BRRRR - Buy, Renovate, Rent, Refinance and Repeat: Step-By-Step Guide

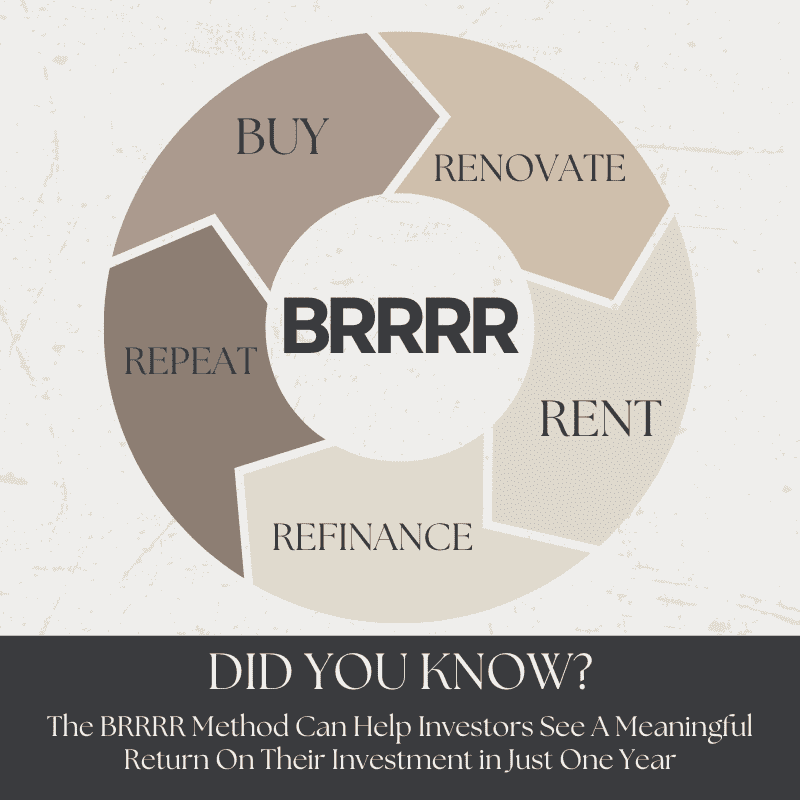

If you’re just starting out in the Canadian real estate investment space, you might find yourself confronted with a laundry list of terminology that seems complicated at first, including “BRRRR.” One of the most commonly used terms in real estate refers to one of its most popular strategies for building an investment portfolio. That’s BRRRR, or Buy, Renovate, Rent, Refinance and Repeat. You don’t have to be a real estate mogul to understand the basic concept behind BRRRR. Investors buy a house, fix it up, rent it out to a tenant, refinance the home once it has some equity and repeat the whole process.

I know the BRRRR strategy may sound a bit intimidating at first, but trust me when I say that once you get used to the process, it is one of the most powerful investment strategies on the market, and this is the same investing strategy I have personally used for all of my properties.

However, if you want to have the easiest time investing, I suggest getting a pre-approval before you begin your search. That way you can lock down the best available rate, ensure the lender you selects is BRRRR friendly and learn your maximum purchase price before you ever start hunting for properties. Book your strategy call with an expert on my mortgage team here, or by clicking the button below.

5 Steps to BRRRR

So, how does the BRRRR method work exactly? This strategy employs five easy-to-remember steps: Buy, Renovate, Rent, Refinance, Repeat.

Step One: Buy

Before you can use a rental property to build equity and create cash flow, you need to own the place. That means hunting down the right property for your portfolio’s needs. To successfully accomplish a BRRRR, you will be looking for a house that needs minor to moderate renovations only. Keep this step in mind for the future.

When I am searching for the right fixer-upper opportunity, I start by trying to find a property I can improve considerably without pricing it higher than its neighbourhood. (So do yourself a favour and don't bother looking at the most expensive house on the block.) I do this by first looking at the average price of homes in a given area. Then, I find homes that are going for $30,000 or more under market value. To get an ever better deal I will employ the help of a real estate agent to identify motivated sellers willing to unload their house at a discounted price.

On top of buying a property with room to grow, you need to take the time to consider how much you will need to pay up front for the investment. Typically you can expect to have approximately 20 per cent of the rental properties purchase price saved for a down payment. However, my team and I do work with lenders that are willing to work at a higher LTV (Loan to Value) depending on your application and occupancy of the property. This means in some cases you may be able to buy a rental property for as little as 5 per cent down. Generally, single family home and duplex's start at 5% down, whereas triplex's and fourplexes will require 10% down, as long as you're moving into the home.

However, you need to be careful with this as most lenders have a minimum amount of equity you need to have built into a property before they will allow you to refinance. Also, many lenders do not allow you to refinance right away, and require that you wait a year. We will show you how to get past this issue by continuing reading.

Step Two: Renovate

Once you’ve found the perfect fixer-upper, it’s time to start the home renovations. Remember that you’re not trying to turn your property into a palace. You’re not even trying to put your personal touch on the home. That’s a task for the renter (and one they will tackle with joy). The way I like to look at it is this - the goal is to improve the home’s value as much as possible without making it too expensive for the neighbourhood it’s located in. You also have to realize that this is not where you will live, so try to seek neutral colors and textures in the home.

Then, seek out a contractor that offers you the best value for their work. This means that you are getting the best quality work at the best price. I suggest doing this by looking over reviews and work examples from local contractors to get a clear picture of the quality of their work. (I suggest you view the work in person and not in a picture.) After that, choose a contractor who is priced most reasonably for the quality of their work. (Never choose the cheapest option, they charge less for a reason.)

