Beware of These 5 Investment Property Renovation Mistakes

Whether you are looking to sell your home, or prepare a property to be rented out, the investment property renovation process is one you should enter carefully. After all, if things begin to go wrong, a quick update can turn into an expensive repair.

That is why you need to be diligent as an investor whenever you begin a new project. There are plenty of investors who fall for the same oversights constantly and it costs them thousands of dollars. So, in order to help you avoid financial pitfalls while renovating your properties, here are five mistakes you should avoid.

Now, before we dive into the world of investment property renovations, let us teach you how to fund these projects by using your existing equity over a free strategy call at the link below.

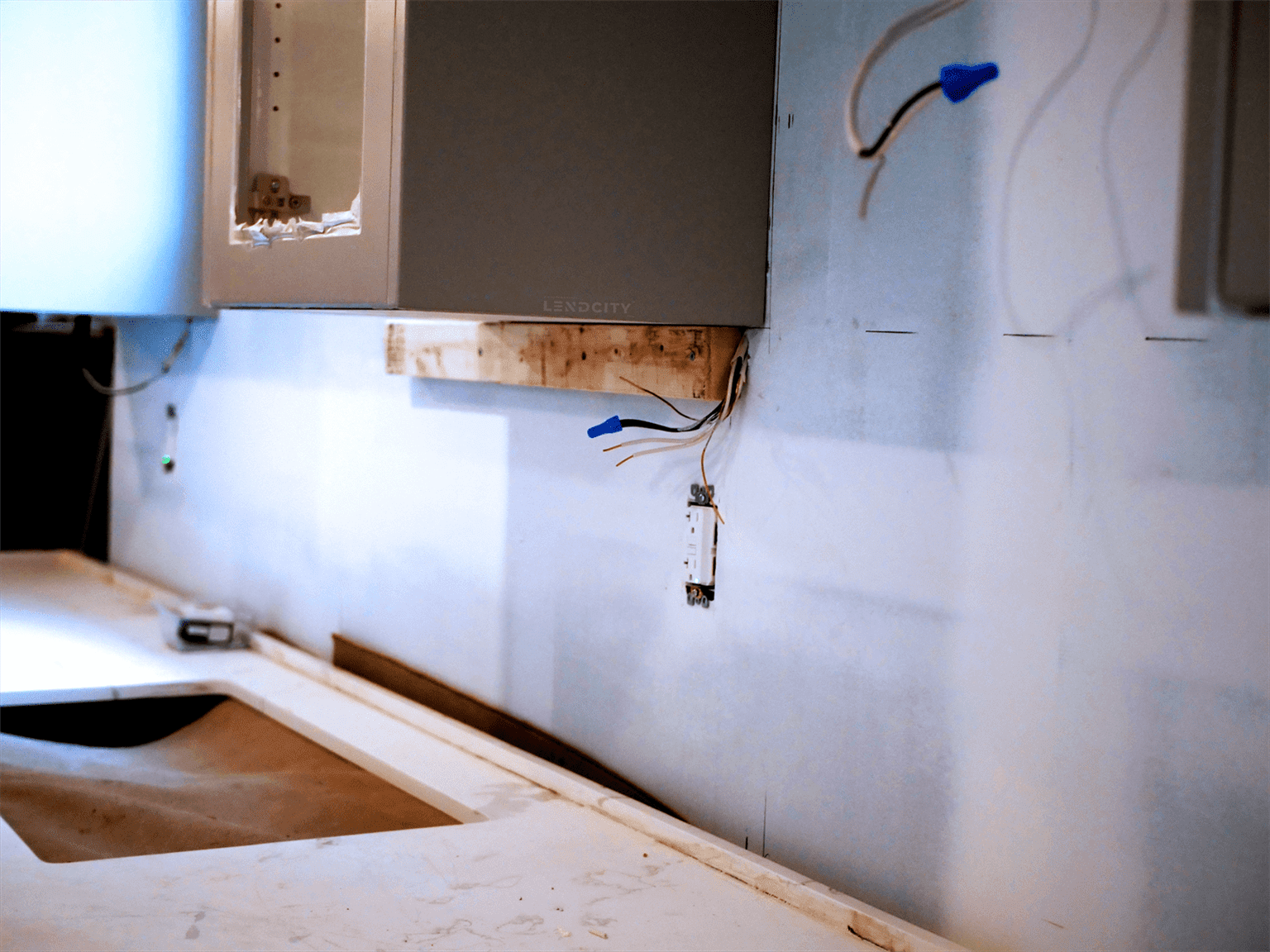

Not Getting the Proper Permits For Investment Property Renovations

Plenty of new investors have the mindset that simply because they own a property, they are free to do whatever they want with it without asking for permission. Sometimes this is true, especially if you are doing something minor like painting a wall or replacing your cabinets. However, if you are planning to do a larger renovation, it is essential that you acquire the proper permits and approvals for your investment property renovation in advance.

If you want to create an open concept living and dining area by tearing down a wall, you cannot do that without a permit, otherwise you are going to face a hefty fine in the long run. The approval process is in place to make sure that anyone conducting investment property renovations is adhering to a variety of health, fire and safety guidelines as outlined by the Building Code. For a renovation such as this, inspectors are going to check to make sure the wall you would like to remove is not load-bearing, and if it is you will be required to ensure the weight of the building is properly redistributed to avoid a collapse if the project is approved.

Discover Residential Property Management With This Step By Step Guide

Trusting the Cheapest Options

When you are looking for contractors, inspectors, and supplies to complete your investment property renovation, it can be incredibly tempting to go for the cheapest option. That way you get the most bang for your buck and maximize your profits. However, these cheap options are often cheap for a reason, and you need to be wary of this.

When looking for contractors and labourers, it is essential that you ask for quotes from multiple workers and companies in order to gauge their prices. From there, ask for references and analyze their portfolios closely. You want to hire someone who has the best price relative to the value they are bringing in. This way you do not fall into the trap of paying for cheap labour and ending up with a poor final result that will bring down your property’s value or force you to pay another contractor to come and finish the job properly.

Improperly Budgeting For Investment Property Renovations

