Investing in Land Pros and Cons - 4 Key Things You Should Know

In the words of Mark Twain, “Buy land, they’re not making it anymore.”

Land is one of the most overlooked assets in the world of real estate investing. Investors frequently find themselves focused on buying existing properties and making the most of those structures. Meanwhile, at its core real estate is not about buying and selling houses, but instead it is about buying and selling the land.

Investing in vacant land comes with many unique advantages and disadvantages over other forms of real estate investment. So, to help you decide if undeveloped land is the right investment for you, let’s take a look at investing in land pros and cons.

However, before we start weigh investing in land pros and cons, it is important to understand that financing a vacant lot or raw land is going to be different than buying a house or another property.

So, if you want to learn more about how to invest in land and make money as an investor, we invite you to book a free strategy call with us at the link below today.

What is Undeveloped Land and Why is It Popular For Real Estate Investing?

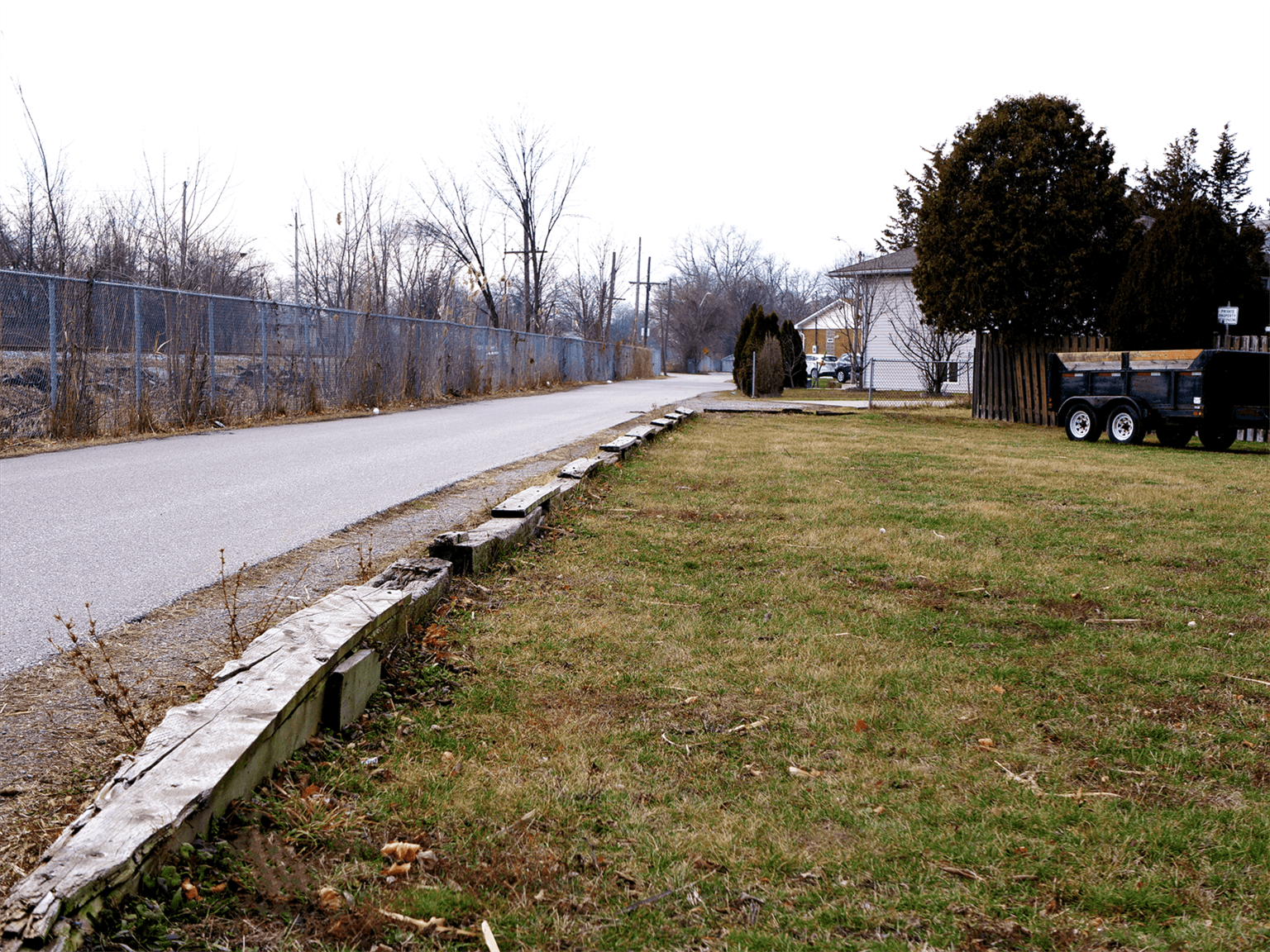

Undeveloped land – also known as raw land – is a vacant plot of land without any buildings, utilities, or existing developments. This type of land is highly valued amongst real estate investors for its versatility and potential to be utilized for all sorts of investments. Typically this type of land is found in the county and in rural areas, however it is occasionally available within city limits.

