Use a Mortgage Investment Corporation to Fund Your Next Successful Flip in 2023

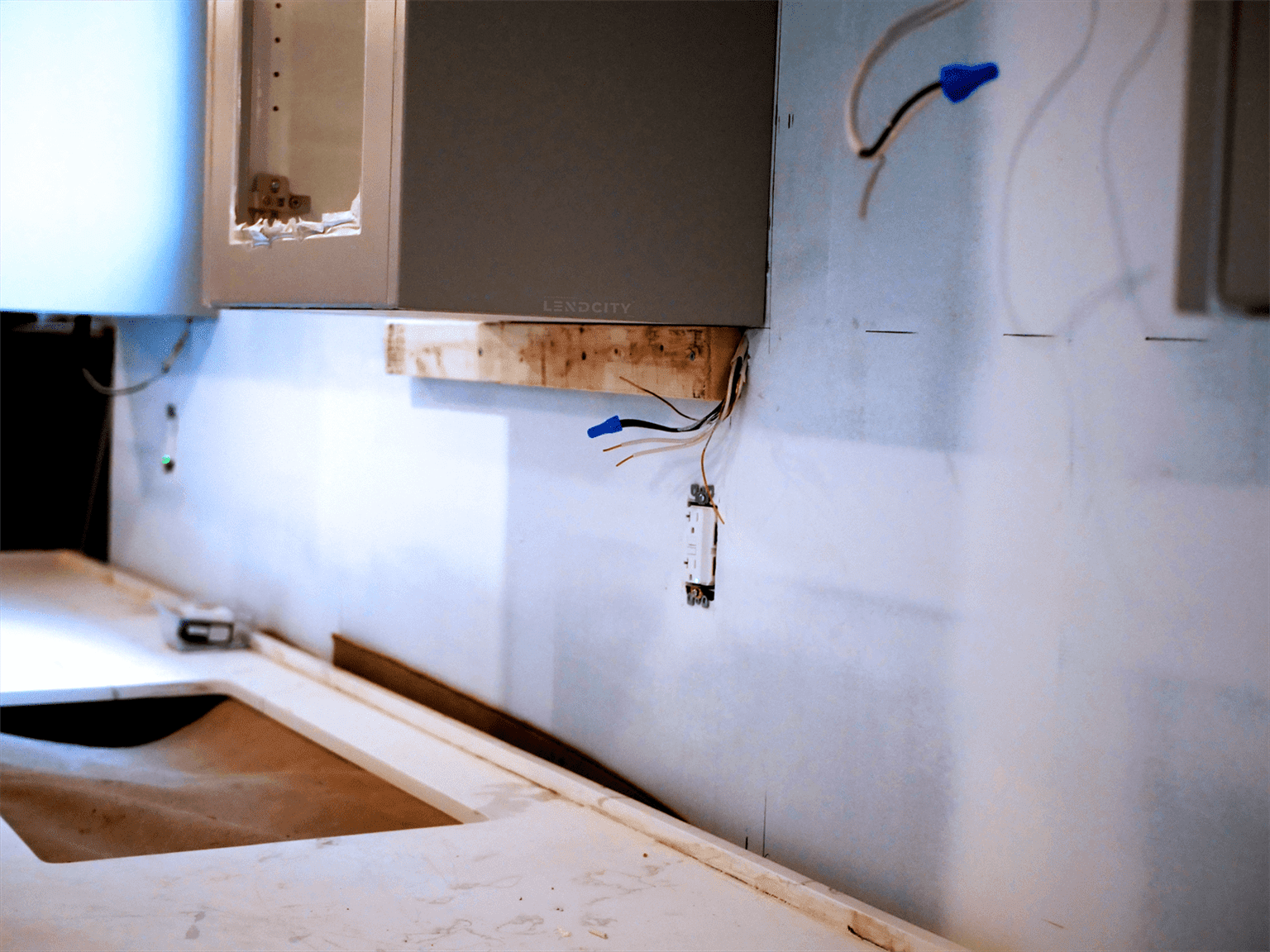

One of the most popular ways of finding success in the Canadian real estate market (and, indeed, in any real estate market) is a good, old-fashioned fix-and-flip. On the surface, a fix-and-flip is a relatively straightforward means of investment. A buyer locates a property in an up-and-coming neighbourhood. Ideally, this property will require some work and, in turn, will be listed below the average market value. A fix-and-flip involves a lot of homework to find the perfect property that won’t bankrupt you, and the right contractor willing to work alongside you.

