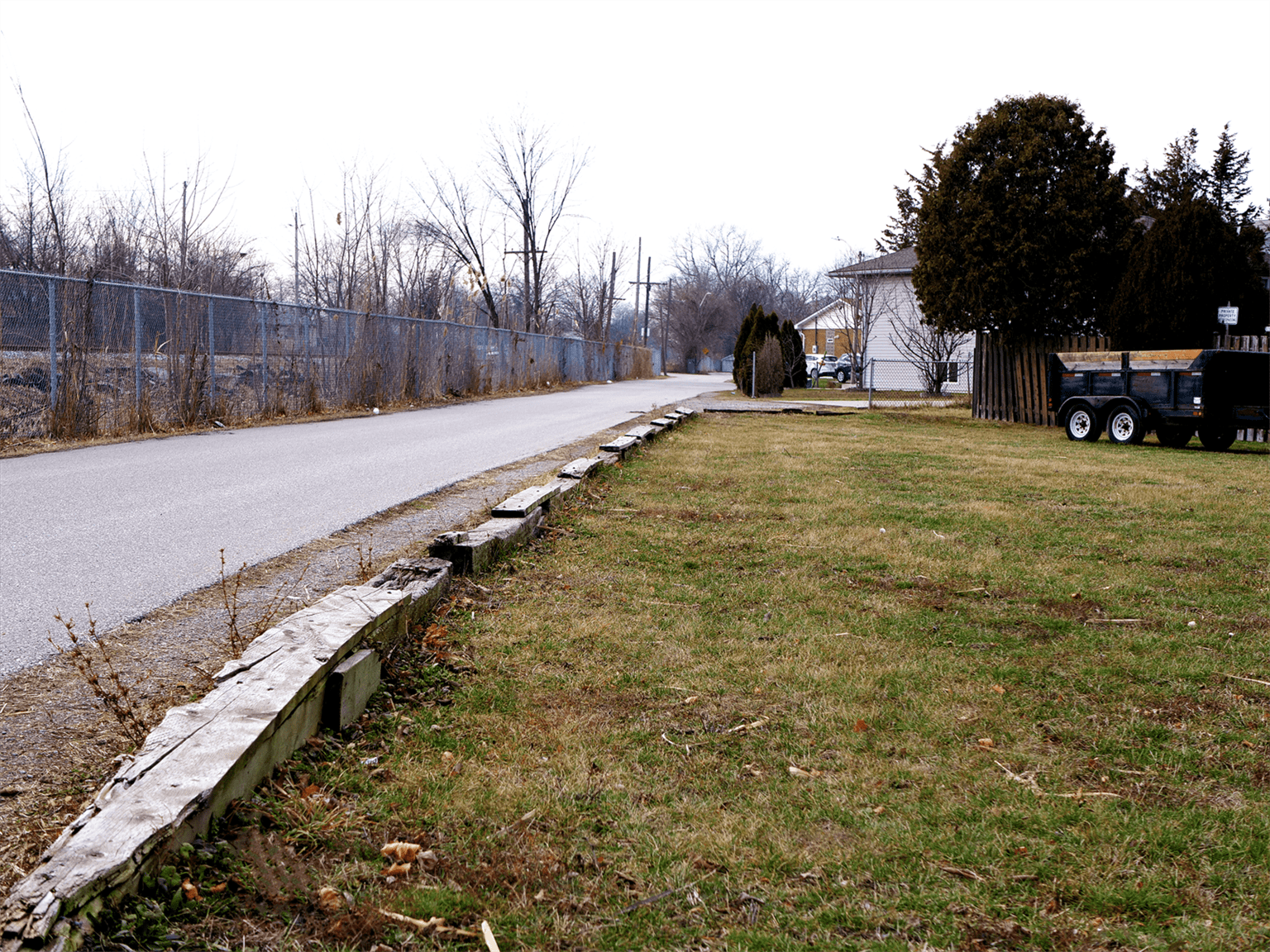

Investing in Vacant Lots - Alternative Investing Success in 2023

If you’re looking for a creative way to build wealth through real estate investment, you may want to explore the benefits of investing in vacant land. Investing in vacant lots often requires a limited amount of capital. Moreover, with the right combination of market conditions, it can appreciate significantly.

It’s important to point out that vacant land investing is often a high-risk endeavour, and is not recommended for inexperienced real estate investors. Even well-heeled investors can run into trouble with vacant land purchases. A lot can affect the price of land, especially if market conditions take a turn, zoning restrictions prove problematic, or site problems arise.

