How to Buy Commercial Real Estate: Step-By-Step Guide

When the average person thinks about investing in Canada’s real estate market, they picture the hustle and bustle of flipping homes and daily interactions with tenants. That’s just one side of the real estate market. There is also a whole world of possibility to explore in the commercial real estate market.

So, naturally investors are looking to learn how to buy commercial real estate in order to take advantage of the potential it holds.

While the process of how to buy commercial real estate will vary by property type, location, and intended use, there are few things that you should know going into any commercial purchase.

For starters, commercial real estate requires strong financing. That is why my team and I work with a network of reliable commercial lenders so that your mortgage can be crossed off of your 'buying commercial real estate checklist.'

To learn more about how to obtain the best strategic financing available, book a strategy call with us at this link and we can get started.

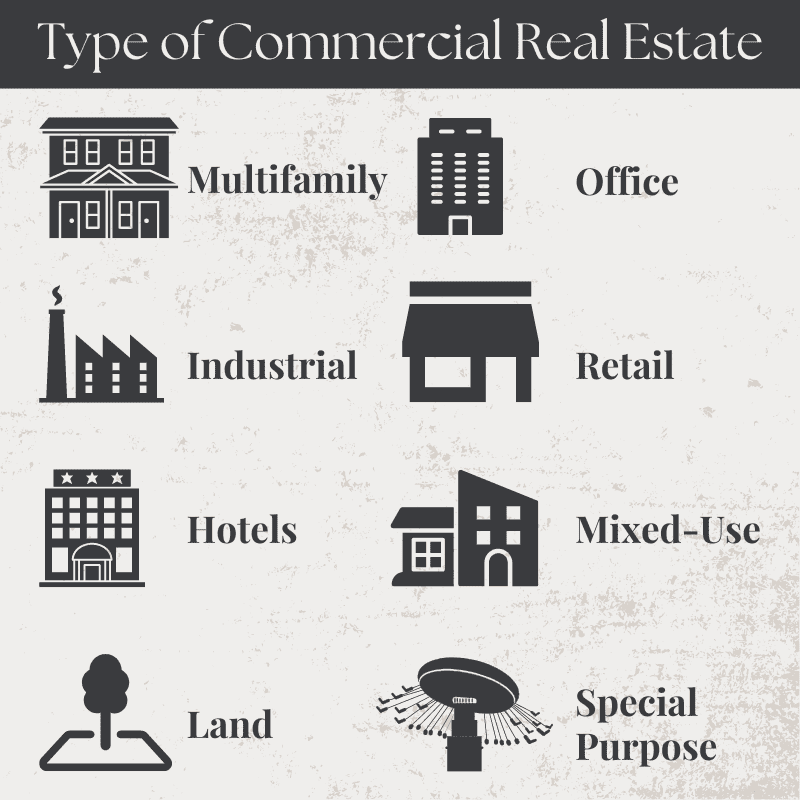

Types of Commercial Real Estate

Before you worry about how to buy commercial real estate, you will need to focus on what type of commercial real estate strikes your interest. In general, there are eight different kinds of commercial real estate:

- Office Space is home to a variety of businesses that do not require space for traditional customer interaction.

- Retail Space is for shops and restaurants that cater directly to consumers.

- Multifamily Property encompasses apartment buildings or complexes with five units or more.

- Industrial Property houses manufacturing and warehousing businesses.

- Hotels and Hospitality offer short-term accommodations

- Mixed-Use Real Estate offers a combination of the above categories.

- Land covers undeveloped or vacant land.

- Special Purpose Real Estate is any property that does not fit into the other classifications.

So remember, before you worry about how to buy commercial real estate in Canada, you need to decide which type of property you want to buy.

Owner-Occupied or Income Property?

Once you have decided on the type of commercial real estate you are buying, you need to know whether you are buying the property for personal use, or if you are simply looking to buy a commercial income property.

Each of these processes are going to look a bit different, so while you are looking at how to buy commercial real estate you should always keep this factor in mind.

