How Many Mortgages Can You Have in Canada? Building a Well-Established Portfolio With 100s of Properties

If you are new to the world of real estate investing, you may find yourself wondering how some investors can have portfolios of over one hundred investment properties, yet the banks are stopping you after four or five properties. Is there a trick to getting more mortgages and buying more properties?

The answer is yes, there is.

While certain lenders may impose a limit on the number of mortgages you can have in order for them to work with you, there are plenty of alternative options and strategies that you can utilize to increase the number of mortgages you are able to have.

So the real question is, how many mortgages can you have in Canada?

However, if you are ready to get started right now, stop asking how many mortgages you can have in Canada today, and give us a call. With a simple strategy call we can show you how to get unlimited mortgages for your portfolio through careful planning and wise investments.

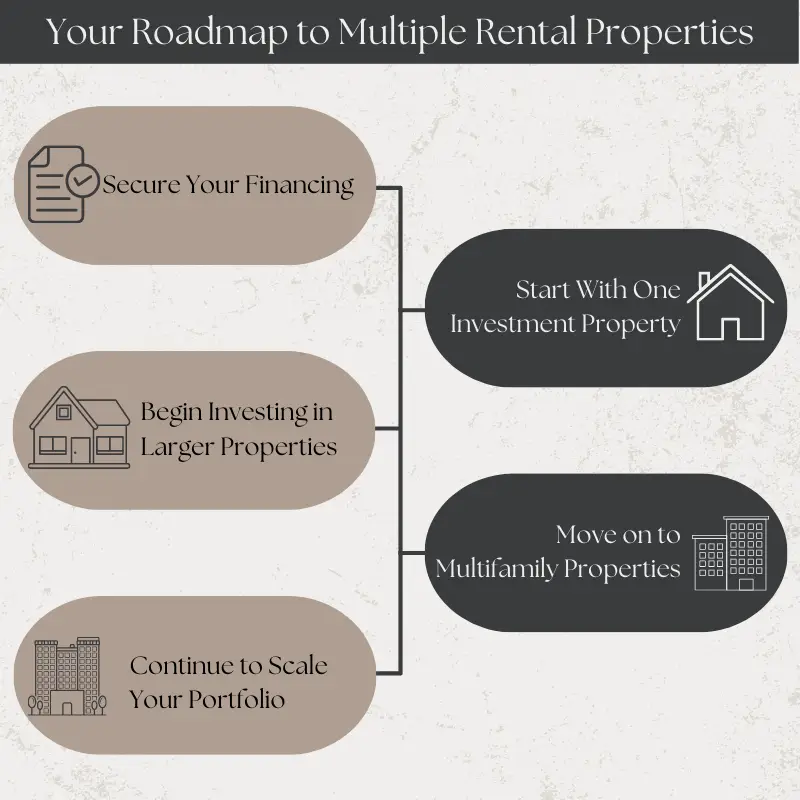

Prepare Yourself Financially For Your Investment Type

You may not have enough money in the bank to buy your next property with cash, but you still need to demonstrate that you are financially fit enough that a lender isn’t risking their investment with you. Just how fit you need to be depends on how many mortgages you currently have and how many properties you’re planning to buy. This will also change the answer to how many mortgages can you have on one property as well.

The easiest way to secure a mortgage while purchasing multiple income-generating units is to buy a multi-unit property. This way you can apply for a regular mortgage while still having multiple opportunities for rental income. You only need to meet the minimum mortgage requirements for buying an investment property, i.e. a 20 percent down payment.

If you’re looking to finance two to four rental properties, you will need to prove greater financial fitness. A mortgage broker can help you find a lender who is less restrictive than a major bank, but you still need to be prepared. Make sure your credit score is at least 630 and that you have at least three months of cash reserves for your monthly mortgage payment, in addition to the down payment.

