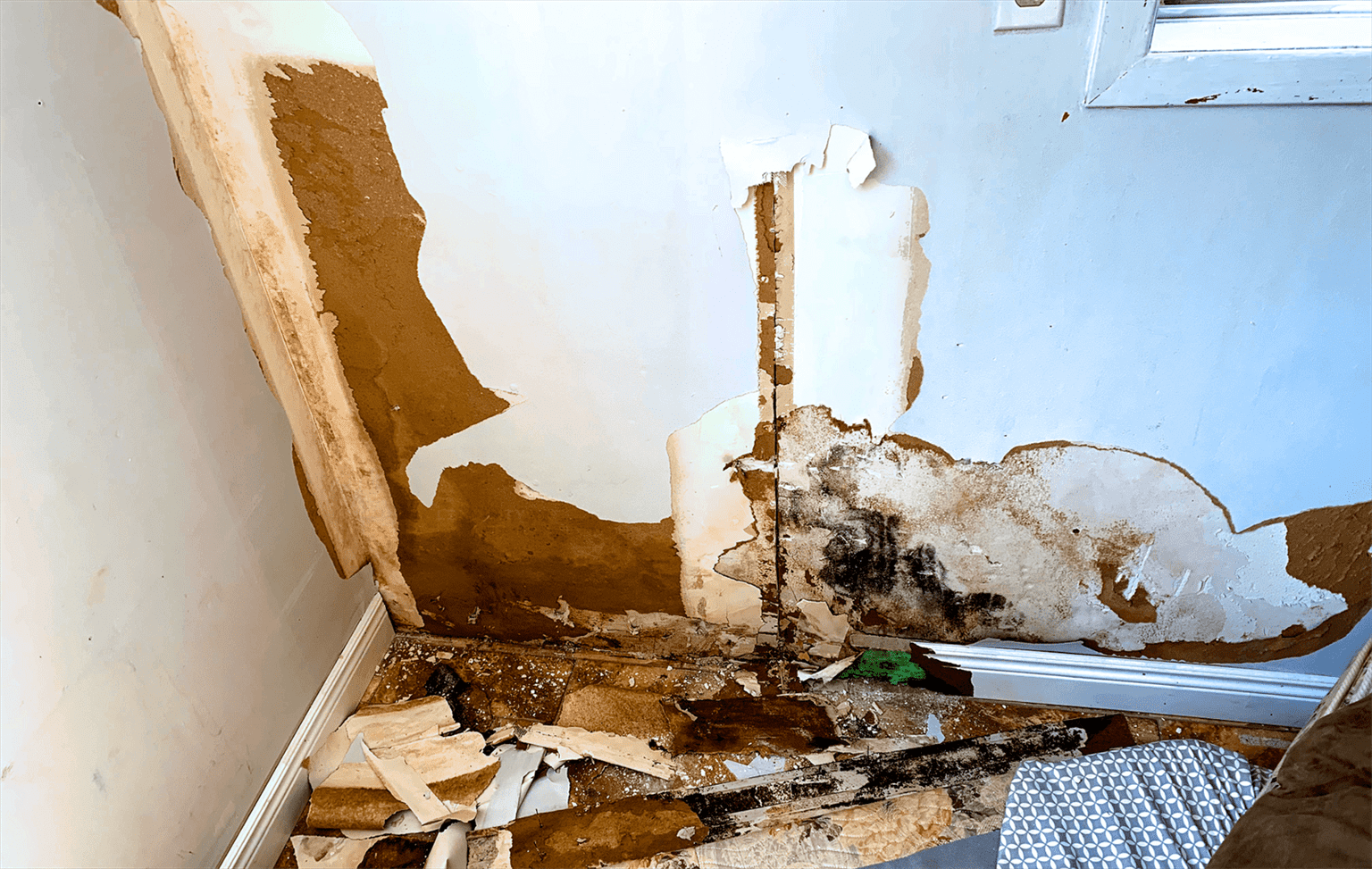

4- Issues with the structure

Some communities may be more prone to foundational or structural concerns than others, depending on the topography, weather, and year of construction. A house built on the side of a hill requires far more structural analysis than a house built on flat land. Consider the foundation, bearing walls, beams, floor framing, and roof framing as concerns that will require repair. Always consult a structural engineer before investing in your property because you cannot always detect structural flaws and poor property features.

This is not to say that you should not buy a property if it is on a flat surface. You should do your homework before investing, and you should be aware of any fees associated with improving structural integrity before closing. Make sure your purchase price reflects the structural changes you will need to make and that you keep track of any updates so you can show repairs when it's time to sell.

5- Unpleasant surroundings

Nobody wants to live near power lines or a gas pipeline because it could be dangerous. Similarly, no one prefers living in a noisy environment. Buyers will be suspicious about unmanageable noise at any hour if the property backs up to train lines, a bar, or a sports field.

When looking for an investment property, look around the area to see if any property features could cause problems in your everyday life. If the home you are looking at backs up to a liquor shop, the price per square foot will be higher than a comparable property.

Desirable property features, on the other hand, will raise the price per square foot. The presence of a golf course, a water feature, or a green area is ideal.

Discover How To Develop Real Estate With This Step By Step Guide

6- The house with the highest square footage on the block

A large house may seem impressive, but it can stand out like a sore thumb in the wrong neighborhood. It is not always the reality that bigger is better. When comparing comparable properties in the neighborhood, keep in mind that the price per square foot drops as the square footage grows, so remember that when doing your calculations. If you're having difficulties calculating the house's potential value, engage an appraiser to help you come up with a reasonable figure.

After all square footage is one of the most important property features for both buyer and renters.

7- There are no good alternatives

If you can't identify a similar transaction in the area to use as a benchmark for your investment, purchasing the property is too hazardous. To get precise estimates, you'll need data on previously sold properties that are similar in area, size, condition, and property features. Appraisers can assist you in locating comparable and calculating helpful figures for your investment. Without comparable sales, determining a realistic prediction will be impossible.

8- Anything that feels wrong

Facts and numbers are critical to investment; you should not buy a house just because you feel good about it. However, if a prospective investment feels terrible, it probably isn't good! Trust your intuition. If you must convince yourself of a property's potential, it isn't worth buying. Listen to your gut and believe that some of the property features are likely problems!

Conduct your research to avoid these property features

Always do your research and do your figures on a potential investment property before deciding. If you are unsure or need assistance, consult specialists who can provide you with unbiased advice. Real estate investing is all about profits, so do not skimp on your homework and risk losing money.

If you would like to learn more about how to finance the purchase of a property that has all of the property features you want - and none of the property features you don't - click the link below to book a free strategy call with our team here at LendCity.