Setting the Rent For Your Rental Properties in 2023 - Making Fair and Profitable Investments

There is a lot to consider when setting the rent rate on a property. If a property is being rented out for too much money, it will be much harder to find a suitable tenant to afford the rent. However, if the rent is too low you will struggle to find a suitable tenant amongst countless applications while losing out on potential income.

So, the question remains, how do you go about setting the rent for your rental property? Here is a list of things to consider that may help answer that question.

But first, if you want to get the full picture of how much you can expect to make after setting the rent, click the link below for a free strategy call to get set up with our free cash flow calculator today.

Location

Some neighbourhoods have higher property values than others - keep this in mind while setting the rent. A rental in an upscale neighbourhood is naturally going to be more expensive than an older home in a worse part of town. As well, these more expensive properties also tend to appreciate faster than others and allow for higher rental rates overall.

Additionally, a property may be worth more when it is close to certain amenities. Close proximity to grocery stores, public transit, parks, and the like can raise the value of a property and increase the potential rent a tenant may be willing to pay for the convenience. So, when you are setting the rent, take the time to look beyond the property.

How Large is The Unit?

It is a simple factor, but an important one when setting the rent. Are you trying to rent out a one-bedroom apartment? A three-bedroom house? At the end of the day, larger properties will typically go for higher rates than smaller ones. Take some time to research rentals in your area and find out what other property owners are setting the rent at for similarly sized units. From there you can determine a reasonable range of prices to consider.

Another trick people will use when setting the rental rates based on the size of their property is by calculating the rent per square foot. In Canada during the fourth quarter of 2021, the average rent per square foot for properties of all kinds was $2.33 according to a study by Rentals.ca. However, not all listings show their square footage, with the majority of listings sharing this information being for newer, more expensive properties, so the data may be skewed higher.

In Ontario, the average one-bedroom apartment is estimated to be 660 square feet. So, at the average of $2.33 per square foot, that apartment would be worth $1537.80 monthly.

What Type of Property Is It?

There is a key difference between a two-bedroom house and a two-bedroom basement suite and you need to consider that when setting the rent. The amount a tenant will be willing to pay is likely to change accordingly. Even if the properties have the same square footage, tenants will typically be willing to pay more for houses and detached units than apartments and attached suites.

As well, buildings with multiple units may be priced differently due to their ability to create multiple streams of income. While every unit is filled, it will be much easier to earn enough to cover the mortgage and expenses for the property and make a reasonable profit. This allows for lower potential rental rates, but it is still advised to use caution when setting these rates to ensure you can afford your expenses in the event of units becoming unoccupied.

Discover How To Analyze a Properties Cash Flow With This Step By Step Guide

What Government Controls Apply?

An important factor to consider when setting the rent is government rent controls. In many places, there are limits on the among that can be charged for rent, or the rate at which rent can increase after your first 12 months. In Ontario, the limit rental rates can rise is determined by the Ontario Ministry of Municipal Affairs each year based on the Ontario Consumer Price Index.

For example, in 2020, the maximum allowed rent increase in Ontario was 2.2 per cent. However, in 2021 it was cut down to zero per cent to combat the pandemic financial hardships. Now, the limit on rent increase has been set to 1.2 per cent.

However, there are cases in which rent can be increased beyond the set limits. If you make significant improvements or repairs to a property, you can apply for an approval to increase the rent from the Landlord and Tenant Board.

As well, residences built or first occupied after November 15, 2018, are exempt from these controls, but still must wait 12 months before requesting an increase.

How Much Does the Property Cost?

