Making Money With Rental Properties - There Are 3 Important Methods You Should Know

Plenty of new real estate investors are drawn into the industry under the promise that they will start making money with rental properties right away. While this can be true, it is important to understand why these properties are so profitable.

The majority of methods used to start making money with rental properties can be divided into three key categories; money coming in, value being added, and expenses being recovered. By knowing how to property balance and utilize the tricks to start making money with rental properties included in each of these methods, you can be confident that your properties are more likely to generate the wealth you are seeking.

So, let us take a look at three key methods you can use to start making money with rental properties.

But first, before you can start making money with rental properties, you need to secure financing that supports that. So, in order to start getting investor mortgages and begin making money with rental properties today, click the link below for a free strategy call today.

Cash Flow

Cash flow is the term for the remaining rental income after all expenses have been paid on a property. This can be positive or negative - however if you have a negative cash flow from a property, it may be time to reassess the investment and find a solution.

You cash flow may look different based on your investment strategy and property usage. Although, it will typically resemble one of the following structures.

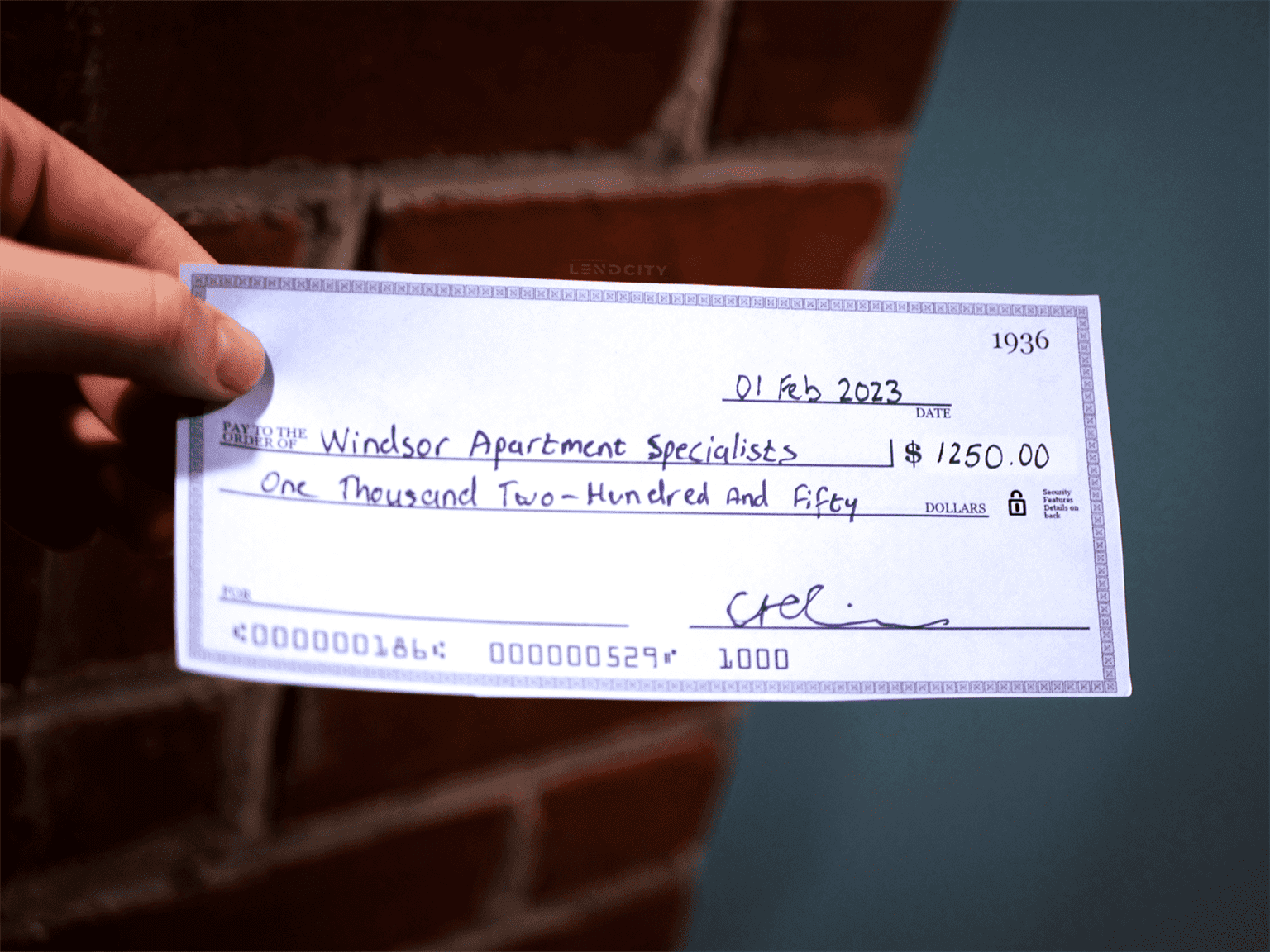

Monthly Rental Payments

If you are investing in long-term residential real estate, your cash flow will traditionally come in the form of the remainder on your monthly rent payments. Often investors will structure their rental prices in order to assure they earn a sufficient cash flow from their property. This is done by calculating all of their monthly expenses and then charging an amount equal to the cash flow they wish to earn. If you are doing this, is it important to keep an eye on local rental rates to avoid over-pricing your units.

Short-Term Rental Payments

If you are operating short-term rentals such as vacation homes or listing properties on Airbnb, your cash flow may look different. While you are still calculating your income by comparing your expenses to the rent payments, it is going to be spread across multiple payments. As a result, you will need to calculate your rates based on the average demand for your unit (i.e., the number of days it is occupied each month) and the operating costs of the property.

Discover How To Anaylze a Properties Cash Flow With This Step By Step Guide

Appreciation and Equity

The next way that investors start making money with rental properties is through appreciation and equity. These are essentially the means of introducing new value to a property over time or through working on the property.

Location

Whenever you are buying a property, you should think long and hard about the location. Not only will the location of a home alter the quality of life and the accessibility of a property, but it may also impact the rate at which the home appreciates.

