Investing in Corporate Housing - Investing in Vacant Lots - Alternative Investing Success in 2023

Looking for a creative way to generate passive rental income? You may want to consider investing in corporate housing. Corporate housing is a great way for savvy real estate investors to mitigate many of the risks associated with traditional real estate, while still earning a significant amount of passive income.

Like all real estate investments, corporate housing comes with its own set of pros and cons. More than anything, you need to have urban real estate holdings to even consider this alternative investment option. But, if you’ve got real estate in major metropolitan areas or up-and-coming cities, there may be a future of opportunities for you in corporate housing.

We’ll go into the benefits and nuances of corporate real estate below. You can get a look at what makes these investments so attractive in the right setting.

So, if you are interested in learning more about how to finance corporate housing, click the link below to book a free strategy call with our team at LendCity.

Spotlight on corporate housing

Corporate housing units are short-term rental solutions designed to meet the needs of mobile professionals. Corporate housing tenants are usually affluent urban professionals who spend significant periods of time travelling for work.

While many people associate short-term rental agreements with less consistent revenue, corporate housing is usually more lucrative and stable than vacation rentals and other short-term housing options.

Your ability to generate significant passive income from corporate housing is largely dependent on the real estate market that you’re operating in. Additional factors such as the location and positioning of your asset and your property management skills.

With the right combination of business savvy and market conditions, corporate housing can be an excellent investment for both first-time buyers and experienced real estate professionals alike.

Discover Residential Property Management With This Step By Step Guide

Defining corporate housing

Corporate rentals are fully furnished housing units offered on short-term leases. They’re designed to serve long-term business travellers. Many corporate rentals are offered month-to-month. Some property owners may opt for three-month lease contracts, while others decide to provide their tenants with weekly contracts.

All-inclusive housing

The idea behind corporate rentals is that when business travellers need a place to stay for an extended period of time, they can rent out a short-term apartment suite that includes everything they need. All they have to bring is a suitcase full of clothing and food for the kitchen!

Most corporate housing offerings are full-service, meaning weekly or even daily cleaning is provided, as well as building security.

Smaller, well-positioned units

Because they are short-term, it’s common for corporate rental units to be smaller than traditional apartments. If you have a building with smaller, studio-sized units that are strategically positioned, you may be able to reap the highest possible return on your investment by converting the building into corporate housing.