One of the worst mistakes you can make while looking to renovate a property is improperly managing your budget. Whenever you go to make a renovation or update your property, you want to be increasing the quality and value of that property. However, if the projects you have planned are not going to help you achieve that goal, you are likely going to be better off skipping them all together.

Before you begin any sort of renovation, you need to make sure the project makes sense to complete. For example, if you are planning to renovate the kitchen in a property you are getting ready to sell, you need to ensure that the after-repair value (ARV) is going to be enough to justify paying for the updates. You can do this by making sure you get detailed quotes from your contractors for the expected labour and material costs you will need to pay.

Try to set your budget above the quotes you are offered, that way you do not run out of money and get stuck leaving a project half-finished. Then compare this budget to the profits you are expected to make on the sale after these renovations are complete.

For rental properties it can be a little more difficult to determine this budget because you do not have a sale price to use in order to benchmark your budget. However, in order to budget wisely, you can use the quotes you are given to estimate how much more you can charge in rent each month and how long it will take for you to recoup the costs put into the project at the new rental price.

Over-Designing and Being 'Too Flashy' During Investment Property Renovations

Some investors get caught up in the idea of luxury and bold designs choices to the extent that they make their own properties harder to rent or sell. While many people would agree that features such as large murals or bold wall colours can be impressive to look at, most people would not like those elements in their own homes.

For example, while accent walls can be an excellent way to add a splash of colour to a room, there are a wide variety of investors who take this too far and wind up painting their rooms an array of vibrant bold colours that can become overwhelming on the eyes during a walkthrough and turn away interested parties.

There are also different design elements that are over-designed and over engineered that can come across and unwelcoming to many people. People design custom sinks and doorways that feel like art pieces but can be confusing to operate and turn others away.

Focusing on Personal Preference During Investment Property Renovations

Much like over-designed elements, if your renovations are focused too heavily on your own personal preferences it can become difficult to find a tenant or potential buyer. People are looking for homes they can see themselves in, and by creating an environment full of your own ideas and identity you risk making others feel out-of-place while viewing the home.

If you are getting ready to sell your property and are looking to buy a new one, or you are simply looking to learn more about the world of real estate investing, contact us at LendCity. We can be reached at 519-960-0370 or you can visit us online at LendCity.ca. Alternatively, click the link below to book a free strategy call with our team at LendCity today.