Buying Multiple Rental Properties: Step by Step Guide

You can buy multiple rental properties when you work with the correct lenders. However, I don't want to settle with teaching you how to buy multiple rental properties, I want to teach you how to buy unlimited rental properties.

We only share content like this article with our insiders who subscribe to the Canadian Real Estate Network and download the Investor Success Toolbox Kit. The download link is above if you're wondering.

However, we received such a tremendous response that we have decided to take the email and convert it into an article for you.

However, if you would like to have this process explained to you directly by a member of my team as well, you can do that by booking a free strategy call by clicking this link.

That way, you can sleep confidently, knowing that you are ready to learn how to buy multiple rental properties and bypass the limits your bank may impose on you.

How to Buy Unlimited Rental Properties

I'm going to show you how to buy unlimited rental properties. I use this strategy for all of my mortgage clients, and you can use it too.

I didn't think this was possible when I worked at the bank, and many of my customers didn't either.

When I first started at the bank, every investor I worked with wanted unlimited properties.

In fact, I never thought I would quit the bank because we had at the time, the best rental program in town.

I was at the bank for many years, and I quickly saw the lender reduce its rental program.

First, they offered unlimited properties.

Then 10,

Then 5 with them, but no cap on how many you can have.

I have recently heard they now cap at 5, regardless of where you got the mortgage.

The funny thing is, while I was working at the bank, I received many referrals from mortgage brokers who told me they could only finance 4-6 rentals.

So, leaving the bank, I figured 4-6 was the max, then off to the b-lenders or privates.

However, that is not the case, and I will share our road map with you.

Step 1 - Pre-Approval

The very first step is a mortgage pre-approval or what I like to call a cash flow analysis.

What happens is we gather all of your documents and information about your rental properties and analyze it through the lens of the lenders.

If you have not started your investment journey yet, this step is where we will analyze your current creditworthiness.

From there, we can begin the process of helping you buy your first rental property.

That way, you can get started on the right foot and eventually learn how to buy multiple rental properties simultaneously.

Step 2 - Lender Selection 1-6 properties

Most of the big banks will do 5-6 properties.

Some of the big banks claim to finance up to 10 properties; however, I have found that anything over 6 has to go to head office, and they are incredibly tough in their review.

In this step, we match you up with the lenders that allow you to have up to 5 to 6 properties in TOTAL.

The keyword here is in total because some lenders will do 2-4 rentals without a cap on how many you own. More on this is step 3.

If you have good credit and income, getting 1-6 properties should be a breeze, and these would all be with A lenders at excellent rates.

It is incredibly important that your early properties go through the correct lenders because these options will not be available to you later.

However, they also offer some of the best rates.

So, you do not want to miss this step and miss out on the opportunities these lenders can offer you.

However, f you are coming to us later on in your journey and already have six or more properties, there are still excellent options available at later stages.

Step 3 - Lender Selection 7-23 properties

As an investor, this stage is when you really start raking in the cash flow.

We have a lender with no cap on the number of properties you can own.

This lender will do up to 12 properties or 1.25mm, whichever comes first.

We also have several A lenders who will do 2-4 properties regardless of how many you own in total.

In this step, the interest rates can be slightly higher than the Step 2 lenders; however, the rates are still incredibly competitive.

Based on our findings, most mortgage brokers do not understand investor financing in this stage or the next.

Download your FREE Printable Excerpt for this Step By Step Guide

Step 4 - Lender Selection 24+ properties

If you're working with a Mortgage Broker who understands this stage, you're more than likely in the B-lending category.

B-lending can have between ok to high rates.

HOWEVER, we do not go to B lenders at this stage unless you 100% need to.

We have access to the commercial departments at many large lenders, allowing you to buy unlimited rentals with A lending rates.

I have found that branch representatives at a specific lender don't know about this option for investors.

It makes me laugh sometimes.

But I figured this out because, like you, I am an investor and needed access to low-cost funds.

There is one negative that I can think of with going the commercial department route: we then have to charge you a lender fee.

Generally, this fee is 1% of the funded mortgage amount.

In all other steps, excluding b-lending and private funds, there are no lender fees.

How to Buy Multiple Rental Properties in the Field

If you want to learn how to buy multiple rental properties in Canada, the most important thing to learn is how to develop a reasonable order of operations.

While it is possible to start anywhere as long as the financing works out, the truth is that the easiest way to learn how to buy multiple rental properties is to take it one step at a time.