Sometimes, I will bring a contractor I plan to work with to a property with me before I purchase it. That way they can help me spot areas that need improvement and which rooms in the house can introduce the most new value into the property. Also, with this strategy I can get up front pricing of what it will cost me to determine if the deal is worth it to move forward with, or not.

Once you’ve found a reliable contractor, have them start with the kitchen. Updating appliances, adding an island (if there’s room) and installing new cabinets and countertops can drastically increase a home’s value. After that, replacing carpets or adding hardwood are also excellent interior projects to undertake. Another major room to look at when you are trying to increase a home's value is the bathroom.

On the outside of the home, these three projects offer a significant return on investment:

- Siding cleaning, replacement, or repainting

- Constructing a deck or patio

- Increasing the size of your entryway

These upgrades to the curb appeal will improve the value of your rental property by several thousand dollars. However, in the case of improvements such as a deck or patio, you need to be careful that there is enough room on the property to add or extend them without making the property feel smaller. Usually it is suggested that a deck or patio does not extend beyond 1/5 of the available yard space.

Download your FREE Printable Excerpt for this Step By Step Guide

Step Three: Rent

Ultimately, the goal of a BRRRR is to leverage your improvements to one property into a more extensive and more diverse real estate portfolio. It would be fantastic if you could make that happen overnight, but moving onto the final step of the BRRRR takes time. In fact, a lot of reputable financial institutions won’t allow a property owner to refinance a home until 6 to 12 months after the purchase. This period is known as the “seasoning” period. Again, this is why its so important to a lender that understands the BRRRR investment strategy to set yourself up for success.

Another thing I have learned in my career is this: some banks and lenders won’t refinance an empty building. Rather than just let your home sit vacant for the duration of the seasoning period (and to improve your odds of securing a refinancing loan), you’ll need to find a renter. This of course is not the case from all lenders, but if the property is vacant it will negatively impact your debt ratios making the refinance more difficult or impossible.

Whether you want to continue renting the property after the seasoning period ends or you’re hoping to sell the property once you refinance, the smart choice is to establish a year-long contract with the option to either renew or go month-to-month at the end of the contract period. The best part about a year-long rental agreement is that you don’t have to make long-term decisions right away, and you have several choices when the time for action arrives.

However, you should not rent the property to just anyone. A large part of how BRRRR works is using the improved value of the property to refinance and draw out equity. So, I recommend you are extra careful during your tenant screening process. A neglectful or destructive tenant can derail your plans very quickly. Fortunately, if you are asking for references from previous landlords - which I always recommend asking for - you should be able to get a clear picture of how they are going to treat your property.

There is some good news here too. As the property is fully renovated, the likelihood of having repairs and maintenance issues is greatly reduced and you can demand a much higher rent from your tenant as the property is fully renovated.

Step Four: Refinance

Once the renovations are done, it’s time to refinance your rental property. Again its best to have someone living on the property full-time. Mortgage lenders and insurance companies often operate under the assumption that a lived-in residence is better-taken care of than one left to sit alone. Some insurance companies will not insure vacant properties, or charge you a large monthly premium to do so.

With a renter in place, your next step is to locate a lending institution that is familiar with the BRRRR process. Remember, there is no benefit to your strategy remaining a secret, so make sure to seek out a lender who understands the BRRRR method and will give you a loan at the price point you need, within the time that you need. (You do not have to wait a year, like most lenders say, you can refinance right away if you can provide proof of the renovations and work with the correct lender in the first place.)

Luckily for you, my team at LendCity Mortgages works with many lenders that are incredibly familiar with the method. This means that from the initial moment of financing you can let the lender know your plans and they can help you determine when the best time to refinance would be. To get matched up with the best lender for your next BRRRR, book a call with me today by clicking the link or the button below.

In fact, we may even be able to get you the money from the lender to pay for the renovations. It's always best to use other peoples money.

Refinancing is likely the most rewarding stage of the BRRRR process because it is when you see the main return on your investment. This is because your hard work results in appreciation on the property and increases its value.

Let me give you an example: Let’s say you buy a home for $300,000k with only $60k as a down payment. Then, you have a contractor implement several home improvements that raise the property’s value by $100,000k. You can easily do that by doing renovations such as kitchen repairs, refinishing the bathroom and updating the floors. Now your property will be worth 400k allowing you to increase your mortgage to $320k, and using the proceeds for the next step... Repeat.

In Canada, you can refinance up to 80% of the value of your home.

Step Five: Repeat

Now comes the final step! Once you’ve completed the BRRRR cycle, it’s time to take your freshly refinanced cash and find a new property in which to invest. At the same time, you can rely on a steady supply of income from your first renter, or you can go about securing a buyer and flipping the house to get a payout in one lump sum. That choice depends on you!

What makes this step exciting in my eyes is the fact that depending on how much available equity you've built, you can potentially turn your first property into multiple new purchases - scaling your portfolio much faster.

This process is even more exciting when you move into the home with 5% down, and do the whole process, as you will have a lot more funds on hand to grow. However, it is important to live in the home for at least one year, if you are going to try the BRRRR strategy with 5% down.

Access BRRRR Friendly lenders

To continue growing your real estate portfolio using the BRRRR methods, it's incredibly important to leverage a lender that supports BRRRR's, as not all do.

Some lenders have caps on the renovation funds when doing a BRRRR, while others don't. Lastly, some lenders charge mortgage penalties, some don't.

You need a lender on your side to set you up for success and minimize your fees.

That is why I recommend using my team at LendCity Mortgages. We can be reached from the link or by calling 519-960-0370. At the end of the day, we want your success as bad as you do!

Winter Is Coming Time To Get Into The BRRR Mindset, With Scott Dillingham