Buying an Apartment Building: Step-By-Step Guide

When you’re working in the world of real estate investment in Canada, one of the most common long-term goals for investors is buying an apartment building or complex. That’s entirely understandable. Apartment buildings can be incredibly lucrative opportunities if you go about it the right way.

You would be surprised at the number of investors I have had ask me, "Is buying an apartment building a good investment?" After all, as long as you take the time to do things properly, there are very few reasons why buying an apartment building would be anything other than a great investment.

As long as you take your time and do your homework, the process of buying an apartment building can be smooth and painless.

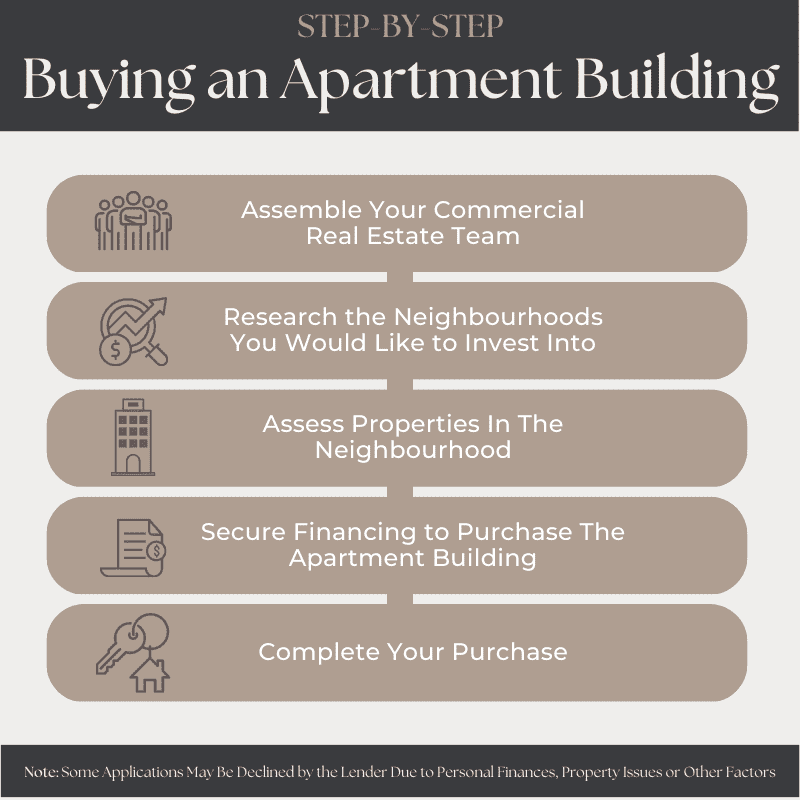

Of course the first step to successfully making your purchase is to secure financing for the property. It is important to remember that the process of getting a mortgage looks a bit different for apartments than it does for buying a house.

However, we can simplify that process for you with our in-house commercial financing team at LendCity. All you need to do is book a strategy call with us at the link here, and our team will get to work finding the best lender and product for your purchase.

Decide if an Apartment Building is Right For You

I always tell investors not to be blinded by the potential for making money while you are looking at buying an apartment building in Canada. There are certainly rewards to reap, but it’s critical to remember that owning and operating a multi-unit building takes a lot of work.

In terms of benefits, owning a building with several units means that you will almost always earn rental income month-after-month. Apartment buildings also allow you to supplement your rental income by adding stuff like vending machines and coin-op laundries to the property.

On the other hand, a lot of apartment buildings will see more consistent tenant turnover than single-family homes, which means you will spend time and money advertising for vacancies. You will also need to make sure your tenants are happy. That means almost daily interactions with them.

Of course, if you are working with a property manager or a management company, the bulk of these tasks can be performed by them instead.

If you’ve got the people skills and the determination required, then buying an apartment building is a wonderful way to invest.

Apartment Building Expenses Go Beyond the Mortgage

Once you’ve decided to go ahead and start buying an apartment building, it’s essential to understand the added expenses. When you buy a rental home, for example, your most significant expense is likely your mortgage on that property, plus occasional maintenance services when something breaks down or a tenant moves out.

