Buy and Hold or Renovate and Flip? Depends - Make the Best Investment for Your Time Horizon in 2023

Every investor is different and there are all kinds of different opportunities for investors to make a profit in real estate. Buying and holding and renovating and flipping are both tired and true real estate investment strategies that have been proven time and time again in markets around the world. While you have the potential to profit from either of these real estate strategies, there are key distinctions you should consider to determine which option is right for you.

As well, before we dive into the time horizons of flipping and buy and hold real estate, click the link below to book a free strategy call with our team at LendCity to discuss the financial side of both investment strategies.

Fix and flip

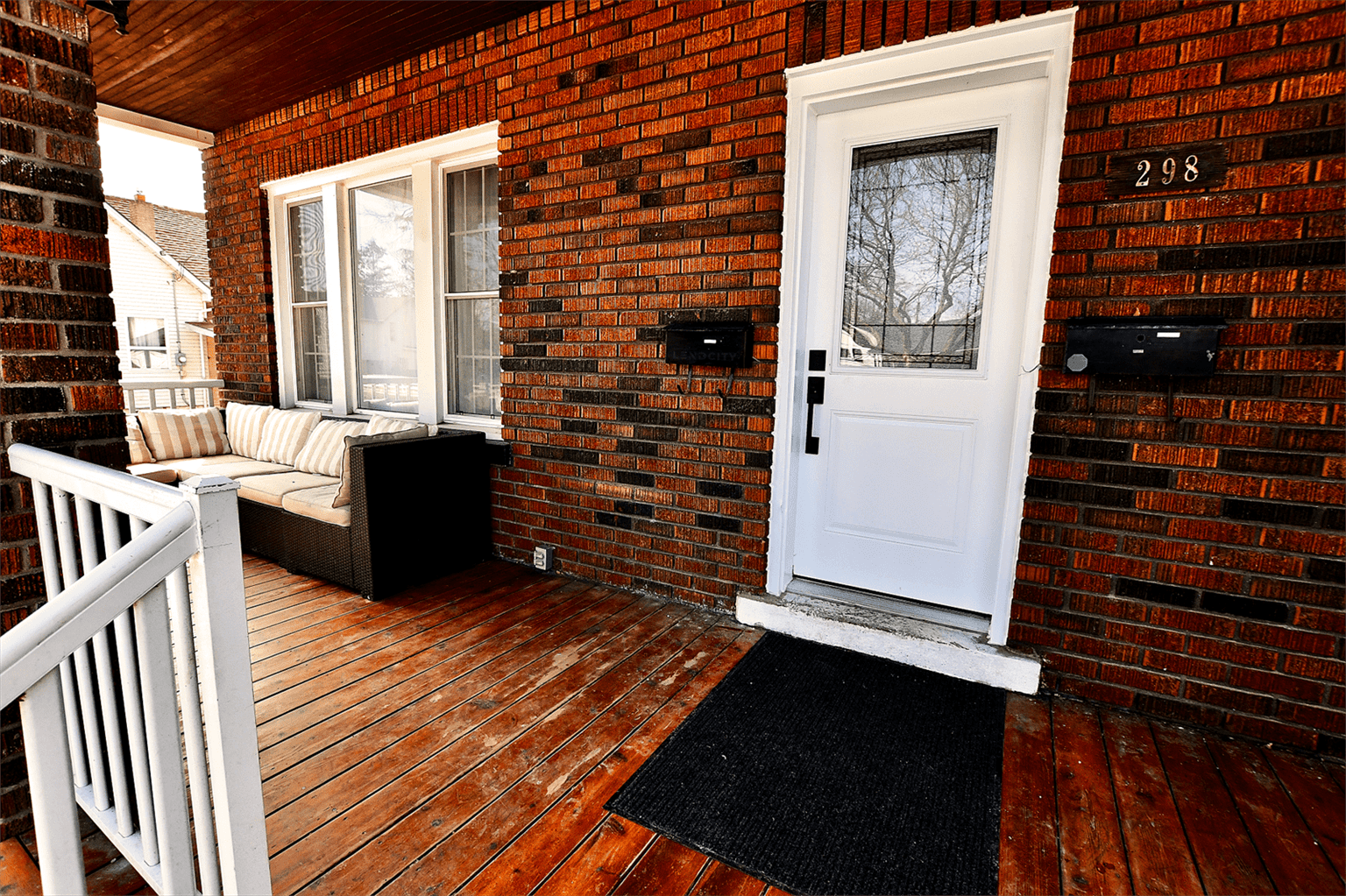

Fix and flip is an investment strategy in which investors buy a property that’s listed under the market value, invest in renovation and remodelling to flip the home and sell it for a profit. Investors who follow the fix and flip strategy often do most of the renovation work themselves and aim to get their property back on the market in a matter of months. Fix and flip appeals to investors who want to turn a quick profit and are willing to put in the hands-on work to get there.

The economics of fix and flip investments vary depending on the circumstances, but most investors aim to sell a property at a profit of at least 30 percent more than what they put into it. Let’s say there is a foreclosed home on the market for $100,000 and would be worth $200,000 at full value after renovations. If you can flip the home with $40,000 or less, you will have made a 30 percent profit—a very healthy margin for a fix and flip investment.

Buy and hold

With a buy and hold strategy for your investment, an investor takes a long-term approach to a real estate purchase and profits from rental income and value appreciation. Buy and hold investors will purchase a home that’s ready for rental, but some investors choose to purchase a home and rehabilitate it before renting it out. An investor can keep the home rented out for a monthly rate that exceeds the property mortgage and earns the investor a passive income—then, sell the home after several years as the value appreciates.

The key to a successful buy and hold investment is to maintain positive cash flow through property rental. As long as your monthly income from your property exceeds the monthly expenses by a margin of about 10 percent or more, you’re in good shape to make a passive income for your property, even when you factor in unexpected expenses.

Discover How To Analyze a Properties Cash Flow With This Step By Step Guide

Factors to consider

If you’re unsure about which investment option is right for you, it’s a good idea to consider the key factors that distinguish buy and hold and fix and flip investments. Understanding the practical implications of these investments can help you take a strategic approach that aligns with your needs and goals as an investor.

Time commitment

Buy and hold investments require a much longer time commitment than fix and flip investments. You can purchase a fix and flip property, renovate it and sell it within just a few months. A buy and hold property investment typically requires you to commit for at least 5 years. If you want to make a quick profit on a real estate investment, a fix and flip property is probably your best bet. On the other hand, if you don’t mind waiting for a greater return on your investment, buy and hold is a great strategy.

Capital flexibility

When you make a long-term investment, you choose to park your money into a single property and wait several years before you get that money back. With a fix and flip investment, you can make a profit and put your money back into another profitable real estate deal relatively quickly, since your capital remains more fluid.

Energy investment

There is a considerable amount of effort required for a successful fix and flip. Even if you don’t do all of the work yourself, you have to hire contractors, coordinate labour and manage property renovations to get the property ready to sell. Buy and hold investments are usually much more passive sources of income. Aside from screening tenants, managing residents and fielding the occasional maintenance requests, there isn’t a significant amount of ongoing work that has to be done.

There’s always an element of unpredictability and risk in real estate investment, but you can minimize your risk by carefully weighing your options and being realistic about your circumstances. When you make choices with your own needs and goals in mind, you will experience much greater success, regardless of the specific strategy you take.

Once again, click the link below to book a free strategy call with our team at LendCity to discuss the financial side of both investment strategies if you would like to learn more about the financial side of these investments.