Buying Owner-Occupied Commercial Real Estate

Buying owner-occupied commercial real estate is typically the easiest way to buy commercial real estate. After all, in these cases you are not working out how to buy commercial real estate that someone else would want, you are simply looking for a property that suits your needs.

For example, let's say you are looking to open a dentists office, you are going to have a list of things you need the property to have in order for it to be a good fit for you. This may include a waiting room off the entrance, a certain number of examination rooms, space for an office, and a secure area for equipment and file storage.

If the property meets your needs, you will then be free to pursue financing and complete your purchase.

Financing an Owner-Occupied Commercial Property

Financing an owner-occupied commercial property is relatively similar to buying residential real estate.

This is because one of the main things the lender is going to look at while you are shopping for a mortgage is your income. However, instead of your personal income, they will instead be looking at your business income to ensure your business is profitable enough to support the mortgage payments, taxes, insurance and other expenses on the property.

Buying Commercial Income Properties

The true complications in learning how to buy commercial real estate come into play when you start buying commercial income properties.

This is largely because instead of buying a property that suits your own needs, you need to buy a property that is going to attract tenants.

Keep Your Tenants in Mind

The type of property you buy is going to change the type of tenant you attract. While you could always use commercial real estate to house your own business, most of the time you are going to rent these properties out.

What is an Anchor Tenant

Another important part of learning how to buy commercial real estate with multiple tenants is understanding the role of an anchor tenant.

An anchor tenant is a larger, prominent tenant with two jobs, covering a large part of the mortgage and attracting other tenants to the property.

A great example of an anchor tenant is Walmart, many shopping centers will introduce a major retailer like Walmart to their property in order to attract large crowds. As a result, additional tenants are attracted to the property in hopes that some of Walmart's existing consumer base will visit them as well.

Ideally, you want to secure this tenant first so that you can use them to advertise your property to other potential tenants.

Financing Commercial Income Properties

When you are securing financing for a commercial income property, there are a few things the lender is going to look for.

First, the lender will want to know if you already have a tenant lined up for the property. If so, your financing process should go much more smoothly because you will be able to use the agreed-upon rent to calculate the profitability of the property and determine the risk level.

Next, the lender may want to see the previous financial performance of the property to make sure they are not lending against a property with a history of consistent turnover. This is especially important because if you ever default on the property, they want to make sure it can hold a tenant and resell easily.

Finally, most lenders will want to get a clear look at your portfolio and your income to make sure that in the event of a vacancy, you are not likely to default on the mortgage.

Consider Starting With a REIT

Because of the intricacies involved with investing in learning how to buy commercial real estate, novices, especially those with a limited budget, may find a lot to love by opening their commercial career with a real estate investment trust (REIT). Think of a REIT as a hedge fund that focuses solely on real estate. These companies are operated by professionals at the top of their game who invest in a variety of real estate ventures using capital from investors (like you) who purchase shares.

Though riskier than a standard government bond, REITs are considered a relatively safe bet in the world of investment. Best of all, there are a variety of REITs focused on different sectors of the residential and commercial real estate markets, which means you can take your pick. For a rookie hoping to learn the ins and outs of a specific sector of the Canadian commercial real estate market, learning how various REITs track and choose investments can prove an invaluable education.

Download your FREE Printable Excerpt for this Step By Step Guide

Determine Your Budget

For those people who want to dive right into learning how to buy commercial real estate, the first thing to do is establish your budget. First-time commercial real estate investors are best served by working on this with the help of an accountant who has experience in the field.

The popularity of the Canadian real estate market makes it extremely competitive, as well. Properties enter and leave the market in virtually no time. It’s easy for a novice investor with a poorly-defined budget to get swept up in that drama and pay far too much for their first property.

That doesn’t mean you can’t enter the market and discover how to buy commercial real estate, it just means that you have to set a reasonable budget and remain patient while you wait for the right opportunity for you. It may not happen overnight, but if you stay true to your financial capabilities, you can hardly go wrong.

While it is possible in some cases to learn how to buy commercial property with no money at all, that is something you will have to work out with your mortgage agent.