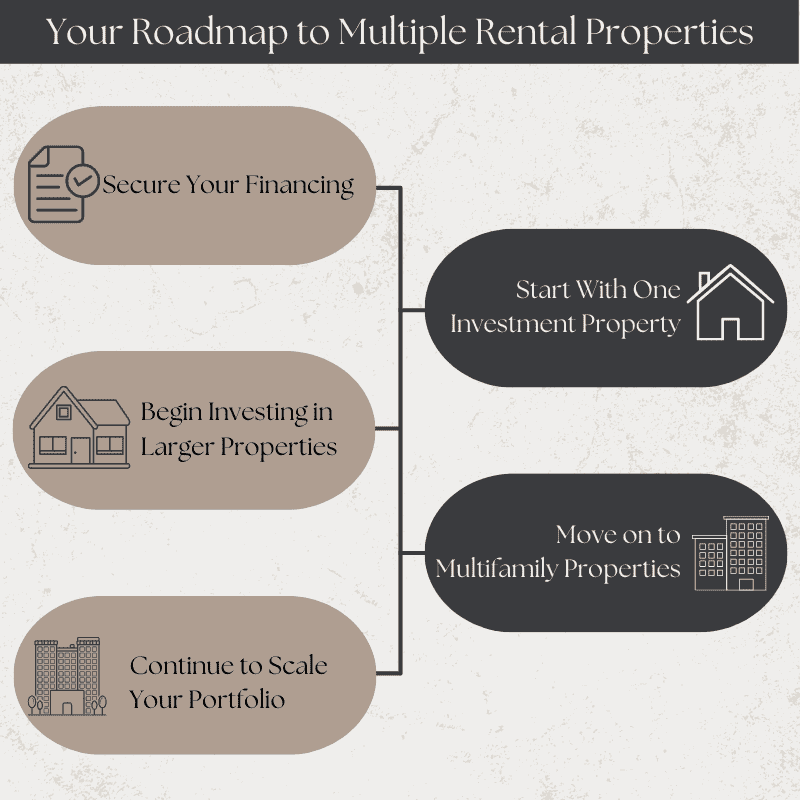

So, for those looking to develop a strategy to buy these properties, I have developed a simple progression that should help the process go smoothly.

Step 1: Start By Lining Up Your Financing

Before you can start learning how to buy multiple rental properties, it is important to plan your financing beforehand.

Fortunately, as explained earlier in this article, I have an entire roadmap ready for you to help you finance unlimited rental properties.

From your first pre-approval to locking down a blanket loan for multiple properties, my team and I are ready to help you build a strategy to continue expanding your portfolio for years to come.

So, if you are ready to start, book a call right by clicking this link to book your free strategy call today.

Step 2: Buy a Manageable Rental Property

While the goal is to learn how to buy multiple rental properties, is essential to remember that you always need to start with one.

Find a property that is not too expensive but also has a significant cash flow potential. Ideally, this property is valued lower than other properties in the area.

This is your launchpad to discovering how to buy multiple rental properties.

With this property, your goal is to establish two key things, equity and cash flow.

One of the most popular methods I have seen investors use to achieve these goals is the BRRRR method.

Step 3: Transition to Larger Rentals

The next step in mastering buying multiple rental properties is moving up towards larger rental properties.

While the smaller, cheaper properties have the potential to kickstart a portfolio and generate meaningful equity early on, you are going to want more significant rental properties in order to generate more equity for future leverage.

So, once you are comfortable with smaller, more manageable properties, I recommend moving towards larger, more complex ones.

After all, your goal is to learn how to buy multiple rental properties, and it will take a lot longer to achieve this goal if you constantly play it safe.

These can be larger luxury rentals with more bedrooms and better amenities.

Or these can be rentals in more competitive and profitable markets.

Step 4: Shift Towards Multifamily Investments

Multifamily real estate is more expensive than single-family properties, so it's not a very common place to begin.

However, once you have gotten started and have experience in the market, I believe they are an excellent tool to help you expand your portfolio.

With multiple units of cash-flowing real estate on a single property, this step will quickly begin to maximize your potential to buy whatever type of real estate you would like as time goes on.

In fact, with the cash flow potential in most large-scale multifamily properties, learning how to purchase these properties can feel like you have discovered how to buy multiple properties with one mortgage. (This is a real thing that you might be able to do.)

Understanding The Impact of Multiple Units on Cash Flow

Not only do multifamily properties typically come at a higher price and thus have more potential for you to earn equity, but their cash flow potential is also greater.

A strategy I love when trying to maximize cash flow on a multifamily property is to structure the rents so that you can cover all of your property expenses without every unit being occupied.

This way, if you have a six-unit property with all of its expenses paid for off of the four-unit rents of four units, the remaining rents from the other units are pure profit.

You cannot get that type of cash flow from a single-family home.

With that cash flow established and your equity secured, it is less of a question of how to buy multiple rental properties and more a question of when you will buy them.

Step 5: Continue to Scale Your Portfolio

Once you have reached this stage, you should have the equity, cash flow and experience to master some incredible investing strategies to help you continue scaling your investments.

After all, no investor gets this far by accident.

At this point, you should be able to begin mastering how to buy multiple rental properties at once or how to buy multiple properties with no money coming out of your pocket.

However, even at this point in your career, I need you to remember this one piece of advice.

Never get too proud to ask for help, real estate is a complicated market, and no one can master every investment technique.

So, make sure you utilize your network to continue growing.

One of the best ways to continue growing and scaling is to learn how to diversify your portfolio.

Most investors looking to learn how to buy multiple rental properties will look at residential properties.

However, you can also use some great commercial options to build a diverse portfolio.

A great option I have found is mixed-use properties.

These are properties with multiple units that serve different uses.

For example, you will often see retail spaces with apartments or offices above them.

How Can I Buy Multiple Properties at Once?

If you want to learn how to buy multiple rental properties simultaneously, you are in the right place.

The most common way to get approved for multiple mortgages for multiple properties at a time is through a tool called a blanket mortgage or a blanket loan.

While this tool is typically only accessible to investors with a high enough credit rating, buying many properties at once can still be incredibly valuable.

Just be careful; defaulting on one of the properties under this type of loan can trigger a ripple effect that may cost you the rest of the properties under the blanket.

How do I get started?

If you are ready to get started and learn how to buy multiple rental properties without limits today, you can do so by booking a strategy call with me and my team today at this link. From there, we will assess where you are in your investment journey and get you started on the right path today.