If you want to finance five or more investment properties, you’ll need to have even stronger finances, including:

- A credit score of 720

- At least six months of cash reserves in case of a vacancy

- A down payment of 25 percent for a single-family home and 30 percent for multi-family properties

- A record of timely mortgage payments from the last year

- No history of foreclosures

If you’re looking to finance more than 10 properties, you’ll want to work with a major lender who better understands commercial investments.

Convincing a Lender to Finance Multiple Properties

If you decide to go with a conventional lender or are working with a new lender for the first time, you’ll need to establish who you are, what your intentions are and why you’re trustworthy.

It’s critical to have all of your financial information handy to present to the lender. Your lender will first want to know your debt-to-income ratio. This will change depending on the number of rental properties you have. The lender will likely add a percentage of your rental income to your overall income to help determine your ratio; however, the percentage varies by lender.

Your lender will also consider the value of the property and the amount of money you have for a down payment. Depending on how many properties you already own, how many mortgages you have and how much cash you have on the hand, the amount they request for a down payment may vary. While you need at least 20 percent for your first rental property, once you have five or more properties the bank may ask for a higher down payment, e.g. 35 percent. Keeping your finances in tip-top shape will strengthen your argument.

Unlike a mortgage on a primary residence, you should treat the mortgage process for your investment property as a business – because it is. Develop a business plan that you can present to the lender that details your current financial picture and your projections. The goal is to better help them understand the return on investment for this property. You’ll want to include information such as:

Putting this information together in an easy-to-read business plan will help your case with lenders.

How Many Mortgages Can You Have at One Time?

Answering the question how many mortgages can you have is more realistically a question of how many mortgages can you have at once. Realistically, over a lifetime of investing, you could have dozens of mortgages without ever dealing with bank-imposed limits on the number of mortgages available to you.

Realistically, in order to answer the question, 'how many mortgages can you have at a single time?' you would need to dive into your finances and fully break down all of your credit, debts and income while also weighing it against the profitability of upcoming investments.

After all, many commercial lenders will finances multiple investments as long as they make sense by the books. How many mortgages can you have from a commercial lender?

Find a Lender Who Understands Investments

Most homebuyers turn to conventional lenders to secure financing for their primary residence. If you’re just getting started in real estate investing, this is likely what you’ll do too. Typical lenders will help you with the first couple of investment properties you buy, but they aren’t ideal resources for your business. Known for their conservative ways, big banks and conventional lenders aren’t eager to help investors secure more properties.

Instead, you’ll need to find a lender with experience lending to investors. These lenders understand your financial goals and how this asset class works. They understand that you are using leverage to grow your wealth. They are less likely to be afraid of the risk and are eager to join in making money from your income-generating venture.

More than being a source of financing, the right lender can be a valuable member of your team. You should find a lender with whom you can talk about your plans for the future and your ultimate goals. This person is a sounding board for any issues with your financing or ideas for securing the next property. They will help you create a timeline for paying off existing mortgages and finding new ones. A great lender can function as an advisor in growing your business.

Growing your wealth quickly with real estate investing requires financing multiple properties at once. While the traditional lending system doesn’t seem conducive to this method, the option is available to investors like you. All you need is a bit of preparation and research.

How Many Mortgages Can You Have With One Lender?

Part of finding the right lender includes asking them how many mortgages can you have with them.

Some lenders are restrictive and will limit you to a single mortgage though them while others may allow you to have up to five. There are also lenders who do not have a limit on the number of mortgages they will give you as long as it makes sense to them from a business standpoint.

Why Is There a Limit on The Number of Mortgages With The Banks?

One of the first questions you are likely going to ask yourself when looking into how many mortgages can you have in Canada when it comes to achieving multiple mortgages is, “Why are the lenders limiting me in the first place?” If you have gone in to buy an investment property to take out a new mortgage and been told that you have hit your cap, this question has almost certainly crossed your mind. After all, if you have the funds to support it, why are they telling you no?

