The Cost of Flipping Properties – 5 Factors You Should Consider When Assessing a Strong Flip

Flipping properties is all about cost-efficiency. While the professionals make it look like a handful of quick, easy renovations, the truth is it is a complicated process that requires you to calculate a lot of important factors in advance.

Whenever you are assessing a potential fix & flip property, you need to understand the costs you are going to be expected to cover throughout the process. This way you can properly budget and plan for the flip while determining if the property is going to yield enough of a profit to be worth your while.

If the following considerations do not add up to make a satisfying profit for a flip, you may still be able to utilize the property for long-term real estate investing, but that will not always be the case. Traditional buy-and-hold and BRRRR investing methods have their own criteria to determine if the property is a worthwhile investment.

So, before you buy a fix & flip, take the time to consider these five financial factors.

The Cost of Flipping Properties

Whenever you are flipping properties, costs are going to be one of the largest concerns that you need to face. This is because not only does the cost of flipping properties directly impact the amount of profit you will make, but the costs aren't usually covered by lenders beyond the initial purchase.

However, that's not to say no lenders will finance the cost of flipping properties, but it is not very common.

So, if you want to learn more about how the cost of flipping properties will change the type of financing you need and how much you should budget, click the link below to book a free strategy call with us.

Up-Front Cost of the Home

As with any purchase or investment, it all begins with the up-front costs. This includes the asking price, final purchase price and required down payment you will need to provide. Each of these initial factors will greatly impact the affordability, financing, and profitability of the profit later in the process.

Asking Price vs Purchase Price

Whenever you are buying a property, it is important to remain wary of the difference between the asking price provided by the seller and their agent, and the final purchase price you are going to need to secure financing for.

Take a look at the local market. Are properties frequently selling over the asking price? If so, by how much? If not, are they selling at the asking price? Lower? This will give you a realistic picture of what you will need to do in order to get an offer accepted. If there is a ton of competition in the market, you may need to bid higher than asking in order to get the property. This can sometimes be a deal breaker for house flippers because it eats away at the profits the property can generate.

Down Payment

While it is always important to have enough saved for an adequate down payment on a property, it is also essential when you are flipping properties to save more than your required down payment. Unlike buying your own home or a rental property, it is much more common to be asked to pay a higher percentage of the purchase price up front in order to cover the risk of buying a distressed property.

Closing Costs

Similar to the up-front expenses of buying the property, you need to be prepared to cover the closing costs when buying and selling the property.

Buying

When you are buying a property, the closing costs are significantly less than if you were to be the seller. Traditionally, people are recommended to save about 1.5 per cent of the purchase price to cover any legal fees, appraisals and other expenses needed to make the deal close.

Selling

Once you have finished your repairs and updates, it is time to become the seller. As the seller you can usually expect to pay much more in closing costs than you did when you bought the home. Unlike buyers whose realtors and mortgage agents are typically paid by the lender, sellers often find themselves on the hook to pay their realtor’s commission themselves. Often the closing costs can reach as high at 10 per cent for the seller, so it is important that you budget accordingly.

Financing and Monthly Expenses While Flipping Properties

Unfortunately, while you are flipping properties you do not have rental income coming in to help offset the monthly expenses tied to the property. This includes the mortgage payments, insurance, and other expenses you would traditionally use in order to set the rent.

While you are flipping properties you want to know how much these factors are going to cost you each month to ensure you can afford to pay for the property throughout the renovations and do not end up defaulting before you get to sell.

Discover How To Flip A House With This Step By Step Guide

Expected Repair Costs

In order to complete the renovations, you need to know how much you would need to budget for. Some repairs such as a full rework of the plumbing or an extensive rewiring of the house’s electrical system can become incredibly expensive very quickly and may not be a task suited for a flipper to undergo.

Regardless of the work that needs to be done, you need to calculate the expected cost of the time, materials and labour that will be needed to go complete the work. After that, you should take that cost and the purchase price of the property in order to calculate the final factor.

After-Repair Value (ARV)

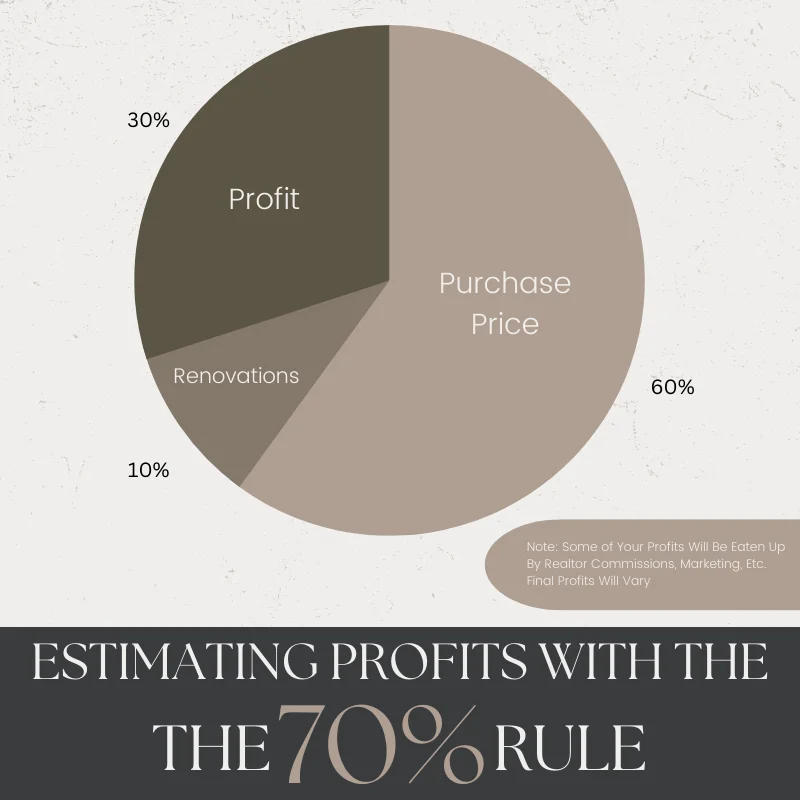

Flipping properties works because it rapidly introduces new value into a property and causes it to appreciate and grow in value. This new value is called the after-repair value (ARV). If you can estimate the ARV of a property ahead of time, you can determine exactly how much you can afford to spend on renovations and purchasing the property while still making a worthwhile profit for yourself.

Many people suggest that you spend no more than 70% of the ARV during a flip, but the exact figure is much less important than your own anticipated satisfaction with the final sale price on the home.

Securing financing for a flip can be complicated, with many traditional lenders not wanting to lend against homes that are in obvious disrepair. So, it is important you go to an experienced mortgage broker who can connect you with the best lender who is best suited to you and the property you are purchasing.

Luckily for you, LendCity works with a wide network of experienced lenders to ensure that you get the best financing at the best rate available to you. So, if you are ready to begin investing or would simply like some more information, you can visit us online at LendCity.ca or give us a call at 519-960-0370. Alternatively you can click the link below to book a free strategy call today.