However, in the meantime, you will need to know how much you can get in financing if you are going to set a budget. Fortunately for you, I have a great commercial lending team here at LendCity that is yours to use. All you need to do is book a call with us here, and we can get started.

Go Local, Go Urban

When you’re working out your budget, you will want to take into account a handful of geographical considerations. Experts suggest that if you’re going to learn how to buy commercial real estate, make sure it’s somewhere that you can readily visit to start.

It doesn’t need to be in the same town you live in, but it should be somewhere that you can get to within a day. This makes you more inclined to visit, which will, in turn, keep you focused on the property itself.

When you’re looking for a place that’s easy to visit, you can hardly go wrong by searching through the urban markets. Over half of new immigrants to Canada are settling in and around three major metropolitan areas: Toronto, Vancouver and Montreal. That makes commercial investment opportunities in these areas a strong long-term bet as offices and shops will continue to crop up to meet the growing demand.

Once you’ve chosen a robust urban area in which to invest, you can start researching average building costs. The potential for urban renewal and several other factors that will go into determining your budget.

Commercial Property Assessments

Once you have determined where you would like to invest, there are three main assessments that must be performed in order to secure a mortgage on a commercial property.

Commercial Mortgage Agent Assessment

First, in order to determine whether it will be possible to secure a mortgage against a commercial property, you will need a commercial mortgage agent assessment.

Gather all of the property details you can and submit them to our commercial financing team. From there, they will look over the property to ensure there are no immediate red flags that will turn lenders away.

This process typically takes about half an hour provided all of the property details are provided up-front.

After this assessment, your agent should have an idea on whether you can finance the property and if so, which lender you should go with.

Appraisal

Next, you will need to have the property appraised. This will tell you the current value of the property which can impact a few factors regarding the purchase.

First, it will impact whether the lender will provide you with the funds for the purchase. If a property appraises dramatically below the listing price, most lenders will require you to talk to the price down before they would ever finance it.

This is where the second factor comes in, if the property's value does come in low, you can and should use that to negotiate a lower price. Even if the lender is willing to go forward at the current price, it is always worth it to see if you can cut the price down.

Environmental Assessment

Finally, depending on a property's location it may require an environmental assessment. These are to ensure the property is not home to any environmental hazards that make it ineligible for financing.

For example, a property located beside a gas station may require a soil sample to be taken in order to make sure the soil is not contaminated by runoff from the gas pumps and vehicles.

Due Diligence

One of the final steps you need to take if you are learning how to buy commercial real estate, is to cover the due diligence. Once you’ve agreed to the purchase of a property, it’s on you to research any title and zoning documentation and review any surveys or leases that apply to the property - or find a professional who can help you.

In most cases, I find the due diligence comes as part of the back-end of any commercial real estate deal, but it’s not a given. Before you enlist legal counsel to help with a commercial real estate deal, make sure that they’re willing to oversee the due diligence when the time comes.

I will repeat, doing your due diligence is one of the most important parts of how to buy commercial real estate. If you are not making sure everything is done properly, you will have problems later.

After you’ve followed these steps, you can rest assured that you have a basic understanding of how to buy commercial real estate.

How to Get Financing to Invest in Commercial Real Estate

Now that you know how to buy commercial real estate, the next step is to shop for a reliable commercial real estate loan. Adding an experienced commercial broker can go a long way toward reducing the stress of securing a loan for your needs.

As you’re searching, banks and financial institutions will want to see strong financial statements and projections, but don’t go overboard. Remember, financial institutions make their money by betting pessimistically - while they may trust you know how to buy commercial real estate, they may not trust you to succeed in the market. It’s better to remain humble about your expectations and be pleasantly surprised than to overextend yourself before you begin.

With so much variety in terms of property types, it can be intimidating to search for a good mortgage. So, instead of taking the time to hunt for the best lender, I suggest you book a call with my commercial financing team to get sorted with the best available mortgage financing every single time so that you have less to worry about while working on how to buy commercial real estate.