How to Analyze an Investment Property One Room at a Time - Property Analysis Success 101

It’s easy to trick yourself into thinking you’ve found the perfect investment property. It has a spacious, recently-updated bathroom or a great master suite. The kitchen is filled with high-end materials and new appliances. There’s a brand-new roof. These things are great… but if you’re focusing too much on the one or two big-picture items, you could be missing the little value traps hiding elsewhere in the home.

This is why it is crucial that you know how to properly analyze an investment property.

Being thorough when you analyze an investment property is something every investor needs to master. It’s often a skill that comes with time. If you’re just getting started, you might not know exactly what to look for or how to evaluate the pros and cons of a property. The key is to not get overwhelmed. Focus on one room at a time, be meticulous and beware of misdirection.

But first, if you are wondering what lenders want to see in a property before you analyze an investment property, click the link below to book a free strategy call to learn more about the lending criteria you need to consider.

Start big, with the kitchen and bathrooms

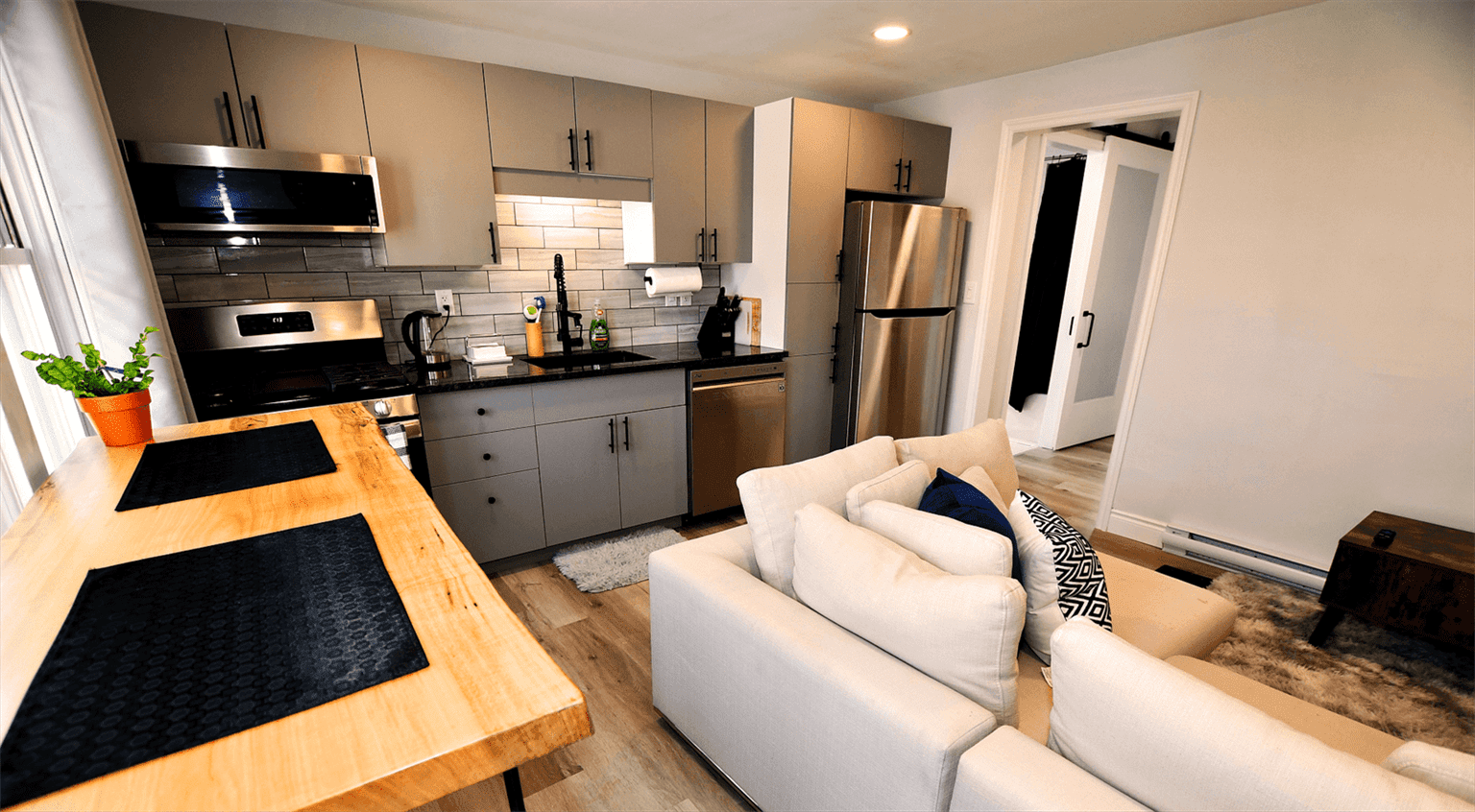

If you analyze an investment property and there’s a problem, what rooms are going to cost you the most to fix? The kitchen for sure; and bathrooms aren’t far behind. The reason is simple: A lot is going on in these rooms. Plumbing, electrical and HVAC are all present, along with high-value installations like cabinetry, countertops and non-carpet flooring. There’s a reason they cost tens of thousands of dollars to remodel!

