Setting Up a Real Estate Joint Venture Agreement: Step-by-Step Guide

Year after year, the home prices in the country’s urban areas continue to rise. Construction companies are racing to meet the demand for new homes, but they’re struggling. Even the outlying areas of the Great White North are seeing an influx of new people searching for a place in Canada to call their own. It’s the perfect time to become the real estate investor you’ve always wanted to be.

Of course, real estate investment in Canada can be a tricky labyrinth to navigate alone, especially if you’re relatively new to the scene. As you invest, you’ll build a team of brokers and lawyers focused on protecting your investment, but that’s not the same thing as having another person to rely on for the health and well-being of a real estate project.

I find that sometimes you need someone whose goals mirror your own. You need some extra insight. Maybe you need a little additional capital to make your real estate dream a reality. Or maybe you need someone with expertise.

Whatever the reason, it’s time to think about a real estate joint venture.

Before you decide to set up a joint venture, one of the mortgage important things is to speak to a mortgage lender that understands your goals. If you start off on the wrong foot your investing journey could be a disaster. Book a free strategy call with my team of mortgage experts get you the best available rate, advice and strategy for success. Click to book a call with us so that we can get started today.

What is a real estate joint venture?

A joint venture is a business term that refers to a deal struck between two or more parties to pool resources and accomplish a goal. When that joint venture regards a real estate deal, then it is — you guessed it! — a real estate joint venture. It’s as simple as that.

Dozens of real estate joint ventures occur every day, at every level of the industry. If you’re working with partners who have complementary skills to your own, a real estate joint venture can be very lucrative. It can also help protect some of your assets and relieve the burden of accomplishing your real estate goals solo. If you’re interested in setting up a real estate joint venture, here’s how to make it happen.

Look for a joint venture partner with something you lack

The key to a suitable joint venture partner is to pick someone with skills that you don’t have. For example, if you don’t have a lot of capital, someone who’s willing to pay the checks while you do the legwork is ideal. If you have the money, someone with industry experience and a history of successful real estate deals could make for a perfect partner. Don’t be afraid to stop at just one partner, either.

Typically, what I find is that there are usually two main types of partners in a joint venture deal: the money partner who qualifies for the financing, and the managing partner who is capable of working on the property.

Depending on the size of the real estate transaction, you could need more than one helping hand to make the most of the deal. What is important is that everyone involved in the partnership has a role and everyone works to fill their role to the best of their ability.

Someone has to get the deciding vote

Make no mistake, a real estate joint venture is not a 50-50 partnership (at least, not most of the time). There’s a clear-cut hierarchy in a joint venture, and for a good reason. Regardless of how well you work with your team and who smoothly the deal is going, the odds are good that there will be disagreements. Those disagreements will likely be very passionate, too.

When you and your joint venture partners are locking horns, it’s essential to have one person who can make the final decision for the group. Establish who that person is on day one.

Ideally this should be the person who has the most experience in building successful real estate investments. I find that by giving the tie-breaking vote to the most seasoned investor in the partnership, you can usually expect to find the most success in your real estate joint venture.

Outline the joint venture relationship

Before you set off looking for a profit in your real estate transaction, make sure to draw up a document that explains the terms of your joint venture in clear-cut language. Even if you’re entering a joint venture with someone you feel you can trust completely, like a family member or a friend, it is still a good idea to make sure that the financial stakes are settled, in writing, at the beginning of the agreement.

If you don’t have a joint venture agreement, that’s no problem. You can use the form my clients use. The form is below to download for free.

Real Estate Joint Venture Agreement Download

Before you even enter into a joint venture agreement, you should have the proper legal documents. Below you can download your free joint venture agreement that many of my clients have used. It's always best to have a lawyer go over the contract and make sure your fully protected.

By filling out the form below you can access our FREE real estate joint venture agreement form that you can tailor to suit your partnerships.

Protect yourself

In a lot of joint ventures, one party is the financial backer, and the other person is the name on the lease. This could potentially leave the financier in trouble if their partner decides to sell the property out from under them.

You might think this kind of fraud only happens to other people, but you’d be wrong—few people ever expect to be betrayed, yet it happens frequently. It’s best to play it safe and make sure there is legally binding documentation on file to prevent unforeseen losses.

Ideally, I suggest that you make the contract incredibly detailed so that regardless of who you are in the deal, you know the terms for if, when, and how the property can be sold on top of how the equity is shared between investors.

