Meet the “Mortgage Plus Improvements” Approach to Investing in Great Rental Properties in 2023

Every good investor is looking for ways to maximize the cash flow of their property while keeping expenses down. One of the strategies we love—and one we've done on every single purchase we've ever made—is to do a “mortgage plus improvements” financing strategy. It’s the number one tool we recommend to investors.

So, before we dive in, if you would like to book a free strategy call to start applying for this amazing product, click the link below to get started today.

How does mortgage plus improvements work?

A mortgage plus improvements is a simple concept. It’s a mortgage for your purchase, plus additional financing from the bank for improvements. You’re telling the bank upfront that you plan on making immediate improvements to the property you’re buying.

What you have to do is get quotes on the cost of your intended improvements from one or two contractors. The more you get, the better, since you’ll be able to get competitive quotes. Once you have at least one or two, you’ll need to bring them to the bank. The quote needs to encompass all renovations you want to perform.

Then, what the bank will do is have an appraiser confirm the value of the property will be worth as much as the mortgage plus the cost of improvements. If the math works out, you’ll get the money for improvements!

Instead of adding the renovation funds to your mortgage, however, that money will be held at the bank level. This is done so you’re not paying interest on the renovation money until you get it. It’ll be held at the bank level until you complete the renovations.

Finally, the bank will send out an inspector to confirm that you did everything you said you were going to—everything you specified on the quote. There will be a thorough inspection and you might be asked questions about the improvements. In many cases, you’ll have to provide documentation of the work, to prove the improvements were made.

Doing a mortgage plus improvements can save you from refinancing after the fact. And, because it's all done in one shot, there aren’t any penalties or stipulations with your mortgage you’ll need to worry about violating.

Be thorough when doing a mortgage plus improvements!

The most important thing to remember is that a mortgage plus improvements plan is contingent on you completing the renovations. All of them.

You have to do everything listed in the quote you provide to the bank. You can’t deviate from it or do any extras, either. If you miss an improvement listed on the quote or allocate that money for anything other than the specified improvements, the bank can outright refuse to provide you with the improvement funding. The quote is king! Whatever's on the quote is 100% mandatory and you have to do it.

Provided you completed all renovations and covered the scope of your quote, you’ll receive the specified funding for the improvements. When the renovation money is yours, you can pay off your line of credit or paper contracts or whoever you need to use those funds for. As soon as it’s yours, however, the interest and payback period begins.

Discover How To Analyze a Properties Cash Flow With This Step By Step Guide

Enjoy the benefits of mortgage plus improvements

The benefit of doing everything up front is that when you rent out the property, you're renting it out fully renovated. That means more rental income for the property and much lower expenses for things like maintenance or repairs. Every property we've done this for hasn’t had any major expenses for repairs at all. Plus, with all renovations grouped into the mortgage, it’s super convenient! It's been amazing for cash flow!

And the benefits don’t stop there! Take a look at a few of the biggest and best reasons for taking the mortgage plus improvements approach:

For starters, you're forcing the appreciation of the property. This means you’re tapping into its future potential for appreciation sooner, so you can start earning revenue from it right away.

The renovation month funds are being lent to you, so they’re not coming from your pocket directly. Today it's coming from the bank; tomorrow, your tenants are going to be paying for the renovation cost. You’re simply reaping the reward!

Cash flows are going to be higher because you’re going to be able to rent the property for higher. A recently renovated property will always get a higher rental rate because of the lower likelihood of problems and the relative newness of the amenities.

Tenants enjoy a renovated property, which means they're going to stay longer. It also helps attract a higher quality of tenant. If you have a rundown property you could get any type of tenant—a nice place brings pride of ownership to renters.

You’ll also have fewer headaches in the way of maintenance costs and repairs, as well as protection against a market downturn. People will always need to rent and their first choice is almost always going to be a well-maintained, properly updated property.

Make the improvements upfront

For investors looking to maximize their cash flow and minimize their expenses, nothing beats a mortgage plus improvements. We recommend every investor do this when they apply for financing. It's a win-win-win for everybody: Investors, tenants and the bank!

A mortgage plus improvements is also another tool to leverage money and make it work for you. As mentioned above, at no point are you (the investor) paying for the renovations to your property. The bank foots the bill for the improvements and the cost of that loan is passed on to tenants. You’re putting someone else’s money to work for you in a smart way that immediately adds value. Few strategies offer this much reward for this low of a risk!

