What is the 70% Rule? How to Avoid Overpaying for Fix & Flips

Experienced investors know that house flipping is all about the numbers. So, it is crucial that you find the right balance between expenses and profits.

In order to strike this balance, there are plenty of questions you need to be able to answer. How do you make sure you are not overspending on your next residential flip? How much should you budget for updates and repairs? How do you determine the after-repair value of the property?

While each of these questions will give you varying results based on location, type of property, and the needs of the home, there is one rule that many investors refer back to – the 70% rule.

Before we dive into the intricate rules of house flipping, you should always aim to get the best mortgage possible for your flips. This means little to no penalties for breaking your term, and a rate that won't erode your profits.

To learn how you can lock down that ideal rate, click the link below to book your free strategy call today.

What is the 70% Rule?

Investors interested in flipping properties have a simple three-step process to follow: They located a property that requires updates and renovations, completed the work to increase the property value, and sell it at a higher price. Of course, it does not take a seasoned investor to know that it is not advisable to spend more money than you can make on the property. As a result, investors often stick to the 70% rule.

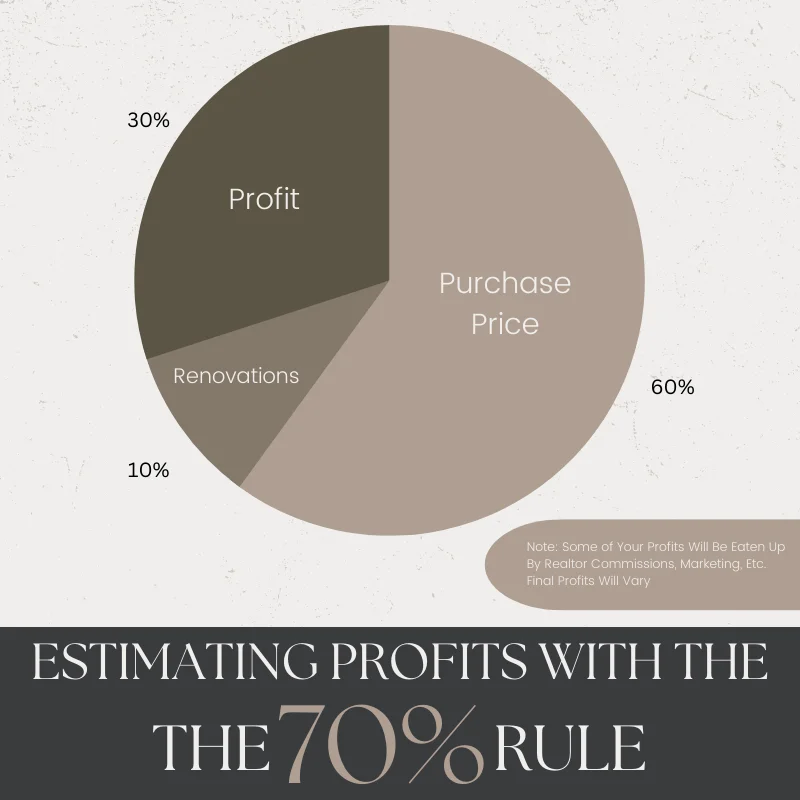

This rule means that when you a buying property, you should not pay more than 70% of the after-repair value of the home minus the cost of repairs when purchasing a property.

How Does it Work?

In order to use the 70% rule, you have to work backwards from the after-repair value on the house. There is a simple formula that you can use to calculate your maximum purchase price with this rule.

(After-Repair Value (ARV) x 70%) – Renovations and Repairs = Maximum Purchase Price.

For example, if you found a property that will be worth $550,000 after $20,000 in repairs, the equation would look like this:

($550,000 x 70%) - $20,000 = $365,000

So, according to the 70% rule, you should not spend more than $365,000 on that property.

Calculating After-Repair Value

So, if you need to know the after-repair value in order to use the 70% rule, how do you get it? After all, the work has not been completed yet. Fortunately for you, there is a key trick to calculate the ARV before ever buying a property.

First, it is important that you look at properties with obvious room for improvement. Otherwise, it will be difficult to quickly introduce new value and cause the property to appreciate. Then, based on the home’s expected specifications once the work is complete, you need to look for comparable properties.

To find comparibles, look for a selection of homes for sale that are located in the same or a similar neighbourhood that meet the same specifications. That means the same number of bedrooms, bathrooms and with similar square footage. Then, compare the prices of these homes to find an expected after-repair value. While the work you are planning to do may make this property more valuable than these comparibles in your opinion, do not over-estimate this value. It is always better to be surprised by more profits later than to be blindsided by reduced profits.

Over-Budgeting for a Flip

After you have an expected after-repair value, you need to determine your renovation budget for the flip. This is the total expected cost of materials, labour and permits needed to complete the work. You can determine this by first taking a walk through the house and assessing all of the work that needs to be completed. From there you can estimate the required permits and materials you will need to get it all done in a timely manner.

When making these estimates, it is suggested that you over-budget and overestimate these costs. This way if additional repairs are later discovered to be necessary, you do not find yourself going over budget.

Discover How To Flip A House With This Step By Step Guide

When Doesn’t the 70% Rule Apply?

The 70% rule is a guideline made primarily for house flippers and real estate investors who do not plan to hold on to a property for a long period of time. It is designed to ensure that you do not overspend beyond the growth potential for the property in the immediate future. However, this rule does not apply to long-term investments.

Unlike shorter investments such as flips which rely almost solely on appreciation to turn a profit, long term investments have more revenue potential through cash flow and equity built over time. Additionally, when it comes to long-term real estate investments and rental properties, it can be nearly impossible to accurately gauge how much the property will be worth if you sell it in 10 years. The market simply is not that predictable. As well, over the term of a longer investment period, you may need to put money into additional repairs and updates that you cannot account for at the time of purchase.

While there are other means to assess the investment potential for rental properties and long-term real estate, the 70% rules does not apply.

Is the 70% Rule a Strict Rule or a Rough Guideline?

The 70 per cent rule is meant as a guideline to help investors avoid over-spending losing their money. However, it is not a hard and fast rule. Some investors cap their spending at 85 per cent on their flips, others will not go higher than 50. What is important is that you never spend more than you need to on a property so that when all is said and done, you are able to walk away with enough profit to justify making the initial purchase.

Financing Your Flips

If you are getting ready to flip a home, you need to secure financing that will let you get out early with the fewest fees and penalties after you make the sale. Luckily for you, the expert team at LendCity is ready to help you get connected with an experienced lender who is right for you and your investments.

So, if you have any questions or are ready to get started, visit us online at LendCity.ca or give us a call at 519-960-0370. Alternatively, you can click the link below to book your free strategy call today.