With the right amount of savvy, liquidity and moxie, vacant land investing can provide you with a tremendous return on your initial investment. When leveraged correctly, vacant lots are one of the more rewarding investment opportunities.

So, if you are ready to learn more about the benefits of investing in vacant lots and how to finance them today, click the link below for a free strategy call with our team at LendCity.

Benefits of investing in vacant lots

While it’s not the right investment strategy for everyone, some people can achieve success by investing in vacant lots. There are several benefits associated with investing in vacant lots, including the following:

Opportunity for improvement

One of the primary benefits associated with investing in a vacant lot is the opportunity to improve it. When you buy a vacant piece of land, you’re purchasing the ability to optimize it for its highest and best possible use. This means you won’t have to abide by the constraints already placed on the piece of property by previous developers. If you have a vision for the empty property, you can make it a reality.

Less maintenance

There’s significantly less maintenance associated with vacant land investments, as opposed to pre-developed properties. Unless you’re working on improving the property, you don’t have to worry about the things that usually go wrong with an investment site, like vandalism, plumbing issues or electrical problems. Because you’re not working with tenants, there’s also no need to market the site until it’s time to sell. Your vacant land needs very little in the way of care or action.

Affordability

It’s much cheaper to purchase a piece of land, compared to a developed site. Vacant lots are significantly less expensive than sites with existing buildings, even if the buildings are in disrepair. As a result, the barrier to entry to invest in vacant lots is usually lower. Most people who own vacant lots are eager to sell them, and they may even offer seller financing or steep discounts if the land has been on the market for a while.

Direct ownership

When you buy a vacant lot, you’re unlikely to secure financing for it. While you’ll have to front the cost of the land in cash, you’re also directly purchasing the property, rather than relying on a bank to issue you a mortgage for it. You won’t have to pay fees and interest on a mortgage, and you won’t have to worry about dealing with banks or agents after the transaction is complete. You will own the lot entirely. Your only real financial burden will be annual property taxes.

Drawbacks of vacant land investments

All investments carry the prospect of potential return… and the spectre of potential risk. While it’s impossible to predict the direction an investment will take until you’ve already purchased it, it’s important to perform your due diligence well in advance.

Take steps to minimize the risk you’re exposing yourself to. Most importantly, recognize that vacant land investments are often risky. Here are just some of the main drawbacks associated with investing in them:

No financing

The lack of financing can make it challenging to invest in a vacant lot, especially if you don’t have much liquidity. Even if you can buy the land outright, your liquidity is completely tied up in the asset. If you experience trouble getting rid of it, you won’t be able to leverage further investments. You may even find yourself in tight financial straits.

Lack of cash flow

With many types of investment properties, you can begin collecting rents from residents or tenants shortly after acquisition. This isn’t the case with vacant lots, however. You won’t be able to reap any kind of return on your investment until it’s time to sell the lot off again. Because of this, you may find yourself open to unnecessary financial hardship.

Discover How To Analyze a Properties Cash Flow With This Step By Step Guide

Permitting and zoning challenges

The zoning associated with your vacant land will determine what you’re able to do with the site, and what subsequent buyers can do with it. You’ll have to work to re-zone the property to perform certain actions or to obtain certain permits. Re-zoning is a time-consuming, money-draining and often futile process. The zoning and permitting constraints surrounding your lot could make it essentially worthless for the purpose you bought it for.

Property conditions

Unsavory property conditions could make it more challenging for you to develop or sell your vacant lot. For instance, it’s very challenging for water to drain off of an entirely flat lot. You’ll likely have to invest in grading the lot before it has any value. The cost of grading the lot could entirely dissipate any profits you may have otherwise generated from the sale of your asset.

Market shifts

Vacant lots are completely at the mercy of the market. Because they aren’t developed and they don’t have any buildings on-site, they have less inherent value. This can prove problematic for investors if the local real estate market takes a turn for the worse. The value of your vacant lot may bottom out, meaning you’re stuck with your liquidity completely tied up until you’re able to sell it off.

If you’re an established investor with the savvy and know-how necessary to tackle a challenging project, investing in vacant land may be right for you. You can leverage a vacant lot to your financial advantage, but only if you play your cards right and do your homework before investing.

There’s a lot of potential in vacant lot investing. But, there’s an equal—and some might argue—the higher potential for loss.

So, once again, if you are ready to learn more about the benefits of investing in vacant lots and how to finance them today, click the link below for a free strategy call with our team at LendCity.