Fixing and Flipping Real Estate - Beware of the Neighborhood Housing Ceiling in 2023

Buying a fixer-upper, investing in repairing and remodelling the home and selling it for a profit is a relatively routine practice for real estate investors. For people new to real estate, fixing and flipping homes can seem like easy money. Anyone who’s spent a lot of time fixing and flipping homes can tell you, however, the process is rarely as easy as it seems!

There’s usually a lot of capital at risk when you’re fixing and flipping homes, and it can often be challenging to recoup your expenses, let alone turn a profit. Many homes that look like good candidates for fixing and flipping require much more investment in remodelling and repair than is initially apparent. For many investors, the real estate they’re planning to flip can quickly turn into a money pit.

Several external market factors make it challenging for even the savviest real estate professionals to flip homes. One example is the neighbourhood housing ceiling.

But first, if you are interested in securing property financing to start fixing and flipping real estate today, click the link below to book a free strategy call with our team here at LendCity.

Meet the house ceiling

The neighbourhood housing ceiling refers to the maximum sale price associated with a specific area of a city. While the average sale price of a home in your city maybe $500,000, for instance, the average sale price of a home in a specific neighbourhood may be significantly lower.

If you purchase a home with the intent to flip it, you need to be intimately familiar with the area and surrounding micro-economic factors.

Buying a home in a neighbourhood you’re unfamiliar with, you may think you’re getting a good deal when looking at the city market as a whole. In actuality, you won’t be able to recoup the value of your investment.

Overcoming the housing ceiling while fixing and flipping

Thankfully, savvy investors can conduct research and perform due diligence to ensure they’re investing in a solid fixing and flipping opportunity.

The first thing prospective home flippers need to do is establish a target neighbourhood. Rather than looking for opportunities city-wide, first, select the specific area where you’re considering fixing and flipping a home. This helps you adequately research micro-market conditions impacting the success of your investment. Becoming an expert in your target investment neighbourhood provides you with information necessary to make informed, lucrative home purchases.

Once you’ve selected your target neighbourhood, you’ll need to carefully research the sub-market, and watch sale prices and neighbourhood trends. This empowers you to make a more informed investment decision that’s data-driven and backed by hard observation.

Choosing the neighbourhood

It may not seem like it, but selecting a target neighbourhood is the most important step in fixing and flipping a home. If you fail to select a lucrative neighbourhood, you may end up with an overvalued investment property you’re unable to sell, because you need to exceed the neighbourhood price ceiling to recoup your investment.

There are both benefits and drawbacks associated with investing in both low-income and high-income neighbourhoods. Low-income neighbourhoods present a much lower barrier to entry compared with high-income neighbourhoods. They’re more likely to have a low neighbourhood price ceiling, however, which could greatly reduce your ability to reap a good return on your investment.

Transitional neighbourhoods may have a flexible price ceiling and could provide you with the best possible return. If there’s a formerly troubled neighbourhood with significant new development activity in your area, consider investing in a home to flip there.

Discover How To Flip A House With This Step By Step Guide

Considering market data

You should plan to spend a lot of time examining market data in your target neighbourhood before purchasing a home to flip. This allows you to more accurately budget for renovations, prepare for real estate sales cycles and time your investment correctly.

There are several aspects of the micro-market investors should consider before buying an investment property to flip, including the following:

Track sale prices

Look at the average sale price of homes in your targeted neighbourhood to determine how much homes are going for. Assuming most of these homes are in good condition, this is the amount you can reasonably expect to sell your investment property for.

Determine the months of supply

The months of supply refers to the amount of time it would take to sell all of the existing homes on the market in your targeted neighbourhood. If the months of supply are higher than six, it’s a buyers’ market and you should consider investing elsewhere.

Research market trends

There may be other market trends affecting home sales in your targeted neighbourhood. For instance, new developments in the area may be pushing prices higher; conversely, an uptick in crime or governmental regulation could depress real estate sales.

Finding the right house to flip

Next, you’ll have to identify the investment property that most accurately meets your needs and goals as an investor. There are several factors you’ll have to think about before purchasing a home to flip, including the following:

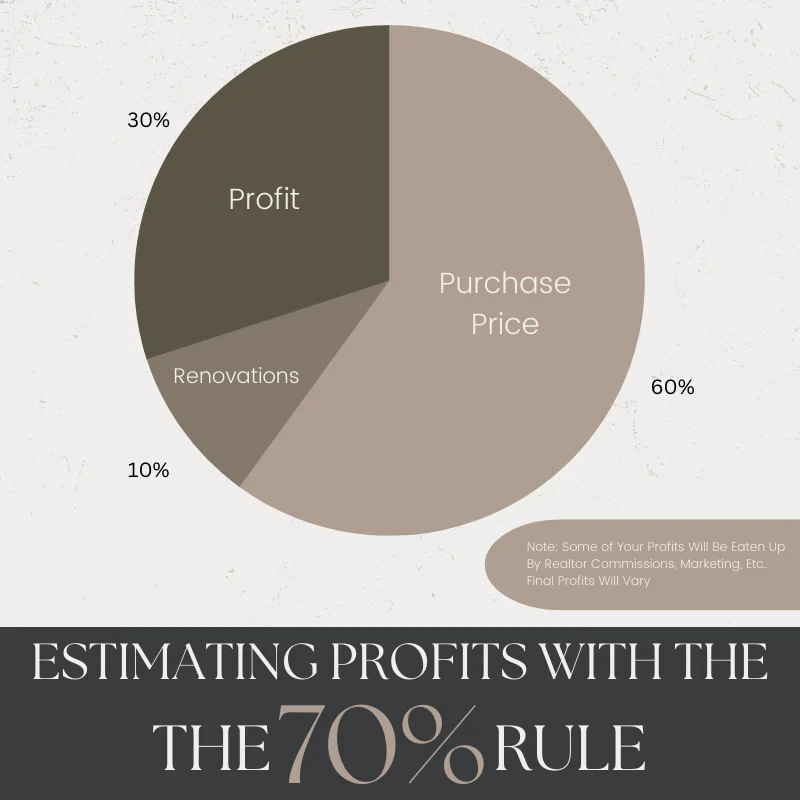

Purchase price

Carefully consider the amount of money you’re going to spend on the home’s down payment, mortgage service and closing costs. Even small miscalculations or oversights could result in missed profits from your fixing and flipping opportunity.

Necessary repairs

Analyze the home thoroughly, and determine all of the repairs necessary. You should plan to spend more than you think is necessary – there are a lot of issues you may not be able to identify immediately.

Size and property type

Also consider the size and type of building you’re attempting to flip. While buying a multi-family property may be more lucrative in the long-run, for instance, there are regulatory considerations you’ll have to account for.

While purchasing a home to flip can certainly seem like a risky investment, it can be a great way to get your career as a real estate investor off the ground. It’s also a great way to rapidly build wealth, provided you perform your due diligence and acquire a property you’ll be able to sell for a profit.

The headwinds of neighbourhood house ceilings can be strong, but not insurmountable. Learning to identify good fixing and flipping prospects in an area will also lead to a better fundamental understanding of house valuation. In the future, you’ll be a more savvy investor when it comes time to buy a property—whether you continue fixing and flipping or try a different investment approach.

So, if you are interested in securing property financing to start fixing and flipping your next property today, click the link below to book a free strategy call with our team here at LendCity.