Real Estate Diversification Benefits - Build a Diverse Portfolio To Succeed in 2023

Whether you’ve been investing in real estate for years or you’re just getting started, you’ve probably heard about the importance of real estate diversification your investment portfolio. A diversified portfolio can benefit you as an investor in several significant ways. But, you might not know exactly how to put the principle of real estate diversification into practice.

There are some simple tips and methods that investors can use to diversify their portfolios and improve the profitability of their real estate investments.

So, if you area ready to explore the world of real estate investing and diversify your portfolio, click the link below for a free strategy call to learn how you can finance diverse investments today.

Real Estate diversification benefits

Diversification is a method used by investors to distribute capital across various different types of investments.

An investor who wants to diversify a traditional investment portfolio might distribute their capital between various stocks, bonds and mutual funds. This enables the investor to hedge against potential losses in the event that one of their investments lose value.

Investors who want to diversify their real estate portfolio can do so by investing in various different types of properties in different markets. Instead of investing in several single-family residential homes in the same neighborhood, an investor who wants to diversify will buy different types of properties. An investor may purchase single-family residential, multi-family rental properties and commercial properties in different areas. Diversifying will minimize risk and maximize the potential for profitability.

Benefits of diversification of your real estate portfolio

There are several reasons why you should diversify your real estate portfolio. For one thing, diversifying is an effective way to minimize your risk as an investor.

If your properties are in the same market, any change in the local economy or market can take a toll on the entire portfolio.

When you have your capital divided between various different types of properties in different areas, you won’t be as affected by market fluctuations.

Another important benefit of real estate diversification is that it enables you to develop your experience as an investor. When you purchase and manage various different properties, you cultivate new skills and experiences that make you a better investor. Exposing yourself to various types of real estate investing can broaden your horizons and increase your capacity to profit.

Discover How To Buy Commercial Real Estate With This Step By Step Guide

How to diversify your real estate portfolio

In theory, real estate diversification is a no-brainer and common sense. Putting it into practice is another story! Many times, real estate diversification means exploring new investments you’re not familiar with. You may also find putting yourself out there on a deal may make you uncomfortable. For example, if you’re a expert in single-family rentals, buying a multi-tenant commercial property will be daunting.

As with any investment, do your research and make smart decisions while protecting yourself and your investments. And, be sure to explore various types of properties in various different markets.

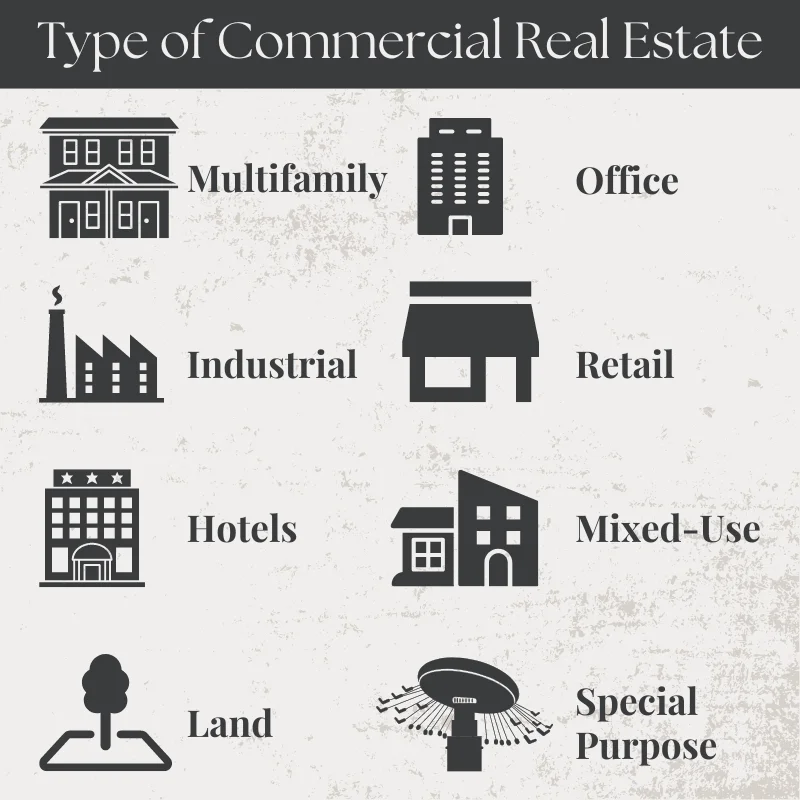

Commercial real estate investing

Investing in commercial properties is a great option if you feel like you have been stuck in a residential property rut. It can be intimidating to invest in a commercial property if you’ve never done so before. Many investors find the risk to be well-worth the reward.

Commercial properties are typically more profitable than residential properties, with higher rental rates. In addition, commercial tenants usually pay the following expenses;

- property taxes

- property insurance

- maintenance costs

- monthly rent

These expenses paid by the tenants help so you can keep your costs low and maximize your profit. There’s also less competition for investors who want to make the move from residential to commercial property investments.

Multi-family residential

As you grow your investment portfolio, it’s a good idea to invest in multi-family residential properties. Single-family residential properties can bring in a consistent income, but you risk major losses if your property becomes vacant. Multi-family residential properties can help you maintain consistent profitability even during months when you have vacancies.

Multi-family residential properties appeal to a wide variety of prospective tenants. You can generate continuous demand for your property to accommodate for vacancies and evictions.

REITs

If you want to benefit from real estate investing without dealing with hands-on property ownership, you can invest in Real Estate Investment Trusts (REITs).

With REITs, you invest your capital and the company that owns the REIT handles every aspect of property management and maintenance. Since REITs bring in regular dividends, you’ll enjoy a consistent passive income by adding this option to your portfolio.

You don't need a lot of money to invest in REIT's. Some of the REITs we have found online start with a minimum investment of $1000. Even if you plan on hands on investing, so such a small sum it makes sense to own a few REITs.

Also worth checking out is the REIT dividend all stars. The REIT's on the all star list have consistently paid dividends out to investors. By using this resource it can help you choose the right REIT to invest in.

Joint Ventures

A joint venture is when two people team up and decide to purchase an investment property together. You can use a joint venture partnership to help diversify your portfolio.

In a joint venture, there are generally two categories of investors. The money partner and the active partner.

Money Partner - The money partner supplies the funds needed for any type of purchase, from down payment to qualifying for the mortgage.

Active Partner - The active partner does all the necessary repairs and property management.

Splitting the responsibilities between two investors helps to reduce your overall risk with the investment, which is another form of real estate diversification.

Look online or in our private Facebook group for investors that are ready and willing to partner with someone on a new project. Find the Facebook group here.

Real estate Diversification Can protect your investments

When it comes to real estate diversification, you don’t have to worry about doing everything at once. Start with small steps to broaden your portfolio and gradually build up to increased diversification. Pushing yourself outside of your comfort zone through real estate diversification will make you a better investor in the long run. And, it’ll keep you and your investments safe in the event of headwinds or sudden downturn.

To diversify your real estate investment portfolio for maximum exposure we do suggest the following;

- Buy single family homes in different neighborhoods

- Buy multi-unit residential homes in different neighborhoods

- Buy commercial multi-family properties

- Considering purchasing a hand off investment like a REIT

- Lastly, invest with a joint venture partner

Investing in real estate can be risk, but when you learn to diversify your portfolio, the risk is greatly minimized.

So, if you would like to learn more about real estate diversification, including how you can use different types of mortgages to improve upon your real estate diversification, click the link below to book a free strategy call with us at LendCity today.