Cheap vs Affordable Real Estate - Saving Money While Making Smart Investments in 2023

Real estate can be an expensive investment, so it is understandable that the majority of investors are always keeping their eye out for a good deal. However, finding a good deal is not as simple as looking at the asking prices on various properties and buying the one with the lowest price. Instead, it is about learning to identify the difference between cheap and affordable real estate and which type of real estate is best suited to your goals.

At first glance, cheap and affordable real estate sound like they would be the same thing – low priced properties. However, there are a few key distinctions that separate them in the eyes of a savvy investor.

Before we dive in, you need to know that at the end of the day, the key to affordable real estate investing is affordable financing. So, in order to get you started on the right track today, click the link below to book a free strategy call with our team at LendCity today.

What is ‘Cheap’ Real Estate?

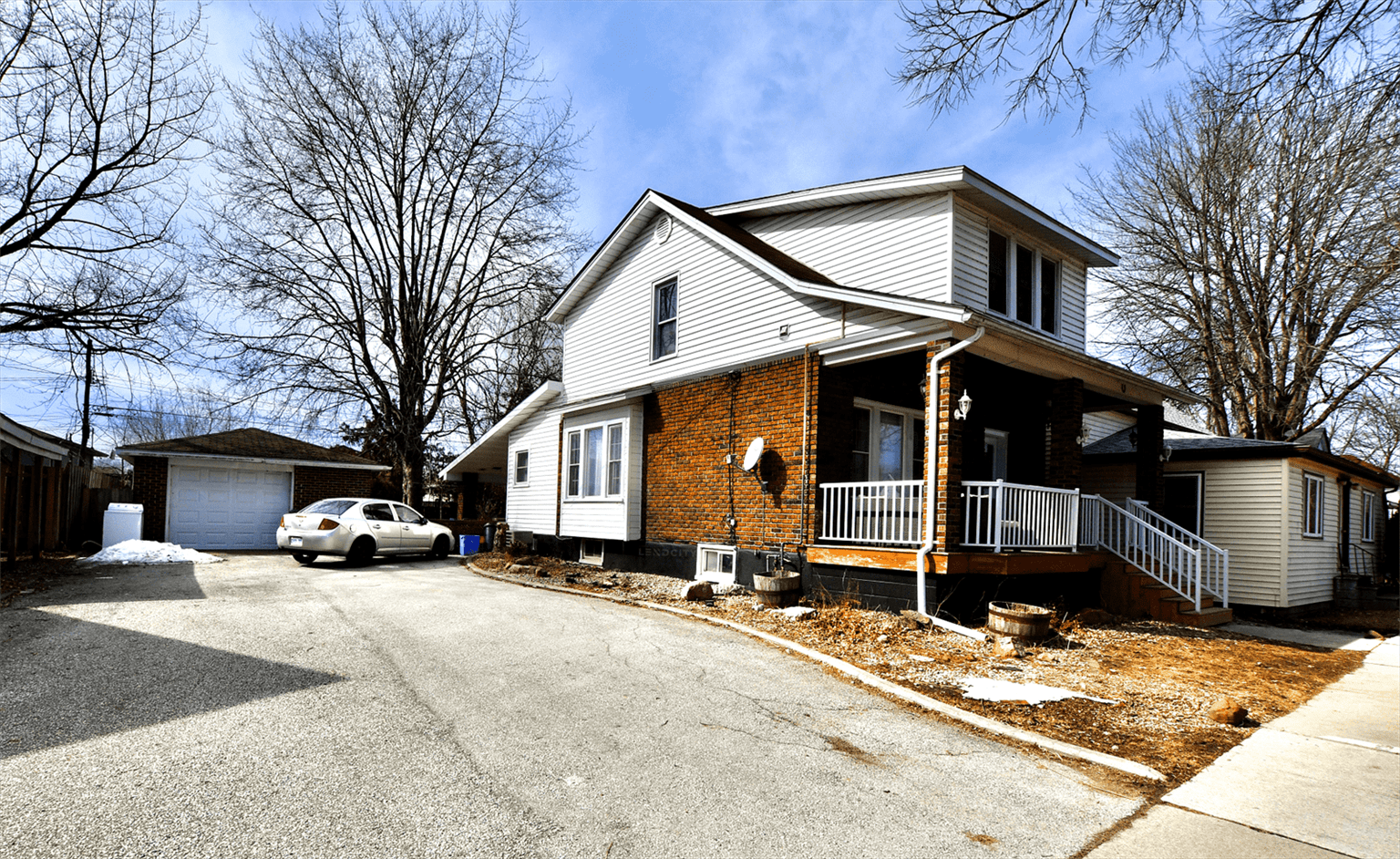

Cheap real estate is typically classified as a property that has a lower price because there is something wrong with it actively lowering its value. These are often distressed houses with clear room for renovation and improvements to be made whether due to damage or poor construction.

