Joint Venture Partnerships - 8 Important Questions You Need to Ask

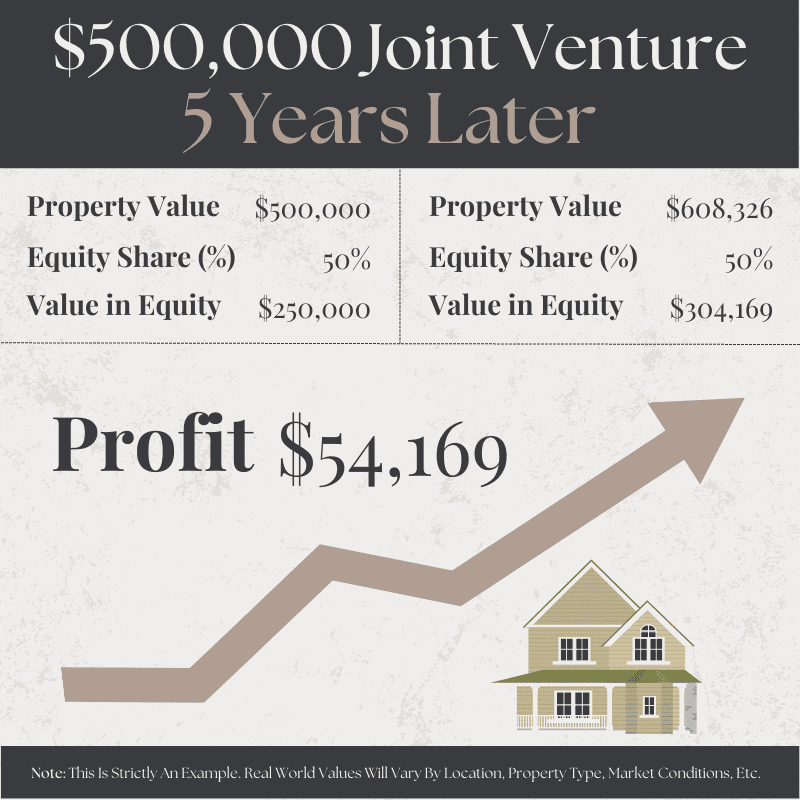

A joint venture partnership can open the door to real estate opportunities that you would never be able to take advantage of on your own. Working with a partner gives you the benefit of additional capital, as well as access to the experience and knowledge that JV partner offers.

However, some joint venture partnerships simply aren’t a good fit and they can leave all concerned parties worse off than they started. To avoid the complications and losses you can experience as a result of failed joint venture partnerships, it’s important to ask yourself some key questions to help you decide whether a potential partner is a right fit for you.

Of course, before you get started, if you are looking to be the money partner in a real estate joint venture, it is important that you find the best financing option in order to maximize your investment potential.

To start securing the strategic financing you need today, simply book a free strategy call with our team today at the link below.

Do you need a joint venture partnership?

Before you dive into the details of what a joint venture partnership would entail, you should carefully consider whether you need a partner in the first place. Working with a partner is a good option if you’re looking for faster growth and higher-value real estate opportunities, but it might be better for you to focus on growing your portfolio on your own, even if it’s not as fast.

What value does a partner add?

Once you determine you need a partner, think about what your potential partner brings to the table when it comes to real estate investing. If you have a clear vision and goals for your real estate portfolio, but you don’t have the capital necessary to finance all of the deals you are looking for, you should prioritize the resources that a partner has. If you are a newer investor with less experience in real estate, focus on the experience and knowledge that a partner offers.

What are your core values?

Core values are incredibly important in any kind of partnership, including a joint venture partnership. Think about what your core values are and make sure your partner's values line up with yours. Having shared values can improve the quality of the relationship between you and your partner and help you stay on the same page.

What are your investment goals?

Not every investor has the same trajectory or plans for their portfolio. Map out a few goals that you are hoping to achieve and share them with your potential partner before entering a joint venture partnership. Ask them about their goals for their portfolio to find out whether you have compatible priorities as investors.

Discover How To Set Up A Joint Venture With This Step By Step Guide

What is your time horizon?

If you and your JV partner have different time horizons for investment opportunities, you will likely have some disputes about which opportunities to pursue. Find a partner who has similar expectations as you and who is willing to work with your preferred time frame for growth and investment.

How actively do you plan on being involved?

Beyond the financial obligation of JV partners, there are additional responsibilities—like the ongoing management of an asset—that have to be allocated. You need to think back to how active you want to be in your investment and how active your partner needs to be to make the deal work.

What’s your strategy?

There are many different approaches that investors can take to real estate investment and portfolio growth. No single approach is better than the others, but you can get into a difficult situation if you and your partner disagree about which approach to take or which strategies to implement. On top of thinking about the strategy that you want to adopt initially, also consider whether you are willing to shift to a different strategy throughout a deal. Talk to your partner about these things to find out what their preferences are and what they are comfortable with.

Can you trust them?

At the end of the day, the most important element of a good joint venture partnership is trust. You need to trust your partner to follow through on their obligations, meet their responsibilities and make good decisions regarding your joint investment venture. In turn, your partner needs to be able to trust you too. Before you jump into a deal, make sure you take the time to get to know your partner so that you can evaluate whether they are trustworthy and decide if they are the right fit for you.

Finding the right JV partner can be a challenge, but it’s well worth the effort. By investing some extra time into the partner selection process and carefully evaluating your personal goals, you can find a partner who’s the perfect fit for you and your future as an investor.

Financing Your Joint Venture Partnership

Regardless of whether you are the financial or managing partner, every successful joint venture partnership is going to need funds in order to make the deal happen - that is simply the nature of real estate investing.

So, that is why it is important that before you begin working on the full details of your joint venture partnership or joint venture agreement, it is important to lock in your financing first.

So, in order to get strategic financing that will satisfy all of the members of your joint venture partnership, start by booking a free strategy call with my team at LendCity. Simply click the link below and start scheduling a time to talk to an agent and get the money flowing.