Real Estate Class Designations

Understanding real estate Class designations A, B and C is important when getting started as an investor in the commercial investing space. Use these class designations to select properties to help you optimize your portfolio, to reach your goals as an investor.

However, before we begin assessing the different real estate class designations, if you are looking to finance your next real estate investment, let us help you get started the right way by booking a free strategy call with our team at the link below.

Real Estate Class Designations basics

Property classifications are designed to help investors determine the quality of a property with a simple, straightforward rating. These designations can help investors determine the costs, benefits and profitability potential of various properties. Many investors wonder what are the best real estate designations?

There are three property classifications: Class A, Class B and Class C.

These designations are assigned based on a number of factors including physical characteristics, market conditions and geography.

Here are some of the best commercial real estate designations:

What is Class A Real Estate Designation?

Class A properties are considered the best properties. Most Class A properties are relatively new and have been built within the last 15 years or so. These properties have high quality amenities, consistently low vacancy rates and high-earning tenants.

Class A properties are located in a desirable area with a high demand from prospective tenants. These properties usually have minimal maintenance needs and bring in high rates of rent. Class A properties perform better because of the newness and quality of the property, as well as the appeal of the location. A lot of Class A properties are professionally-managed and are already well-established as a quality property, with broad appeal to residents.

What is Class B Designation?

The next property tier is Class B.

Class B properties tend to be a little older than Class A properties and have tenants that are lower income earners. There may be some maintenance or repair issues in a Class B property. Investors can usually make improvements that make it a strong part of their portfolio.

Oftentimes, investors can also get a higher CAP rate from a Class B.

The higher cap rate is because of their lower purchasing cost and their high potential for value increase through renovations, maintenance and repairs.

What is Class C Designation?

