How Different Types of Real Estate Investments Can Help You Save 1000s of Dollars Each Year

One of the most important things you can do in order to protect yourself financially is to build a strong savings fund in case of an emergency. However, with the cost of living currently sitting at historically high rates, it can be difficult to build meaningful savings in today’s economy. However, through real estate investments, many savvy investors are finding the key to building long-lasting savings that bolster their financial security.

While it may sound like a contradiction to build your savings by spending mass amounts of money on real estate investments, in practice it can be one of the most reliable ways to build savings. After all, the primary struggle that people face when it comes to saving money is having enough income to set aside in order to build savings – a problem real estate investments can help solve.

However, before we get stated, did you know the best real estate investments are built on the back of strong mortgage financing?

If you are looking to build good real estate investment habits in order to build your savings, we want to help you. With a simple strategy call with us we can start helping you locate and lock-in the best financing for all types of real estate investments today. Don't wait, just click the link below to get book your free call today.

The Importance of Saving Money

Life moves quickly and that means that sometimes people can find themselves hit with unexpected expenses, sudden job loss, or other financial hardships they could not have predicted. So, in order to get out of these times without taking on a large amount of additional, unnecessary debt, you need to make sure that you have enough money saved up to cover these circumstances.

Often, people are told that they should aim to keep approximately three to six months worth of expenses in their savings so that they can be prepared for sudden expenses or job loss without experiencing financial hardship.

Calculating Recommended Savings

Currently the average estimated monthly cost of living in Ontario is $4589 for a family of three. That means that in order to build the recommended amount of savings, that family would need to set aside between $13,767 and $27,534 – an amount which could easily be turned into the down payment on a single-family rental property.

Discover How To Buy Unlimited Rental Properties With This Step By Step Guide

Locking in the Best Investment Financing

If your goal is to use good real estate investments in order to build your savings, you are going to want to make sure that your mortgage is structured in order to help you achieve that goal. This means working with a mortgage broker that understands your needs and is willing to take the time to hunt for the best lender for both your investment property and your personal goals.

If you want to assess your real estate investing strategy today, all you need to do is click the link below to book your free strategy call with us at LendCity.

Why Real Estate Investments are Some of the Best Ways To Build Your Savings

While saving enough money for the down payment on an investment property requires is nearly equivalent to the recommended amount of savings you should have stored away, simply storing the money risks that you lose the value of those funds to inflation over time. As well, money that you have placed in savings is not going to replenish itself over time. However, money that is tied up in different types of real estate investments has the potential to restore your savings after an unexpected event forces you to spend them.

The reliable nature of real estate investing has led to the creation of countless real estate investment groups full of like-minded investors looking to build their personal wealth.

Turning Passive Income to Create Savings

One of the first ways that real estate investments can help you build you savings is through passive income in the form of cash flow. For those of you who are unaware cash flow is the difference between a property’s rental income and the full cost of expenses associated with the property including insurance, taxes, mortgage payments, maintenance costs and property management. That means a property that earns $2500 in rent each month with approximately $2250 in expenses will cash flow an average $250 in cash flow provided their expenses and income do not change.

As a new investor with a full-time job that covers your expenses on top of your investments, cash flow can be one of the best methods of building your savings quickly and effectively. With your job covering your expenses, the cash flow that your property produces each month can become a dedicated source of savings on top of your previous savings strategy. This means that on average, you should be able to increase your monthly savings by $200-$300 per property if you have bought a healthy cash-flowing investment.

Converting Equity into Savings

On top of the slow, passive savings you can build through cash flow, you are also building wealth in the background which you can use to replenish your savings all at once through the equity you have stored in your investments.

Equity is the value of the stake you have in your property. It is how to obtain the financial ownership you gain through the down payment you put on a property as well as the value and stake you gain over time through appreciation and paying down your mortgage. This value is part of the reason why long-term investors turn to real estate investments in order to beat the eroding effects of inflation on their funds.

Through refinancing, HELOCs (Home Equity Line of Credit) and reverse mortgages, this equity can be tapped into and withdrawn in order to do anything you want, such as bolster your available savings after they have been depleted.