Some neighbourhoods appreciate faster than others due to local developments, increased demand and a higher quality of life and level of convenience for that area’s residents.

Home Improvements

Another way to increase the value of your home and gain equity is to complete updates and renovations. It is important to remember some updates yield much higher returns than others, so if you are completing a renovation strictly for its value, make sure you do your research. The most profitable renovations are often in high-traffic rooms such as the kitchen and bathroom.

Building Equity by Paying Off Your Mortgage

Another way real estate can help you build equity and wealth is simply by paying off your mortgage on the property. Each payment you make towards the mortgage principle increases your equity in the property. For example, if you bought a house for $400,000 with a down payment of $80,000 you would be starting out with 20 per cent equity in the home, but over the years if you paid another $120,000 towards the mortgage principle, you would then have 50 per cent equity or a total of $200,000 in equity.

Hedging Against Inflation

One of the most popular reasons that people invest in real estate, including rental properties, is the ability for real estate to act as a hedge against inflation. Traditionally, the average appreciation experienced in a property is greater than the annual inflation rate. This means that by spending your money on real estate, you are avoiding the losses that would be caused by simply holding onto cash.

Tax Benefits

Another way that rental real estate investors are making money with rental properties is by cutting down on their expenses and having them refunded on their taxes. This reduces many of the overhead costs of investing and allows for hundreds or even thousands of dollars to return back to their pocket.

Deductible Expenses

In Canada, there are an array of expenses that can be deducted from your taxes pertaining to your rental properties. These deductible expenses can include:

- Advertising

- Insurance

- Interest and bank charges

- Office expenses

- Professional fees (includes legal and accounting fees)

- Management and administration fees

- Repairs and maintenance

- Salaries, wages, and benefits (including employer's contributions)

- and More

Of course, you should always speak with a financial professional to make sure you and your properties are eligible for each specific deduction, but when they apply, they can do a lot to help you continue making money with rental properties.

Set Yourself Up to Start Making Money With Rental Properties

If you want to start making money with rental properties as a real estate investor, you want to be certain that you have the best available mortgage financing you can get. That way you can be certain you are getting the most financing at the lowest available rates for each of your rental properties.

Luckily for you, our team at LendCity works with a wide variety of lenders to help you secure the best mortgage product for your individual needs. So, if you are ready to get started today, or have any more questions about how the real estate success begins with a great mortgage, give us a call at 519-960-0370 or visit us online at LendCity.ca. Alternatively, click the link below to book a free strategy call today.