How Many Mortgages Can You Have? 3 Important Steps You Need to Achieve Multiple Mortgages

Conventional wisdom says that you should wait at least six months before applying for another mortgage. This gives you enough time to let the most recent credit inquiry fall off of your credit report. It also helps conventional lenders be more likely to offer you new and better lending terms.

At that rate, you’re only securing two mortgages per year. That’s hardly enough to create the kind of wealth that will help you retire early or achieve your other financial goals.

If your real estate investment business is growing quickly, you’ll need to have multiple mortgages open at any given time. While this is necessary for building your wealth, it also smacks against financial wisdom about borrowing too much at one time. Your fear of looking like an irresponsible borrower or having too many mortgages at once may prevent you from seizing an excellent opportunity.

When it comes to financing multiple properties, there are a few steps that you can take to present yourself as an ideal borrower, but the question remains how many mortgages can you have? (And is there a way to increase that number?)

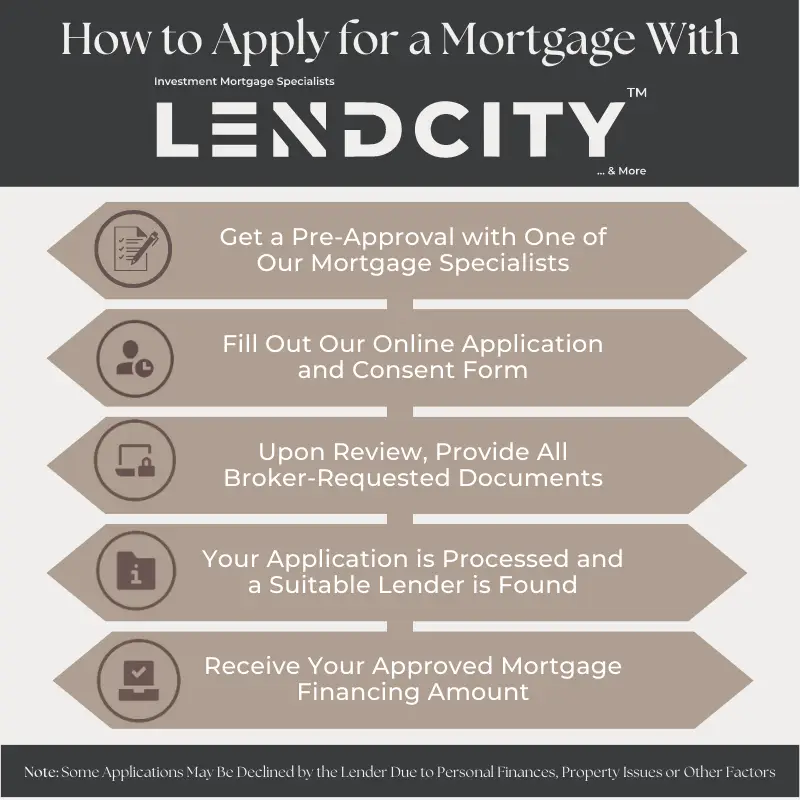

Well before we tell you the answer to how many mortgages can you have, let us provide you with an essential first step to achieve as many mortgages as you need - working with a mortgage broker.

That is why we want to offer you a free strategy call with our team to go over your options moving forward. That way instead of asking us 'how many mortgages can you have?' we can ask you 'how many mortgages do you need?'

To book your call today, all you need to do is click the link below and get started now.