However, a fix-and-flip remains popular for new real estate investors because it offers a compartmentalized approach to real estate development. One: you find the property. Two: you hunt down a contractor. Three: You fix the place up. Four: you sell it for a profit. Five: Rinse and repeat.

However, to break into the fix-and-flip market and take part in all those profits, you’re going to need some capital. Investors with limited funds or access to collateral may believe their options are limited to investment in a REIT or collecting partners to share in the profits. That’s not entirely true.

Investors without much capital who, nonetheless, want to take complete ownership of a property should consider a mortgage investment corporation. These uniquely Canadian institutions allow fix-and-flippers access to capital in exchange for dividends.

However, before we dive into mortgage investment corporations, if you want to see if these are the best bet to fund your next flip, click the link below for a free strategy call to discuss you investment options today.

What is a mortgage investment corporation?

In a lot of ways, a mortgage investment corporation (MIC) operates like any other investment trust. A collection of individuals pool their assets with the goal of buying and developing residential real estate properties. MICs accomplish this goal by investing in mortgage borrowers who make routine payments much as they would with any other lender.

Where other investment collectives, like REITs, focus on a combination of residential and commercial real estate, a MIC concentrates primarily on residential real estate. In fact, by law, all MICs are required to keep at least 50 percent of their portfolio firmly planted in the world of residential real estate mortgages. That means that MICs set their sites on single-family homes and multi-unit buildings of four units or less.

Discover How To Flip A House With This Step By Step Guide

Rising popularity

You don’t have to be actively involved in the Canadian real estate market to be aware of the rising cost of homes in the country. Indeed, the average price of a home in the country has reached nearly half a million dollars. In several urban areas throughout the country, the cost of a home exceeds $750,000. With rare exception, that’s not an easy down payment to cover. Increasing regulations and rising loan amounts have caused some financial institutions to consider mortgages something of a risky proposition.

As a result, more and more Canadians are getting loans from MICs. As the trend toward rising housing costs continues, investors and borrowers alike find a lot to love in mortgage investment corporations.

Invest to borrow

The first thing to know about borrowing from a mortgage investment corporation is that you’re required to own a share in the particular MIC from which you hope to borrow. What’s more, you won’t be able to use funds from your Retirement Savings Plan to buy-in. The Income Tax Act expressly prohibits borrowing from a MIC after you’ve invested using your RSP.

The bright side, there, is that purchasing shares of a mortgage investment corporation shouldn’t cost much more than a few hundred dollars (and the odds are good that sum will net you more than one share).

Risky investments

Once you’re partially invested in a mortgage investment corporation, you should have access to their borrowing system. Most MICs make their money by choosing to lend mortgage money to those people who have been unable to secure financing from traditional lenders. That means your odds of securing a mortgage are greater with a MIC than with a bank or credit union.

That said, because most MICs trade in risky borrowers, they tend to hedge their bets by charging higher-than-average interest rates. Investors love that practice because MICs are legally unable to retain any of their profits. Every dime a MIC pulls in, they must pay out to their shareholders on an annual basis.

Beware of rookies

When you’re choosing a MIC to borrow from, you should be cautious. The rising popularity of MICs has brought several newcomers to the table. Though eager, these MICs have taken on several bad habits. They overlook due diligence. They invest in borrowers who represent too big a risk. Their definition of “residential” real estate borders on worryingly vague.

When you want to get a loan from a MIC, choose one that’s been around for a decade (or more). It might also be worthwhile to have a real estate lawyer guide you to the right MIC for your needs. In general, if you want to secure a mortgage from a MIC and they don’t put you through steps similar to a traditional mortgage lender, that’s a big warning sign.

Finding a mortgage investment corporation to borrow from

Once you’ve located a mortgage investment corporation with a longstanding reputation, here are some general tips to keep in mind before applying for a loan:

- Look for an independent board of directors who will keep an eye on the overall governance of the MIC.

- By law, no one entity in a MIC can own more than 25 percent of the total portfolio. You should look for a MIC where the largest shareholder owns less than 5 percent of the portfolio.

- MICs should provide strong (bordering-on-overly-detailed) financial reporting.

- Relying on third-party independents to conduct appraisals and inspections.

Just keep these steps in mind (and trust your team), and you shouldn’t have any problems securing a loan—then all you’ll need to do is fix and flip your new property.

Always Seek Professionals For Assistant With A MIC

Also seek a license mortgage lender like our team at LendCity Mortgages to get assistance with lending from a MIC.

At LendCity, we shop the market for you, to secure the best financing rates and terms.

Contact Us to get started or click the link below to book a free strategy call today.