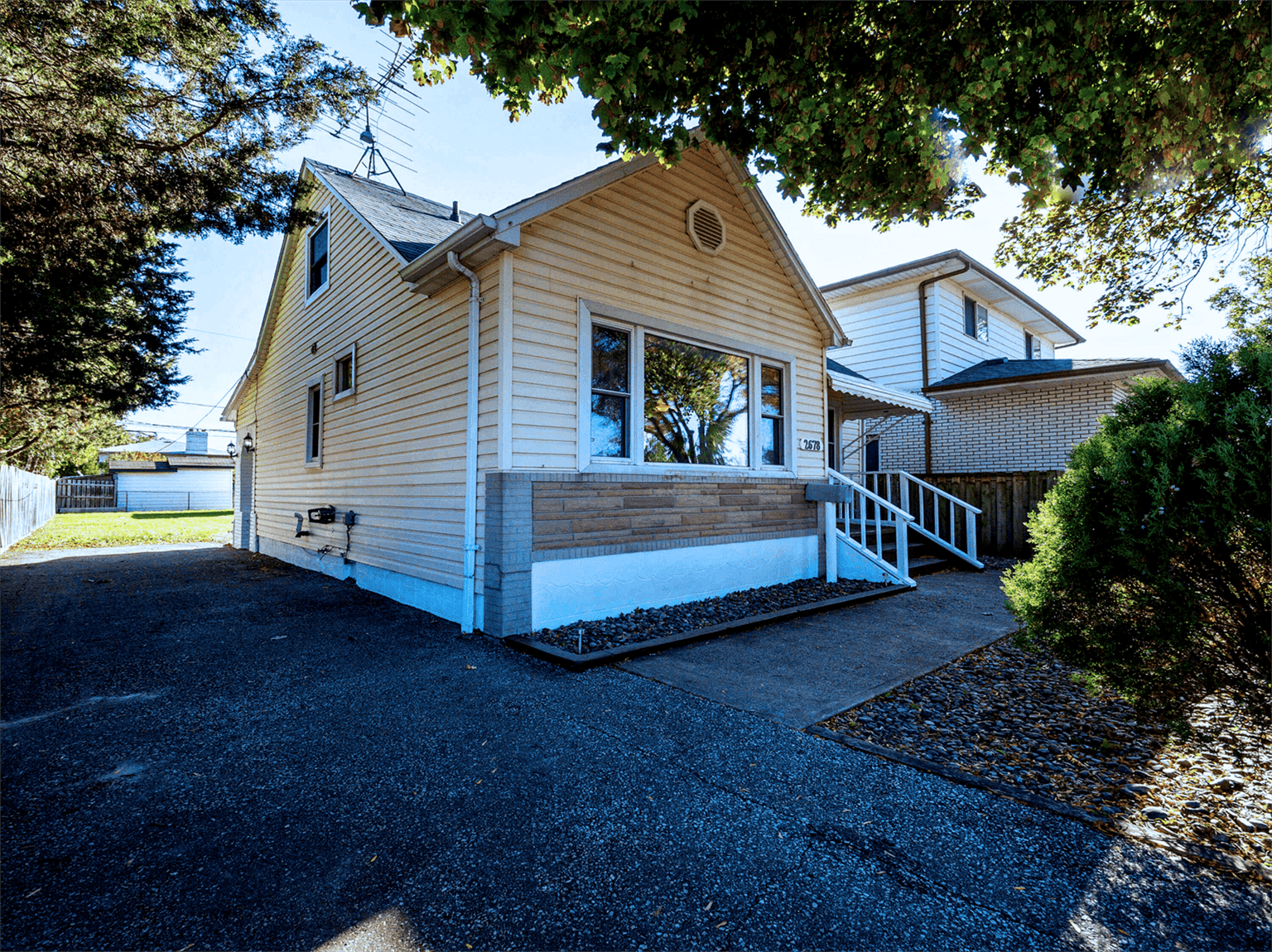

The last real estate designation is Class C.

Class C properties are generally older properties that require renovations and upgrades. Upgrading these properties can yield a nice profit.

Class C properties are usually located in areas with lower demand and often have high vacancy rates and lower rental profits.

This holds true especially in areas where there are Class B and Class A buildings nearby.

Discover How To Develop Real Estate With This Step By Step Guide

If you are looking to develop real estate of any class, you need to get yourself started with the best financing options available. So, start hunting for the financing that is best for you by booking your free strategy call with us at LendCity today.

The unspoken Class D Designation

There’s actually one more Real Estate Class Designation: Class D. These are generally properties you want to stay away from. They’re considered severely run down, prone to devaluation and generally located in unfavorable areas. Class D properties are usually value traps and money pits—especially for new investors.

Investors considering investing into Class D properties should;

- Have a keen insight into future market trends.

- Access to affordable renovation teams and contractors

- Large amounts of cash readily available.

Which Real Estate Class designation is the best choice for investors?

Real Estate Class Designations indicate the current quality of a property, but don’t necessarily dictate its profitability potential.

Depending on the circumstances, an investor might gain more from investing in a Class C property. By fixing it up and marketing it to prospective tenants than they would investing in a Class A property outright.

Investors can achieve higher CAP rates from Class B and Class C properties, which is also important to consider.

Investing in Class A properties usually don't require much money before the property becomes profitable for you.

In fact, many Class A properties are already in high demand and turning a consistent profit. High-earning tenants bring in higher rental profits. It’s important to consider that market downturns can cause a significant increase in vacancy rates in these higher quality properties.

In general, Class A buildings are a good choice if you want to maintain your existing capital and hedge yourself against inflation. You can typically count on the reliable profitability of Class A properties and you benefit from the inflation resistance of real estate.

Consider investing in Class B and Class C properties if you;

- Want a lower upfront investment expense

- Create value in your rental portfolio

Ultimately, your goal should be to own Class A properties, regardless of how you come by them.

Know the risk and reward of each property class

Each real estate class designation has different levels of risk and reward. There is no single designation that’s right for every investor. You have to consider your existing circumstances and your long- and short-term goals as an investor. Once you have laid out your goals you can select property designations that make sense for your portfolio. Understanding these designations in relation to your investment circumstances is the best way for you to choose properties that are right for you.

Once you know which real estate class designations are best suited for you and your investment portfolio, it is time to start hunting for strategic financing in order to make the deals happen. In order to help you get started, all you need to do is book a free strategy call with my team at LendCity at the link below.

Real Estate Designations and What They Teach Us About Properties With Scott Dillingham