Consolidate Debts to Increase Savings

Debt is the natural enemy of savings, after all it is incredibly difficult to save money while making car payments, paying student loans, and trying to wipe down credit card debt. However, real estate investments can offer a solution to consolidate your debts into a single recurring payment at a lower rate than many hard money loans and debt consolidation options.

Instead of using the equity you have in a property to directly fund your savings account, you may also use it to pay off multiple high-interest debts. This converts them into a single debt that typically comes with lower monthly payments and lower average interest rates. With these debts under control and your monthly expenses lowered, your capacity for saving money will naturally increase.

Debt Consolidation Tools in Real Estate

One of the most popular debt-consolidation tools for real estate investors is the Home Equity Line of Credit (HELOC). This is a tool that allows you to freely draw on a portion of your home's equity in order to do whatever you want. This includes investing in real estate, paying down debts, or financing major life moments.

Traditional Savings Accounts Can Lose Money to Inflation

While it may sound ideal to park your money at the bank and take advantage of a high-interest savings account, the truth is that in today's economy the interest you were set to earn through that account is not likely to outpace inflation.

However, historically real estate appreciates at a rate much higher than the national inflation rate, thus allowing you to build wealth much faster than you would have otherwise.

In fact, many banks invest their own funds into the real estate market and real-estate investment trusts in order to maximize their own profits. So, why shouldn't you cut out the middle-man and make those profits on your own?

Start Saving Through Your Real Estate Investments Today

So, if you are ready to start saving money and building meaningful wealth at the same time, let us give you a hand by getting you started.

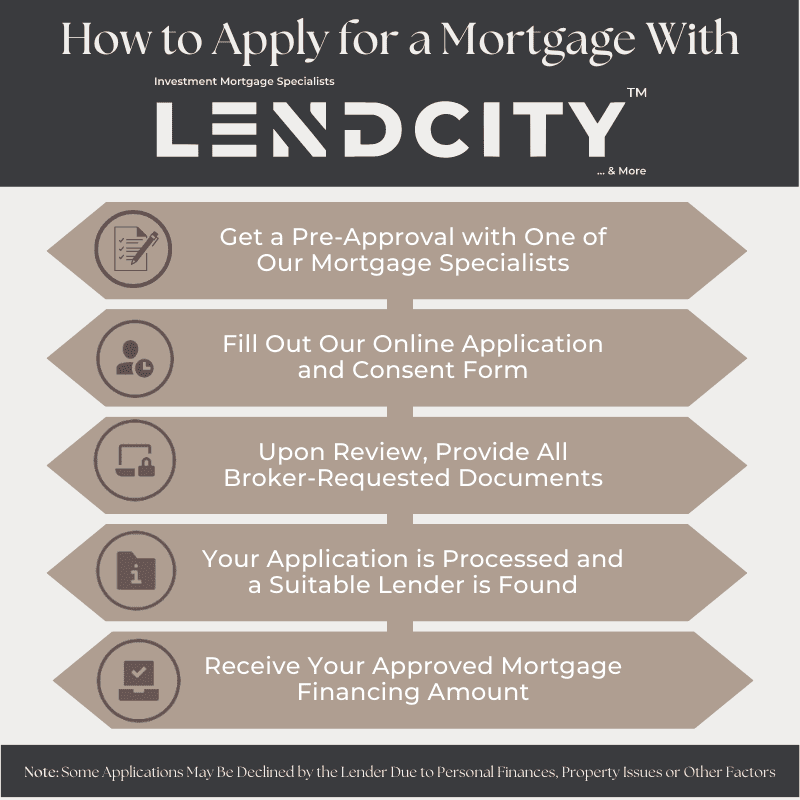

Start preparing for your next real estate deal today by getting a pre-approval with the help of our team at LendCity. Let us help you lock down the lowest available interest rates and obtain the best available financing for your next investment property.

To get started today, give us a call at 519-960-0370 or visit us online at LendCity.ca to book an appointment or apply online. Alternatively, you can click the link below to book your free strategy call with us right now.