After you sign your name on the dotted line of apartment building ownership, you will quickly discover that it is borderline impossible to run an apartment without backup. For example, most apartment landlords find it helpful to have a full or part-time maintenance tech, plus someone on-site to handle emergencies and address tenant concerns.

Remember that it’s critical to have the financial flexibility to employ all the people you’ll need to keep your tenants happy (and maintain your sanity). So, ideally you want to find a solution that can tackle all of your needs in one package.

A popular option I see is employing a full-time property management company to run the building. Many of these companies employ all sorts of property managers, book keepers, and maintenance staff. This option is strong because it allows you to pay for all of the services you need at once which is typically cheaper than contracting multiple services independently.

Sometimes when you are buying an apartment building, the previous property management team will be willing to sign a contract with you straight away and continue working on the property. In this case, the transition between owners should be virtually seamless for the tenants currently living there.

Download your FREE Printable Excerpt for this Step By Step Guide

Find Commercial Success with the Right Team

When you first set about building a real estate investment portfolio, you undoubtedly learned to engage the help of several real estate professionals. A reliable mortgage agent and real estate agent are integral to any good team, for example. When you make the leap to buying an apartment building, however, you will want to be certain the team you are working with is cut out for the job.

Any time that you purchase a building in Canada that is larger than four units, you will exit the world of residential real estate and leap into the commercial market. When that occurs, your best bet is to secure the services of a veteran commercial real estate agent. These pros will understand the distinctions between a residential and commercial real estate that could make or break your deal.

As well, you want to be working with a mortgage agent who has access to a variety of commercial financing options. That is why at LendCity, we built a dedicated commercial financing team in order to help you make purchases such as an apartment building a reality.

If you would like to connect with our commercial financing team today, simply book a strategy call with us at the link here and we will help you get started.

Finding the Right Property

The next step in buying an apartment building is finding the right property for your needs. One of the easiest ways to begin this process is to consult with local real estate networks. By merely engaging with professionals from all corners of the real estate industry, you will steadily build your cache within the community. That could lead to the discovery of a magnificent building before the competition can hear about it.

While you’re on the hunt, you might also consider seeking out a for-sale-by-owner property. Because an FSBO operates without an intermediary, it’s entirely possible to save five percent or more off the purchase price. When you’re talking about apartment buildings, that is no small amount of money.

If you are trying to find an off-market property, it may be worth sending a letter to local apartment buildings that are approximately the size you would like to buy. Sometimes investors will hold on to properties longer than they want to simply because they do not have the time to go through the process of listing the building.

Understand the Neighbourhood

Regardless of whether you are buying a single-family house or buying an apartment building, you should always take the time to research a neighbourhood when you are buying real estate.

Some of the key pieces of information you should be seeking out are the average local rents, property values, tenant demographics and nearby amenities. These will all help you determine whether buying an apartment building in a particular area is something you want to do, or if you would rather pass on to another option.

What Type of Apartment Building Are You Buying?

Now that you understand the kind of neighbourhood you’re working with, you can levy that knowledge into purchasing the right type of building. For example, if you purchase property near a college campus (of which there are plenty in Canada) or notice an abundance of bars and restaurants moving in, you might be best served by choosing a building made up mostly of the studio and single-bedroom units.

Meanwhile, multi-unit buildings surrounded by schools and grocery stores will find more success if they include mostly two-bedroom units and larger.

Research on demographic details can go a long way toward helping you decide.

Understanding Local Demographics

Another key factor to consider before making your purchase are the types of people living in the community.

If you are looking to offer luxury single-bedroom apartments, you are probably not going to have much success in a community filled with low-income families.

Likewise, large family-oriented apartments are not going to be the most profitable investments beside a college unless you are looking to enter the student rental market.