While these properties may not be move in ready and come with additional costs that need to be covered in order to start making money, they are still appealing to a variety of investors with suitable strategies and goals. Notably, these properties are popular amongst flippers who are aiming to buy fixer uppers to work on.

Pros and Cons of ‘Cheap’ Properties

Here are some of the key advantages and disadvantages of investing in ‘cheap’ properties.

Pro: Plenty of Room For Improvement

Since these properties have a noticeable need for improvements, it means there is plenty of room for you to do things in order to increase the value and quality of the property. This provides you with the option to be as creative and innovative with the property as possible in order to make it more appealing.

Con: May Be More Work Than Expected

Cheap properties that are in need of work are not always what meets the eye. While you may only be capable of seeing minor warping on the countertops in the kitchen, once you remove them you may wind up finding water damage inside the walls or mold beginning to grow. These will increase your costs when it comes to preparing the property and may extend your renovation timelines.

Pro: Less Competition

While these cheaper properties are also less expensive, the noticeable flaws and defects you are bound to find on the property are often enough to deter most buyers. This means that you have a lower risk of facing a bidding war on these cheap properties.

Con: It Takes Longer to Start Profiting

Since these cheap properties require additional time and money in order to complete, which will usually delay the amount of time before you can begin renting the property in order to profit. In the case of flippers, your timelines may remain unaffected unless additional repairs are found out to be needed.

Discover How To Buy Unlimited Rental Properties With This Step By Step Guide

What is Affordable Real Estate?

Unlike ‘cheap’ real estate which typically has an on-site reason to be valued lower, affordable real estate is a true bargain. These are properties that are discounted due to outside factors such as pre-foreclosure properties, undervalued properties, and properties located in upcoming neighbourhoods that are not valued too highly at the moment.

These properties are popular among buy-and-hold investors due to the reduced barriers to entry and more marketable condition.

Pros and Cons of Affordable Real Estate

Here are some of the key advantages of investing in affordable real estate.

Con: More Competition

Since these properties are already market ready or require very little work in order to become market ready, the number of potential buyers competing for these properties is usually higher. This means that during active periods in the market you are more likely to wind up with competing offers and bidding wars to worry about.

Pro: Less Work To Get Started

Unlike the ‘cheap’ real estate described earlier, affordable real estate requires less work on average in order to get started with. This means fewer renovations and the ability to put the property on the market faster.

Con: Not As Much Room For Rapid Appreciation

Unlike properties that need renovations, affordable real estate typically are not sitting far below the average market value of comparable properties in the area. This means that in the short-term there is usually less room for rapid appreciation when compared to fixer-uppers.

Which Property is Right For Your Investments

As mentioned previously, cheap, and affordable real estate are good for different types of investments. If you are a buy and hold investor, the affordable properties are a popular choice due to their reliability and reduced up-front costs due to the lack of renovations immediately needed. Meanwhile, ‘cheap’ properties are frequently better for flippers and investors who are looking to capitalize on the equity of a property due to the increased ability to force rapid appreciation through property improvements. So, whenever you are looking to buy a property, take the time to consider your goals and investment strategy first so that you are well-equipped for the road ahead.

How The Quality of a Property Can Impact Your Mortgage

Your choice between ‘cheap’ and affordable real estate may greatly impact the types of mortgage products and lenders you will qualify for during the buying process.

This is because cheap properties in need of repairs and renovations typically have a higher associated level of risk to them in the eyes of mortgage lenders. As a result, certain lenders may shy away from these properties, require higher down payments, or lend at higher interest rates than they would with a property that is discounted for external reasons.

However, this should not discourage you from pursuing these properties. Instead, take the steps to maximize your likelihood of getting approved by calling us at LendCity. Our agents work with a wide network of lenders in order to find the best lender with the best mortgage products for your specific investment goals.

You can reach our office at 519-960-0370 or you can visit us online at LendCity.ca to apply. Alternatively, click the link below to book a free strategy call with our team at LendCity today.