The Popular Pros and Cons of Joint Venture Real Estate in 2023 Explained

Most people look at real estate investing an individual investment strategy. However, that is not always the case. Some investments are too big or too complex to be handled by a single investor, and that is where the world of joint venture real estate comes into play.

When it comes to forging partnerships in real estate, some people are under the impression that only large companies and corporations are capable of making it work, but that is not true. Individual investors and smaller investment companies are also capable of building relationships and combining resources into shared investments they otherwise could not have afforded or managed on their own.

However, with the added potential of joint venture real estate partnerships, there are also new risks that must be factored in. So, in order to help you make an informed decision regarding any joint ventures you may pursue, here are the pros and cons of joint venture real estate investing.

However, before we get started, if you are looking to secure financing to support your joint venture deal, get started today with a free strategy call with my team at LendCity at the link below.

What is Joint Venture (JV) Investing?

Joint venture real estate or JV real estate investing is the process of two or more investors or investment companies, partnering up for an investment or real estate development. Unlike formal business partnerships where each party come together under a new distinct identity, each investor maintains their own individual business identity while working together.

Why Might You Consider Joint Venture Real Estate Investing

You may consider seeking a joint venture real estate partnership in real estate for a variety of reasons. Typically, investors seek out JV partnerships when they need assistance with one of the following factors.

Credit and Equity

One of the leading causes for real estate investors to seek out partners to invest with is a lack of credit and equity. Larger real estate projects can be incredibly expensive and require much more initial capital and higher financing amounts in order to successfully complete. Investors who have leads on deals outside of their price range may consider this a strong factor.

Credibility

Newer investors may seek out JV partnerships in order to ensure they have enough credibility behind their bid in order to complete a deal. By working with a more-established investor, it may be easier to get a project off the ground.

Land Contribution and Construction Management

Some investors may buy a piece of land that has a lot of potential, but they lack the means to adequately develop it and use that potential. In this case, they may turn to an investor with more experience in land development to work together and maximize the use and value of that property.

Discover How To Set Up A Joint Venture With This Step By Step Guide

Advantages of JV Investing

By combining their resources and working together on a deal, joint venture real estate creates a variety of unique advantages that increase the appeal of these arrangements.

Shared Resources and Capital

By working together and pooling resources, investors working together on a joint venture real estate deal have the ability to share resources and capital that they otherwise would not have had alone. This is excellent for purchasing more expensive properties or undergoing large construction projects which require more money and connections to successfully complete.

This also means that the expenses pertaining to the property are also split between the parties involved. So, if you are a 30 per cent stakeholder in a particular property following a JV partnership, you would typically only be directly liable for 30 per cent of the expenses.

Investors Have Different Types of Experience

Joint venture real estate agreements allow investors to complete deals and projects they would not otherwise be able to do on their own due to the shared experience of their partner(s). For example, if you are buying a property that requires major renovations or has construction in need of completion, you would do well to secure a partner who has experience tackling those types of projects. Not only would you have access to their experience managing these tasks, but you would also be able to work with the contractors and skilled trades workers they turn to for their personal investment properties.

Reduced Individual Risk

Much like how the costs associated with investing in the property would be split between partners, the risk and potential for loss would be shared as well. By investing with partners instead of relying on your own resources, you reduce the individual risk you are experiencing from the investment in the event that things fall through.

Flexible

Joint venture real estate partnerships are not set in stone. As the needs of the property change or the goals of the partners evolve, the agreement can change alongside it. This can include allowing new partners to buy in and join, allowing other partners to leave and get bought out, or renegotiating the terms of the partnership to a more agreeable split.

Disadvantages of JV Investing

While joint venture real estate comes with a load of advantages, it also has its own risks and disadvantages you need to consider.

You Don’t Get Full Control

As a joint venture real estate deal is an agreement between multiple investors, you will not have full control over the property. This means your plans and goals may sometimes be overruled by other partners who do not agree with the direction you want to take.

The amount of control each partner has should be lined out in your real estate joint venture contract.

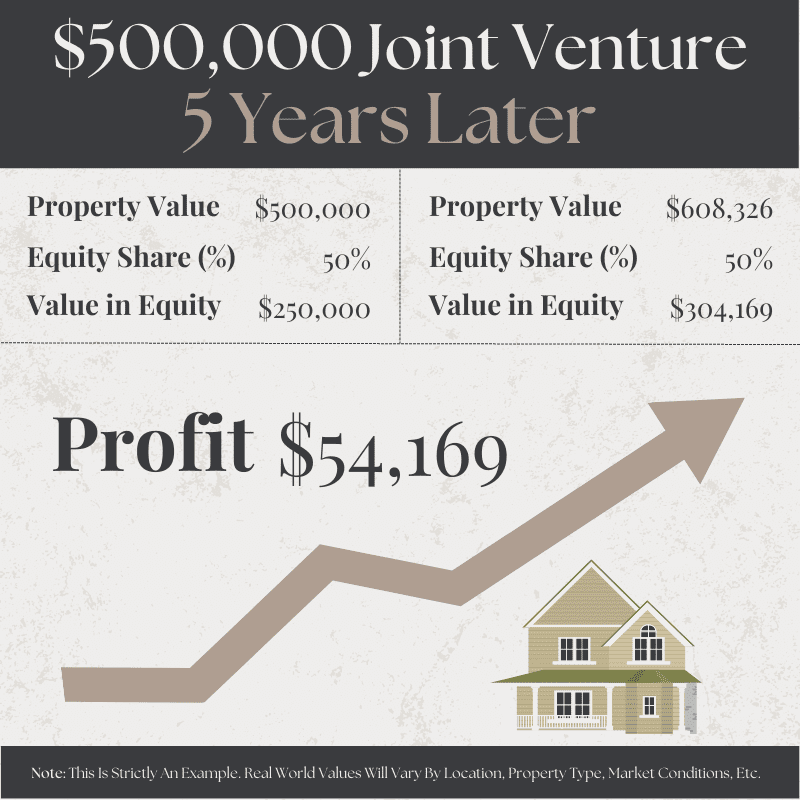

Split Profits

As the costs and risks are divided with a joint venture property, so too are the profits. When you enter into the agreement, there will be an agreed upon profit split between all of the partners in the deal.

Leaving Takes Time

While you can choose to sell and walk away from properties you own at almost any time, the same is not true for joint partnerships. Instead, walking away requires you to notify your partner in advance and receive their approval. This can lead to situations where your exit strategies do not align, and conflict may arise – thus lengthening the process.

Financing Your JV Deals

If you are pursuing a joint venture real estate deal with another investor, you would be wise to take the deal through a mortgage broker. This way you can ensure you are matched with a lender who is experienced with JV partnerships and can quickly qualify you for the best mortgage available to you and your partner(s) combined.

That is why at LendCity we work with a wide network of lenders to make sure you get the best financing available for all of your JV deals. So, to get started today, visit us online at LendCity.ca or give us a call at 519-960-0370 and we can help you get started. Alternatively you can book a free strategy call with my team at the link below.