This land is praised for its high potential for appreciation due to the limited, constantly dwindling supply. After all, once you begin developing on a piece of land, it is no longer classified as raw land. Alongside its resale value, undeveloped land can also be incredibly attractive to investors and developers looking to build their dream homes of find a home for their next big real estate investment.

Understanding Zoning

One of the biggest mistakes that investors can make when buying land is failing to check the zoning requirements of the properly prior to making the purchase. Zoning requirements on a property or in a particular region can dictate a ton of factors such as maximum height, distance from the sidewalk, lot coverage, type of property and more.

While it is possible to apply to have a plot of land re-zoned so that you can do whatever you want with it, that does come at a cost to you as the property owner.

Mortgage Lenders and Raw Land Investing

In the eyes of mortgage lenders, investing in land pros and cons are not the main focus when assessing a potential investment and its profitability. Instead, what matters is the purpose for the land.

There are plenty of commercial development lenders who will lend on vacant or raw land because of what it can become, but many lenders are likely to turn a blind eye from financing raw land that is going to remain vacant because it will not create as much value for them.

Investing in Land Pros and Cons

Now that we understand some of the basic concepts that you need to consider while buying land, let’s take a look at some investing in land pros and cons.

Pro – Versatile Investment

One of the greatest benefits of investing in land is the sheer versatility of vacant land for you and your investments. Undeveloped land is a blank canvas that is free for you to use shape as you please (within the limits of your local zoning laws and building codes.)

That means regardless of whether you want to build your dream home, a new apartment complex, or a commercial shopping centre for the community, you are free to customize and construct to your heart’s content without needing to settle for anything.

Often, investing in developed properties comes with the requirement to find what is best suited to your wants and needs. However, that occasionally means you are buying a property that is not quite what you wanted because it was the closest available property to your vision.

Con – Some Properties are Difficult to Work With

Not all pieces of undeveloped land are made equally. While some properties may be located close to major utilities and hookups in order to make it easier to set them up for the property, other properties are going to be significantly father away. This makes those hookups much more expensive to have brought over to the land in order to properly develop the property.

There may also be issues with the land itself that makes it harder to work with. For example, if a piece of land is sitting on a rough piece of bedrock, or the land is in a flood zone and suffers from rising water levels.

Developed land usually has fewer of these problems because they have been addressed by previous developers and property owners before you buy the property.

Pro – Cost Effective

Purchasing land is frequently much more affordable than buying developed properties – particularly distressed or run-down properties. Instead of taking the time and money to buy, assess and update the property and convert it to suit your needs, you can develop a property to suit your needs from the beginning.

This is especially true if you are looking to buy a property primarily for its appreciation. While developed land requires more upkeep and maintenance, raw land requires much less work to maintain while still experiencing the same level of appreciation.

Con – Lack of Cash Flow

If you are buying real estate for the purpose of generating cash flow and achieving a strong level of passive income, raw land may not be for you. After all, there is little to no demand to rent these properties. Instead they are primarily valuable to developers.

If you plan to develop your raw land and turn it into a property that generates cash flow, that is a different story, and you may eventually earn that cash flow you are searching for. However, if this is not your strategy then you are going to be better off looking for another source of cash flow.

Discover How To Analyze a Properties Cash Flow With This Step By Step Guide

Securing Financing for Your Investment in Land

Unfortunately, most lenders out there are not in the business of lending against undeveloped land. So, as a result, you will often be forced to pay for the property primarily by cash or through another form of lending such as hard money loans.

This is because out of all of the advantages and disadvantages of land in economics, there are not nearly as many advantages that lenders would like to consider when compared to the disadvantages.

Regardless, it is important to know that when you are investing in land pros and cons are not the end-all-be-all of the situation. The truth is that as long as the property makes sense for your individual goals, it will likely be a good investment.

However, if you are planning to develop the land, there may be commercial lenders available who would be willing to finance your project. If that sounds like a plan that is well-suited for you, visit us at LendCity.ca or give us a call at 519-960-0370 and we will match you up with our commercial department in order to help you find a lender who is suited to you and your needs. Alternatively, you can click the link below to book a free strategy call with a member of our team today.