Joint Venture Agreements 101 - Understanding and Structuring Strong Partnerships

Real estate is often looked at as a one-person job. Whether it is buying a rental property, or flipping houses for a quick return, most people do not envision other individuals or companies entering the deal beside them. However, there is always the option of pursuing a joint venture agreement (JV).

In essence, a joint venture agreement is when two or more parties combine their resources for an investment while remaining their own distinct business identity – instead of combining their resources into a single company. These deals are often struck between managing partners and financial partners, each of which bring different resources and expertise to the table. The number and types of partners involved in a JV may vary from project to project, depending on the skills and resources required to make the deal work.

However, before we get into the details, if you would like to learn more about joint venture real estate one-on-one, book a free strategy call with my team at the link below.

Types of JV Investing Partners

Managing Partners

Managing partners are responsible for a large portion of the coordination when it comes to investing in real estate. These are often individuals or companies with experience in finding opportunities for investment and presenting them to the other partners. As well, managing partners are often responsible for the negotiations involved in securing the property.

From there, managing partners oversee and organize any required renovations the property may require. They do this buy hiring any contractors or tradesmen who are needed to prepare the property and overseeing their progress as they work. This can be done by the same partner(s) who found and negotiated the joint venture agreement or another partner who has the expertise to do this job.

Finally, it frequently falls on a managing property to oversee the process of hiring or finding a property manager or management company to care for the property. For some hiring managers, the job of property management may be one they decide to take on themselves, especially amongst newer investors with more time on their hands. These partners may also take on the job of locating tenants for the property or delegating the task to the property manager.

Financial Partners

Compared to managing partners, the job of a financial partner is much simpler. These are partners who have the capital required to make the deal happen. Financial partners typically offer most or all the initial investment. This includes costs such as the down payment, closing costs, material and labour costs for renovation and any reserve funds needed for the property.

Some financial partners can also act as managing partners, offering their expertise to the deal while seeking the assistance of other investors to provide the additional talents and capital that is beyond their own means. Other financial partners may be people with the funds, but no experience in real estate who are looking to invest without taking too much time out of their busy lives to do it all themselves.

Structuring a Joint Venture Agreement

There is not a single way to structure a joint venture. With a variety of partners available with a wide range of skills, experience, and capital, the ways a venture can be split will vary.

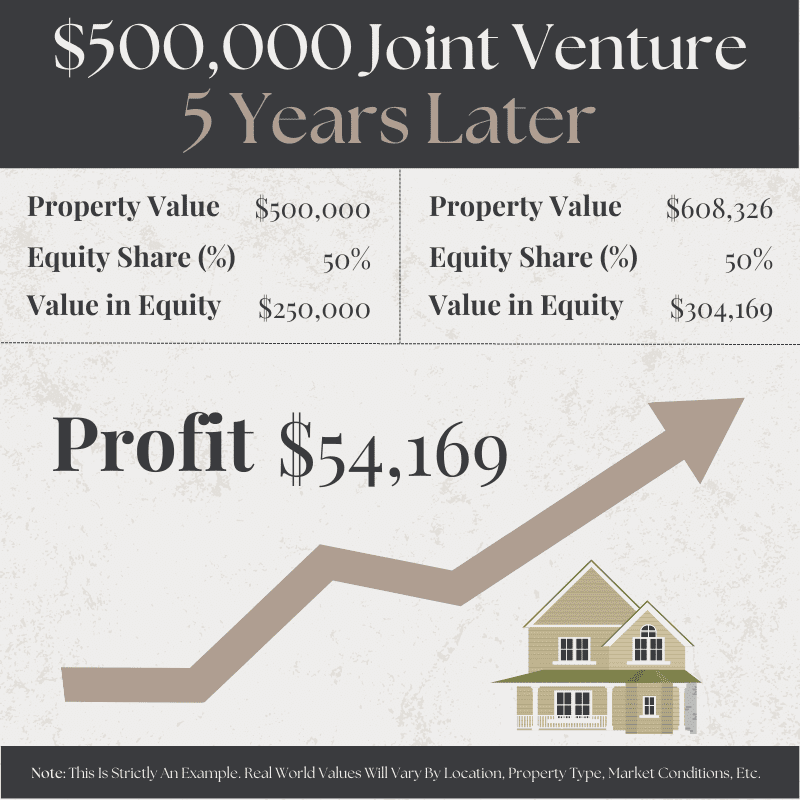

For example, let us imagine a joint venture agreement between two partners, one managing partner, and one financial. The managing partner takes care of 100% of the negotiations and oversight of the property, while the financial partner offers up 100% of the capital required. In this case, many people may opt for a 50/50 split in ownership and profit.

In other cases, when there are more partners doing different types and amounts of work, or contributing different amounts of money, a more detailed negotiation may be required to reach an agreement that works for everyone. This can result in joint venture agreements with splits such as 20/30/50, 60/20/20, 30/30/40, etc. There is no universally correct way to approach structuring a joint venture agreement.

Discover How To Set Up A Joint Venture With This Step By Step Guide

For a managing partner, it is important for them to remember the value of their expertise during negotiations. A single joint venture agreement may only result in 40-50 hours of actual work, but the price of their education and the hundreds or thousands of hours of experience they have spent building their skills are just as important.

The Limitations of Joint Venture Agreements

Joint ventures are excellent for opening a world of investing that otherwise may not be available at the time of investing. However, they do come with their own set of limitations and restrictions that can lead to problems further down the line.

For example, a single-family property could have been purchased with the intent to flip, but once the renovations were completed, the market was not at a point where the sale would generate enough capital to satisfy everyone. So, the partners involved can find themselves in the position of holding a property they never intended to. There is potentially the option of buying out the partners who do not want to continue holding the property, but that can be costly for the partner(s) who buy them out.

So, perhaps there is the solution of using that property as a rental property and waiting for the market to shift enough for a sale to be satisfactory, but then the issues of tenancy, property management and the required cashflow to satisfy all parties come into play.

In Short

Overall, joint venture agreements are a great way to grow your portfolio, even when you are struggling with financing, short on cash, or simply want to work with other people with skills and resources you do not have right now. However, they are still long-term business relationships that should be entered carefully and properly structured to make sure all parties get what they deserve and are treated fairly.

Of course, as with all real estate ventures, regardless of if you plan to enter them alone or with partners, it is essential that you (and your partners) seek pre-approval before shopping around for properties. It not only will show you exactly what can be afforded, but the mortgage rates available may factor into the negotiations of any financial partners.

So, to get started with the pre-approval process today, contact us at LendCity and let us find you experienced lenders for your next investment. Give us a call at 519-960-0370 or visit us at LendCity.ca Alternatively, you can book a free strategy call with our team at the link below.