High-end tenant demographic

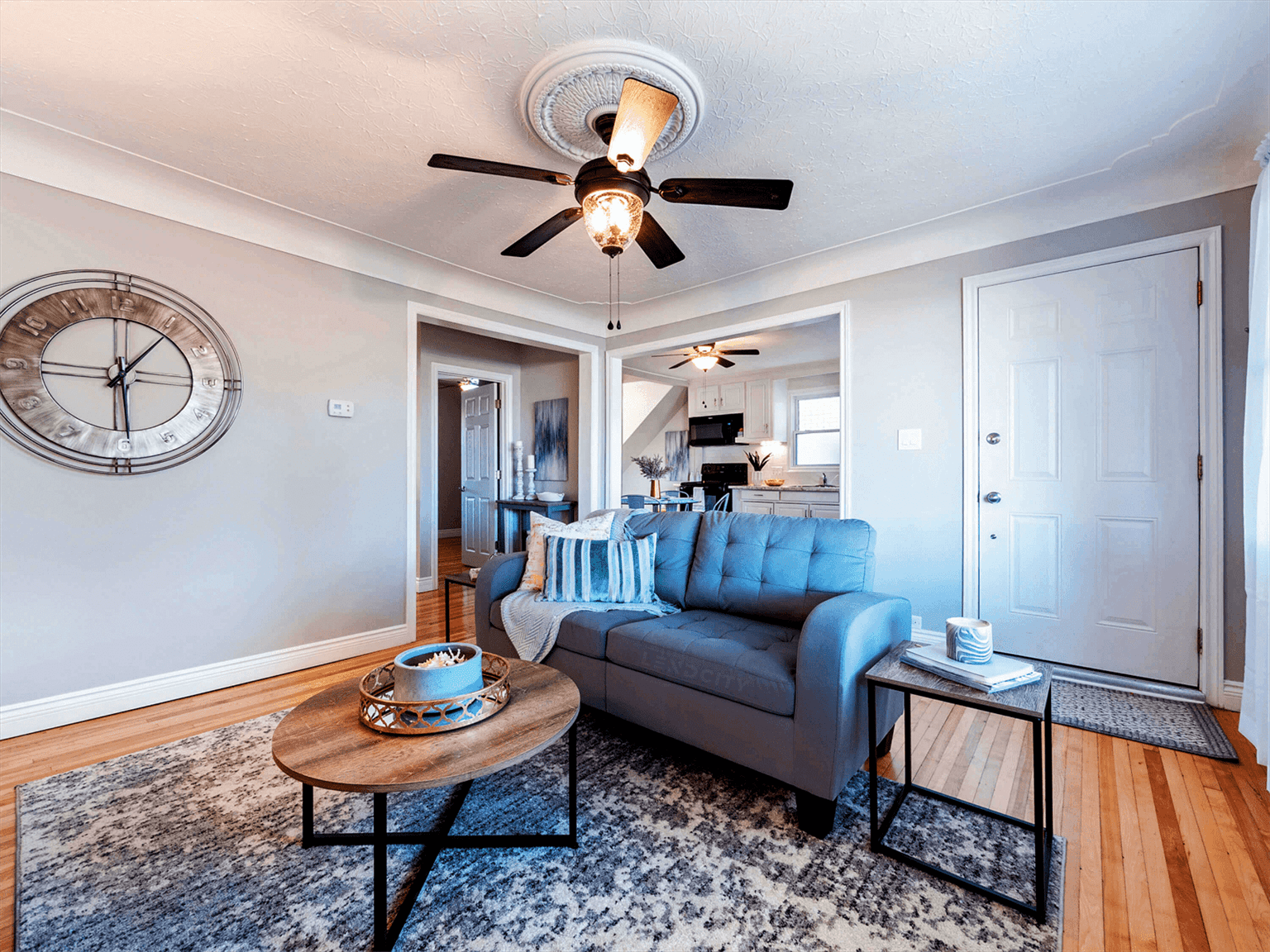

Corporate rentals cater to a working professional demographic. Professionals that commonly take advantage of corporate housing include lawyers, sales executives, media professionals and academics. Because of this, it’s often necessary to invest in high-quality finishes, like designer furnishings and top-end appliances. It’s important your corporate rental feels like a ‘home away from home’ for your target tenant.

Convenient location

Beyond the unit itself, corporate rentals need to be located in areas rife with demand. This is almost exclusive to cities. Professionals will want to be located close to their work—usually no more than 10-15 minutes away, if possible. The closer your units are to major corporate or educational campuses, the better the odds they’ll enjoy strong occupancy. For those located further away, access to bus routes and public transportation is a must-have.

The benefits of a corporate rental

Short lease terms, expensive furniture and high-end finishes may deter many investors from opting to convert their units to corporate housing. While it may seem like an unusual investment decision, there are many benefits associated with corporate rentals worth considering.

For instance, it’s possible to earn significant rental income from a properly prepared corporate rental. Because you’re advertising the housing as a full-service package, you can command a premium. Even if there are some weeks out of the year you have a vacant unit, the additional money you’re earning will far offset that expense. The income of corporate tenants is usually higher than general renters and they usually expect to pay more for sophisticated housing.

Additionally, renting your property to career professionals can mitigate many of the challenges that you may face with other types of tenants. You likely won’t have to worry about late rental payments, or having to deal with potential pets. Corporate tenants are likely to conduct themselves professionally and maintain a clear, open line of communication throughout their stay.

The risk of landing a bad tenant is greatly diminished, which means savvy investors might be able to maximize their returns by acting as their landlord. Keep in mind, the high expectations of a corporate rental extend to maintenance and communication. If you’re organized and up for the task of tending to the needs of these units, you can avoid paying property management fees.

Finally, corporate tenants are also likely to recommend your housing to colleagues and people within their organizations if you leave a favourable impression. The business world is built on networking, which can significantly benefit your real estate business. Establishing high-quality corporate housing and landing a few well-connected tenants could help you keep yourself busy and your building occupied for the foreseeable future.

Disadvantages of Corporate Housing

It’s important to note the drawbacks of a corporate housing model. The two most obvious disadvantages are:

- They require a significant investment to get off the ground.

- Limited lease terms can leave you open to long periods of vacancy.

The location and positioning of your property will determine whether your building is suitable for use as a corporate rental. If your investment property is located in a large, urban center with walking or transit options, you may want to consider offering up your property to short-term corporate tenants.

Before you make any decision, it’s advisable to consult with other real estate industry professionals in your area to learn more about their successes or failures with corporate housing in your market.

So, once again, if you are interested in learning more about how to finance corporate housing, click the link below to book a free strategy call with our team at LendCity.