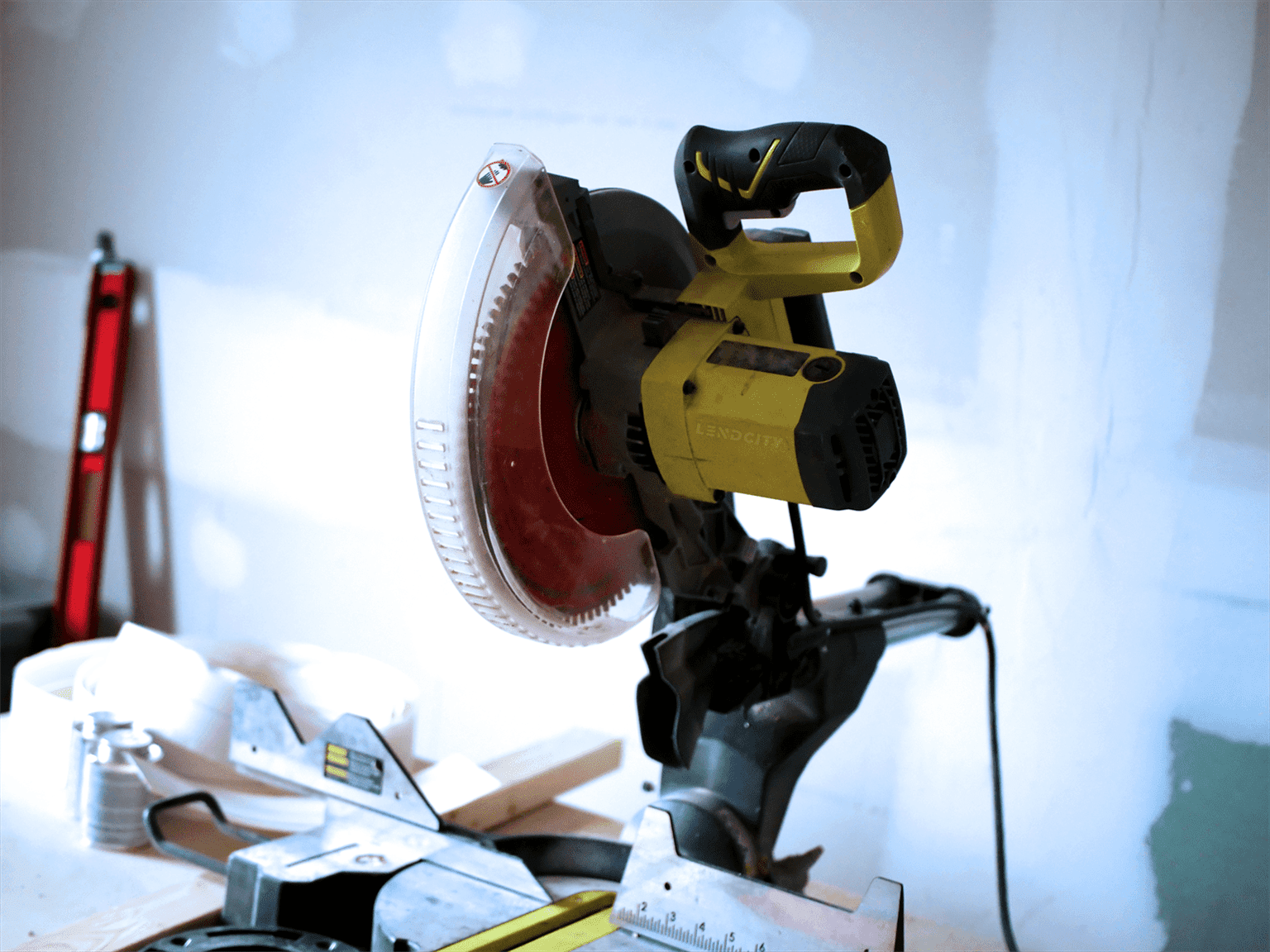

So, what should you focus on to maximize the value of your mortgage plus improvements? Anything you might need to update soon! HVAC, plumbing and electrical are smart ideas, as are big projects like roofing and siding. To make the property more appealing to renters, focus on amenities like new appliances and bathroom or kitchen improvements. Anywhere you can add value is a good bet!

How to get started?

Not all lenders offer the mortgage plus improvements program. We suggest to contact our team at LendCity Mortgages as we specialize in working with investors and can help you set everything up. We can be reached at the link above or by calling them at 1-519-960-0370 or you can book a free strategy call with us at the link below.