Then, in the situation where someone does attempt to violate the deal, you have that document to protect yourself when things go to court.

Joint Venture Investing With Me

Are you looking to take a hands-off approach to real estate investing? I can help with structuring the deal and finding the ideal properties. I am looking for Money partners with the down payment and mortgage financing.

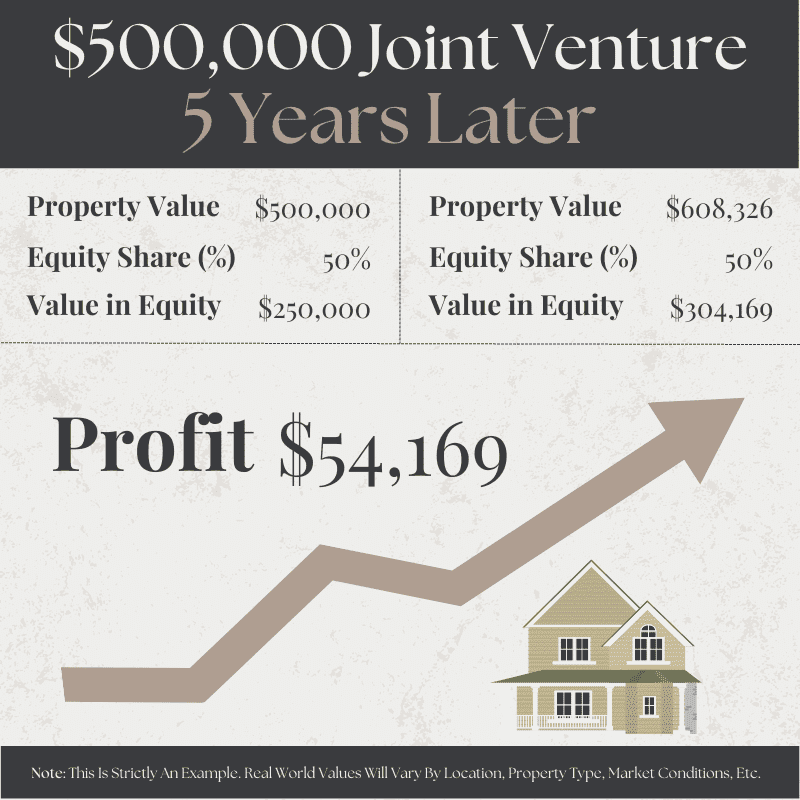

If you qualify for mortgage financing on a property, I can partner with you to run the property for a share of the equity. This way, you can begin investing in joint venture real estate without searching for a partner - we are already right here. Plus you get you leverage our expertise and invest passively.

Simply book a call with us and we can start the process today.

Watch your bank account balance

During a real estate joint venture, it’s only natural to set up a shared bank account to which everyone in the deal has access. After all, when you’re investing in real estate, it is critical to maintaining some kind of liquidity for emergency expenses and the like. Be careful about how much money is in this account. Make sure that you have a ceiling as well as a basement for the amount of money that can be put into any shared account.

I recommend keeping a collection of receipts and invoices for the property so that everyone involved knows what the money in the account it being spent on. These records may also be useful when tax season rolls around if any of the expenses wind up being deductible.

Download your FREE Printable Excerpt for this Step By Step Guide

Is a corporation the right idea?

If you’re considering setting up a corporation to handle your real estate joint venture, you might want to think carefully. Some Canadian lenders won’t offer real estate financing to a new corporation. As a result, depending on the lender you choose, you or one of the members of the joint venture may need to personally offer collateral to get corporate financing. Still, more Canadian lenders won’t let corporations close on residential properties. If you’re working on a large-scale deal, a corporation might be worth the effort; otherwise, they could end up being more hassle than they’re worth.

So, if you are unsure about which option is best for you and your partners, give my team a call and we will help you come to a solution based on the specific needs of your partners and the property at hand. While we cannot give tax advice, we can explain the process between the different types of lenders and go over the terms and conditions with you.

Joint ventures are often the best way to finance a real estate deal—just make sure you follow these steps to protect yourself and your assets.

Financing Your Joint Venture in Real Estate

If you are looking to finance your next joint venture deal, let my team get you set up with the best financing available for you and your partners.

All you need to do to get started is book a call with us today and we can begin working out a strategy together.