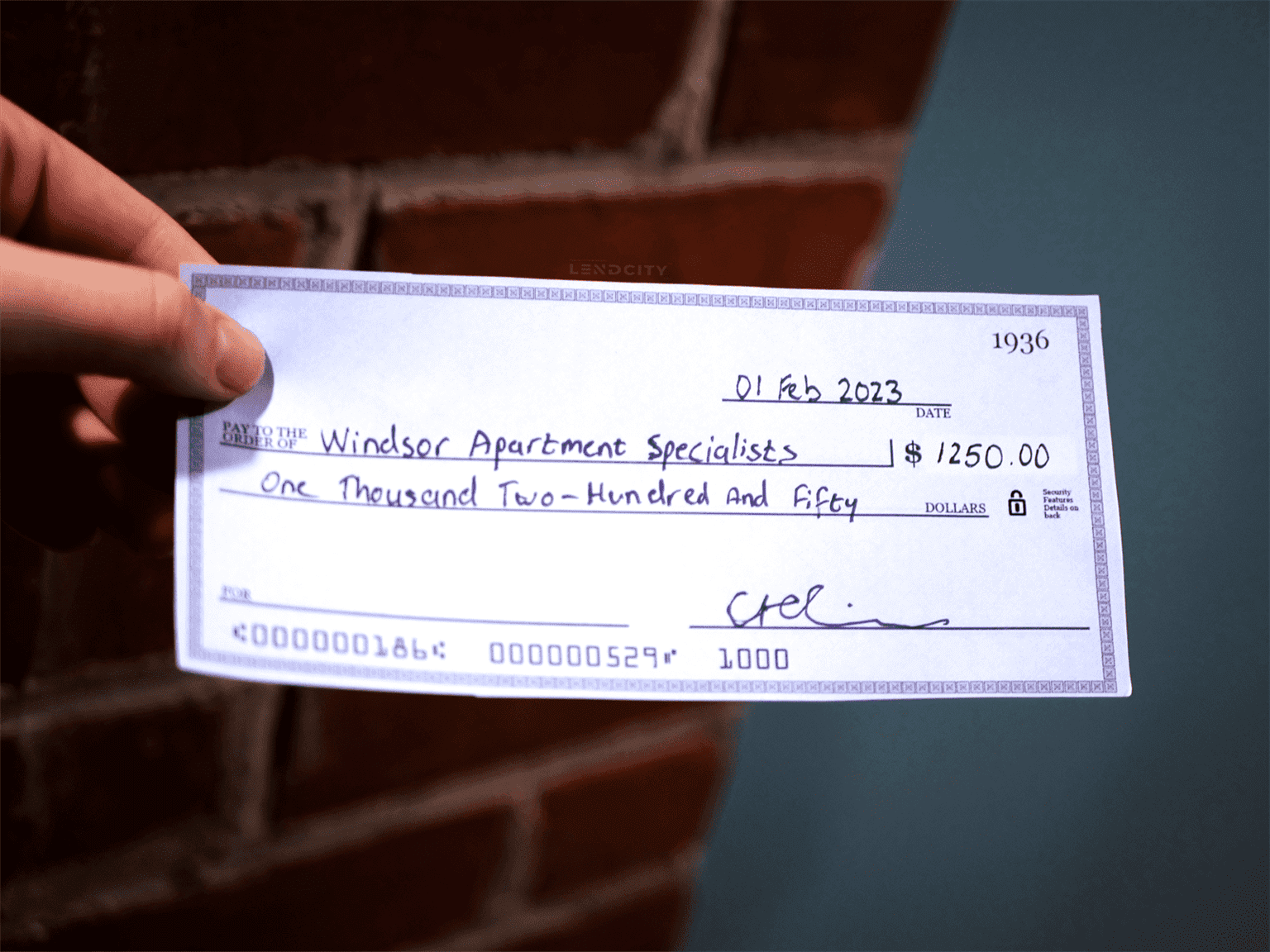

No matter how reasonable you want to make the rent for your tenants, that property still has expenses that need to be covered. You must consider things such as your mortgage rates, property taxes and utility costs when setting the rental prices to avoid losing money. When it comes to utility costs, you can separate this from your rent in the case of your tenant paying the utility bills, but otherwise it should be taken into consideration.

Property Management and Maintenance

Some property owners opt into hiring separate property managers or paying for a property management company to care for their rental units. This can be a great time-saver for property owners who are looking to save time from their own schedules, or those who own multiple properties and may need an extra hand managing their properties. If you are going to pay someone else to care for the property, you must make sure you have the appropriate income to cover it, sometimes this is factored into the rent, while other times it can be charged as a separate fee.

As well, if a property is going to require any sudden repairs or maintenance, you may want to have money set aside from the property to cover those costs.

In Short - Consider Your Expenses While Setting the Rent

Setting the rent for your rental property is a balancing act between the current market and your own related expenses. Before renting out a unit, it is important to do your research to avoid undercharging and getting locked into lower rates, or overcharging and allowing your property to sit empty, costing you money.

Of course, the process of buying any rental property should start with a pre-approval to help you lock in the best available interest rates for your mortgage. To get the pre-approval process started, visit LendCity.ca Alternatively, click the link below to book a free strategy call with our team at LendCity today.