Upcoming Neighbourhood Developments

Another critical reason to investigate the neighbourhood is to search for signs of new construction or renovation. These are signs that your community is on an upward economic trend, which could mean you’re getting in on the ground floor of a neighbourhood revival. In which case, you could be sitting on a gold mine of potential equity within the next few years.

On top of that, keep an eye for new businesses or revitalized businesses in the area. These are often a sign of new jobs and employment opportunities coming into the area which means the that housing demand is likely to rise.

Keep an Eye on Unemployment Rates

When you are looking at a property, it can be incredibly valuable to look at the unemployment rates in the area before you commit to a purchase.

If unemployment is high or trending upwards, the property may find itself facing an increase in tenant turnover rates. If your rental units are relatively affordable, this may be less of a concern for you.

Likewise, if unemployment numbers are dropping, it does not take long for the average household income to rise. This means that your tenants are much more likely to be able to afford the rent and will not need to move in favour of cheaper housing.

Look at the Numbers

When you’ve finally pinpointed a potential building to purchase, the next thing to look for is the triad of important numbers:

- Occupancy Rate refers to the number of tenants currently living in the building.

- Cost Per Unit indicates the individual cost per unit in the building based on your buying price.

- Rent Per Tenant, as you might expect, is the average monthly rent you can expect to collect.

These three figures combined will give you some basic idea of the health of your purchase. They will also factor into the interest rates you can secure for a commercial mortgage. So when you are looking at buying an apartment building with a high consistent occupancy rate, rental fees that are adequate to their neighbourhood and an average-to-low cost per unit, banks are going to view that property as a safer investment, and that’s nothing but good news for you.

Ask The Seller About Cash Flow

On top of all of the financial details above, it can also be worth your time to ask the previous owner about how much the property cash flowed for them.

While the exact cash flow potential of a property is going to change once you make the purchase, you can usually get a pretty clear picture of how profitable a property might be by asking.

However, you need to be wary of dishonest sellers who might decide to overstate their profits in order to sell the property faster.

Lenders Want to See Leases

Whenever you decide to buy an occupied apartment building, your lender is going to want to see the number of leases and how much the units are bringing in each month in rental income.

This is because they want to ensure that the leases can fully cover the property expenses.

They do this by calculating the debt-coverage-ratio or DTR on the property. This is the ratio between estimated income the property generates and the total expenses on the property.

On average, the five top banks want to see properties with a DCR of approximately 1:1.35, meaning that for every dollar the property costs in expenses, it generates $1.35 in rental income. However, some lenders do have looser or stricter guidelines regarding what they consider a sustainable DCR.

Get an Appraisal

Another important things to remember whenever you are looking to buy an apartment building is to get an appraisal.

Typically, this step should come after your commercial mortgage agent has already determined which lender you will be working with. This is because many commercial lenders have a strict list of approved appraisers and will not accept an appraisal from anyone else.

Typically, due to the short supply of appraisers that each lender works with, it can take longer to get an appraisal on an apartment building than you would get from a smaller residential property. This process usually takes about a month depending on the size of the lender's list of appraisers and how many deals they have on the go at the time.

There are two main approaches to property appraisals:

Income Approach

This approach to appraising a property is why lenders want to see leases. This 'income approach' uses a properties DCR to determine the value of the property in a business sense.

The higher the DCR, the more valuable the property is as a rental investment in the eyes of the lender.

Comparable Approach

Alternatively, an appraisal can be approached by looking at the property and finding another property to compare it to.

In this case the appraiser would use a second apartment building in a similar area with similar square-footage, number of units, condition, and occupancy rates.

Then the value of the property being appraised is set by its condition and value relative to the comparable property.

Buying Apartment Buildings Takes Strong Financing

Buying an apartment building can be a massive undertaking for an investor due to the high startup costs that go into these properties. So, you should take the time to line up the best available financing in order to simplify the process and relieve some of your stress early-on.

I have experienced the relief that comes with locking in a strong, strategic mortgage for an apartment building, and I want to share that feeling with you. So, do yourself a favour and book a call with me and my commercial financing team and let us get you started.