Investing in Distressed Properties - 7 Tips For Buying Risky Investments

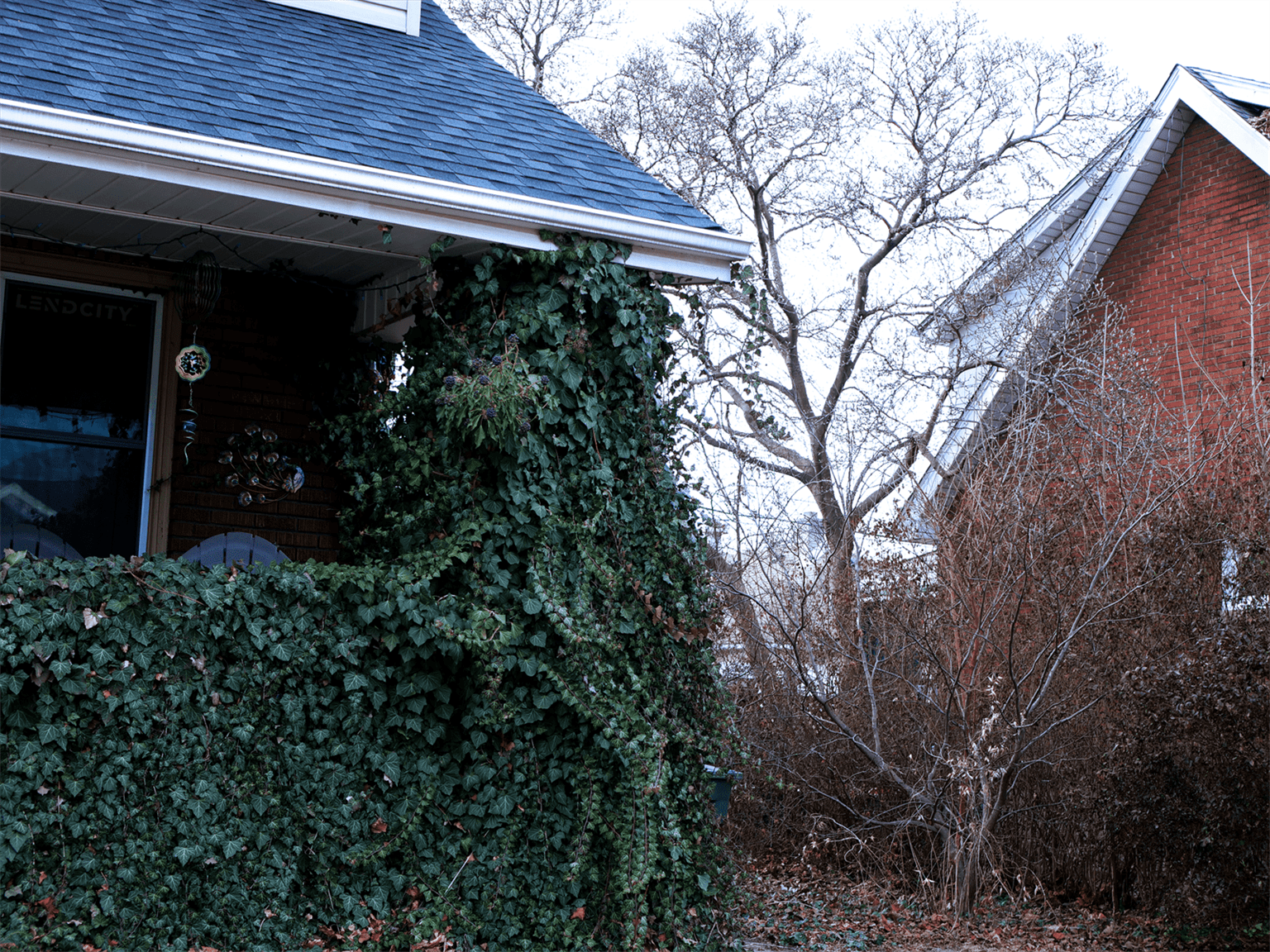

Distressed properties are properties that have experienced plenty of damage—and are thus much cheaper investments. Damages to distressed properties could include fire damage, flood damage and much more. Since these types of properties require many repairs and renovations before reselling, they are usually quite risky, especially for new investors. However, there are ways to make a huge profit from distressed properties.