The primary is for their own security. When the 2008 recession hit, a large number of investors and property owners defaulted on their mortgages or were forced to sell very quickly. This naturally lost the lenders a ton of money all at once, while also eliminating many of their projected profits they expected to earn in the form of interest payments over the upcoming years. So, many lenders decided that in order to protect themselves in the event of another major downturn they would impose limits on the number of mortgages a person can have in order for them to lend to them.

Another reason is to protect the investor. Each mortgage you take on does come with a level of risk, and while well-structured investments can make this risk more manageable, the lenders are also taking steps on their end to avoid the risk from piling up too high.

How Many Mortgages Can You Have in Canada on One Property?

Before you start looking at your entire portfolio, the question you should ask is how many mortgages can you have in Canada that are secured against a single property?

While there is no firm limit when you are asking how many mortgages can you have in Canada against a single property, there are a few benchmarks you will need to meet in order to get approved for additional mortgages on a single home. These benchmarks are tested in the form of a stress test, which will determine your ability to assume and repay debt on a property. During this process they will compare your debt-to-income ratios and credit worthiness to a benchmark interest rate.

Additional mortgages are also limited by the equity you have built in the property. Traditionally, lenders will approve you for a maximum of 80 per cent of the total equity you have built in the property, so as you take on more mortgage debt against the property, the amount of money you will qualify for and your ability to qualify for these mortgages will begin to decline.

Discover How To Apply For An Investment Property Mortgage With This Step By Step Guide

How Many Mortgages Can You Have in Canada in Total?

Now we have circled back to the big question...

How many mortgages can you have in Canada?

It may come as a surprise to you, but there is not a limit on the number of mortgages you can have in total – provided you are financially capable of managing them. That is right, once you know where to look to surpass the limits imposed by certain lenders, the primary limiting factor on your ability to have as many mortgages as you want, is you.

That means if you are capable of securing the funds to buy and maintain additional rental properties then you are free to expand your investment portfolio to your heart’s content.

So, how do you exceed the limits imposed by certain mortgage lenders?

LendCity – The Home of Unlimited Rental Properties

Sometimes, the question is not how many mortgages can you have in Canada, but instead how many rental properties can you finance - and we have a secret for you - the answer is limitless if you know what to do.

The solution we recommend to our readers to unlock the ability to buy unlimited rental properties is LendCity. When you apply for a mortgage, they take a look at your entire portfolio to determine exactly where you are at in order to get you approved with the best lender for you. That means not only bypassing mortgage limits but securing the best available mortgage rates for each of your investments.

How Commercial Lenders Can Allow You Bypass The Banks For Additional Financing

There is a point where each of the traditional residential mortgage lenders reach their limits and will not lend any further, but that does not mean you are out of options. In fact, that is where commercial lenders come into play.

Despite how it may sound, commercial lenders are capable of lending on more than just commercial properties. That means you are not locked into buying things such as retail properties and large multi-family properties. You are allowed to use them in order to buy single-family homes and small multi-family properties.

What makes commercial lenders different from traditional residential mortgage lenders is the fact that instead of focusing on you and your personal credit, the focus shifts towards the property and the profitability of the investment after factoring in expenses, vacancy rates and expected rent costs.

Through commercial lenders, you can stop asking yourself how many mortgages can you have in Canada, and instead focus on the business financials of your investments.

This is because once you enter the world of commercial financing, the answer to the question, "how many mortgages can you have in Canada?" is simply as many as your portfolio and investments support.

If You Are Ready to Continue Investing

If you are ready to invest without limits and grow your real estate portfolio, the team at LendCity is ready to help you. Each agent is dedicated to meeting you where you are at in your investment journey and setting you up with the best lending options to achieve long-lasting success.

Our team is ready to help you answer questions such as, 'how many mortgages can you have in Canada?' 'how to get approved for multiple mortgages?' and more.

If you are ready to begin, you can give the team a call at 519-960-0370 or check out LendCity.ca to apply online. Alternatively, you can book a free strategy call with our team today at the link below.