The high value of these rooms makes them the place to start when evaluating a prospective property. Be as thorough as possible when inspecting utilities, and look closely for signs of wear and tear on installations and materials.

Look for recent renovation work and see if there’s documentation from a reputable contractor behind it. If it was a DIY job, consider having a trusted handyman inspect it closely. Renovations may be appealing, but if they’re done at a sub-par level, they could come back to haunt you later on. Remember, recent renovations are the hallmark of a fix-and-flip—if you’re buying a property someone else is flipping, you want to make sure the updates are worth the price.

Kitchens and bathrooms are also the flashiest rooms of the home. Starting your inspection here will give you a sense of what future tenants will focus on when they’re looking to rent.

Focus on the living areas next

After focusing on the big-ticket areas of the property, spend time assessing the common living areas. These are where future tenants are going to spend most of their time, and where they’ll expect the most space. So, you will want to be more strict when you analyze an investment property's living space.

Inspecting living rooms and dining areas is considerably easier than kitchens and baths, simply because there’s less to be concerned about. In these areas, check the condition of materials like baseboards and mouldings, windows and walls. Then, focus on practical assessments. How many outlets are there and where are they located? What’s the size of the room? What kinds of furniture configurations will fit? How do common rooms play into the overall design of the home?

Note any oddities and ask yourself if they need fixing. If so, how much will it cost to correct them? Something like cracked window pane can be easy enough to repair, while a crumbling brick fireplace façade could break the bank.

Discover How To Buy Unlimited Rental Properties With This Step By Step Guide

Move into the bedrooms

Bedrooms are the simplest rooms to tackle when you analyze an investment property and have the lowest potential for problems. Nonetheless, be sure to inspect each one thoroughly, with a mind for practicality.

Is there adequate closet space? What are the dimensions of each bedroom? Where are they located in proximity to the kitchen or bathrooms? What kind of natural light is there? Outlets and outlet placement? HVAC vents? Taking note of the “livability” of each bedroom goes a long way invalidating the property. These rooms may be simple, but they ultimately need to accommodate your future tenants accordingly.

During pre-analysis, you probably determined how many bedrooms your ideal investment property has based on your target demographic. Make sure the bedrooms in the property you’re inspecting reflects that.

Don’t forget basements and attics

Basements and attics hold untapped potential… and uncertain dangers. Despite inspecting these rooms last when you analyze an investment property, be sure to pay very close attention to them. Look for signs of water damage and pest problems, as well as rot and decay. Check to see that infrastructure meets local building codes. If these areas are currently in use—such as a basement suite or an attic office—make sure they’re properly permitted. And, most importantly, check HVAC, electrical and plumbing to verify good condition.

What are you looking for when you analyze an investment property?

Going room-by-room when you analyze an investment property not only acclimates you with the home itself, but it also gives you a chance to spot problems at a granular level. It’s easy to see a badly damaged roof from the curb, but you won’t find evidence of shoddy electrical wiring unless you get right down into things during a room-by-room inspection.

As you go through a property, you should be looking for two things: Pros and cons. Keep notes of anything you find that stands out in each room.

- The new furnace in the basement? Pro.

- The recently-refinished bathroom? Pro.

- A DIY plumbing job that’s not up to code? Con.

- A bedroom that’s barely bigger than a bathroom? Con.

Pros are things that are going to attract good, long-term tenants and allow you to charge a higher rent for a premium experience. Cons are almost always things you’ll need to fix or concede on. Having a robust list of both gives you a clear picture of what a property looks like an investment.

How to decide if it’s worth the investment

What exactly do you do with a list of pros and cons once you have taken the time to analyze an investment property? Start valuing them. You can charge a $100 premium on rent each month for the recently renovated bathroom. Conversely, you’ll need to pay $1,200 to fix water-damaged insulation in the attic. Is it worth the investment? That’s up to you. Do you think you’ll be able to rent to a tenant for one year to offset the cost?

Do a cost-benefit analysis for your pros and cons. Figure out how much you’ll need to put into the property, versus what’s already there you can capitalize on. And, if you do decide to invest, take everything from your pros column and incorporate it into the rent ad. You’ll quickly attract a tenant willing to make their investment.

Once again, if you are wondering what lenders want to see in a property before you analyze an investment property, click the link below to book a free strategy call to learn more about the lending criteria you need to consider.