Distressed properties are so cheap that the cost of repairs and renovations could be minimal compared to the potential profit. If you want to invest in a distressed property, it’s important to do plenty of research and be aware of the risks involved. Having a good strategy in place can ensure that purchasing a distressed property will result in larger profits.

Before we dive in, if you would like to learn how you can finance the purchase of distressed properties, click the link below to book a free strategy call with our team today.

Do your research for every distressed property you find

If you’ve found a distressed property for a good price, it’s important to do plenty of research before buying. Consider having a specialist inspect the property and check for any and all needed repairs. This will help you avoid the need for unexpected repairs down the line. You don’t want to end up investing in a piece of property that’s beyond repair.

Researching the neighbourhood is just as important. Even if the price is right, you’ll want to make sure the property is in an area where homes sell. Speaking with a reputable real estate agent in your area is the best way of finding out information on a particular neighbourhood.

Take an on-hand approach

It’s important to stay aware of whatever’s being done to your property. While construction and renovations are being done, you should frequently visit the property. Make sure your contractors keep you updated on the progress of any renovations. Knowing that everything is going smoothly will give you peace of mind. If there are any issues, you’ll want to find out about them right away.

Investing in a distressed property takes a lot of time and energy. Make sure it’ll be worth it by staying on top of repairs and renovations.

Discover How To BRRRR With This Step By Step Guide

Do proper planning

Before you start looking at properties, it’s important to develop a good strategy. This will include deciding where to look and how much you’re willing to spend on renovations. Developing a strategy with a local real estate professional and the contractor could help assure that you’re making all the right decisions. Develop a timeline for how long repairs and renovations should take. Try to decide on a specific date when the property will be ready to sell.

Since distressed properties are usually a bit more unpredictable than other investments, be sure to prepare for any situation. You’ll need to push your expected sale date forward if repairs and renovations take longer than expected, for example. This means not promising a specific move-in date to potential buyers unless you’re absolutely sure that the property will be ready.

Know that there are risks

Being optimistic about any property that you’re invested in is a good thing—however, don’t ignore the risks. Distressed properties are usually in bad shape. Don’t invest if you can’t put in the right amount of time and money.

If you were hoping to receive financing for a distressed property investment, then you might be disappointed. There aren’t many lenders out there who will offer financing for a distressed property. That’s why it’s a good idea to have a backup plan.

If you are looking for financing call LendCity Mortgages at 519-960-0370. They have access to construction lenders that will move forward on a distressed property.

Selling a distressed property can also take time, even if it looks great. The market can fluctuate. That is why it’s a good idea to have a real estate agent on your side. A good real estate agent can help you decide on the best time to sell.

Have an exit strategy

Since there are many risks involved with distressed properties, it’s good to have a pre-determined exit strategy. This is true for any real estate investment, but especially with distressed properties. Don’t spend all your money on buying the property and repairs. Have some money set aside in case you need to exit the deal. Exiting will definitely result in a monetary loss, but is sometimes better than sitting on a property and waiting for it to sell.

Hire the right renovation company

Renovations are a big part of investing in a distressed property, so you’ll want to make sure you hire the best local contractors. A good contracting company can take care of all your repair and renovation needs in a timely manner. When it comes to finding the right contracting company, consider asking other investors. They might have good recommendations for inexpensive contracting companies in the area.

Online research could also result in finding the perfect contracting company. Check each company’s reviews and contact them for estimates. These estimates will also help you better develop your budget.

Have a proper budget in place

Most investors buy distressed properties through an auction. This is why it’s important to decide how much you’re willing to bid without going over. Besides just the cost of the property itself, there are also plenty of monetary considerations that need to be made with distressed properties. You’ll need to make sure you have enough money left over for repairs and renovations. The cost of marketing and landscaping, taxes and insurance should also be considered.

Is investing in a distressed property worth it?

Distressed properties are enticing to investors, mostly because they’re much cheaper than other properties. If you have the right strategy, then investing in a distressed property could be quite profitable. Depending on the distressed property, there could be less competition, which means you’ll end up spending even less.

Be willing to take the risk of owning a distressed property if you’re going to purchase one. If you’re not willing to take the risk, then consider putting off your investment and saving up for a safer option. Distressed properties take a lot of time and work, making them difficult investments for new investors. If you’re a new investor interested in a distressed property, consider consulting with experienced investors. Pick their brain for tips on making money from a distressed property investment.

Finally, if you are ready to learn how to finance a distressed property, click the link below for a free strategy call to explore your financing options today.