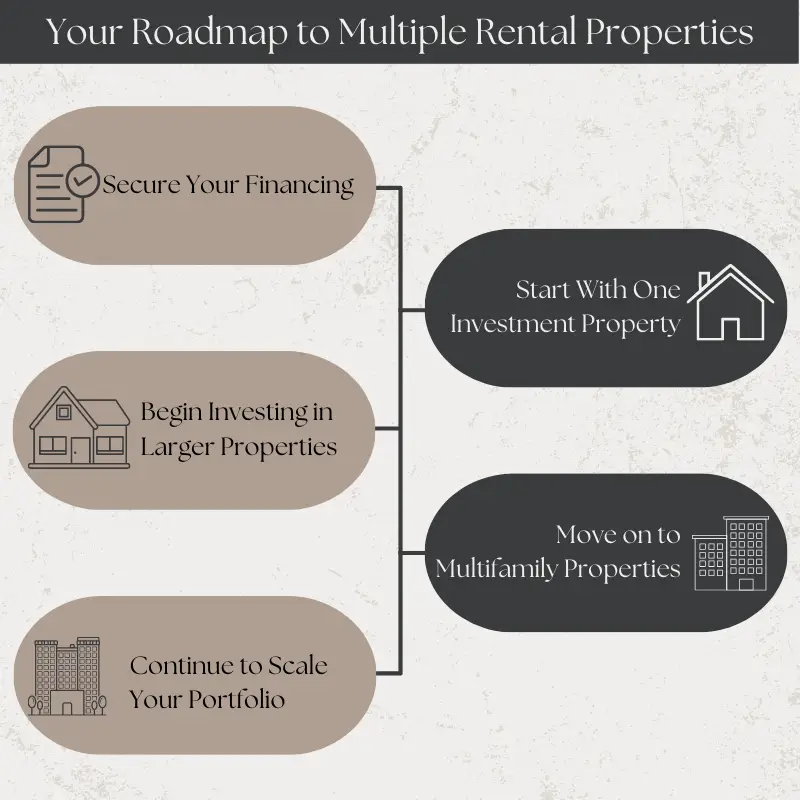

1 - Prepare Yourself Financially For Your Investment Type

You may not have enough money in the bank to buy your next property with cash, but you still need to demonstrate that you are financially fit enough that a lender isn’t risking their investment with you. Just how fit you need to be depends on how many mortgages you currently have and how many properties you’re planning to buy. This will also change the answer to how many mortgages can you have on one property as well.

The easiest way to secure a mortgage while purchasing multiple income-generating units is to buy a multi-unit property. This way you can apply for a regular mortgage while still having multiple opportunities for rental income. You only need to meet the minimum mortgage requirements for buying an investment property, i.e. a 20 percent down payment.

If you’re looking to finance two to four rental properties, you will need to prove greater financial fitness. A mortgage broker can help you find a lender who is less restrictive than a major bank, but you still need to be prepared. Make sure your credit score is at least 630 and that you have at least three months of cash reserves for your monthly mortgage payment, in addition to the down payment.

If you want to finance five or more investment properties, you’ll need to have even stronger finances, including:

- A credit score of 720

- At least six months of cash reserves in case of a vacancy

- A down payment of 25 percent for a single-family home and 30 percent for multi-family properties

- A record of timely mortgage payments from the last year

- No history of foreclosures

If you’re looking to finance more than 10 properties, you’ll want to work with a major lender who better understands commercial investments.

Discover How To Apply For An Investment Property Mortgages With This Step By Step Guide

2 - Convincing a Lender to Finance Multiple Properties

If you decide to go with a conventional lender or are working with a new lender for the first time, you’ll need to establish who you are, what your intentions are and why you’re trustworthy.

It’s critical to have all of your financial information handy to present to the lender. Your lender will first want to know your debt-to-income ratio. This will change depending on the number of rental properties you have. The lender will likely add a percentage of your rental income to your overall income to help determine your ratio; however, the percentage varies by lender.

Your lender will also consider the value of the property and the amount of money you have for a down payment. Depending on how many properties you already own, how many mortgages you have and how much cash you have on the hand, the amount they request for a down payment may vary. While you need at least 20 percent for your first rental property, once you have five or more properties the bank may ask for a higher down payment, e.g. 35 percent. Keeping your finances in tip-top shape will strengthen your argument.

Unlike a mortgage on a primary residence, you should treat the mortgage process for your investment property as a business – because it is. Develop a business plan that you can present to the lender that details your current financial picture and your projections. The goal is to better help them understand the return on investment for this property. You’ll want to include information such as:

Putting this information together in an easy-to-read business plan will help your case with lenders.

How Many Mortgages Can You Have at One Time?

Answering the question how many mortgages can you have is more realistically a question of how many mortgages can you have at once. Realistically, over a lifetime of investing, you could have dozens of mortgages without ever dealing with bank-imposed limits on the number of mortgages available to you.

Realistically, in order to answer the question, 'how many mortgages can you have at a single time?' you would need to dive into your finances and fully break down all of your credit, debts and income while also weighing it against the profitability of upcoming investments.

After all, many commercial lenders will finances multiple investments as long as they make sense by the books. How many mortgages can you have from a commercial lender?

3 - Find a Lender Who Understands Investments

Most homebuyers turn to conventional lenders to secure financing for their primary residence. If you’re just getting started in real estate investing, this is likely what you’ll do too. Typical lenders will help you with the first couple of investment properties you buy, but they aren’t ideal resources for your business. Known for their conservative ways, big banks and conventional lenders aren’t eager to help investors secure more properties.

Instead, you’ll need to find a lender with experience lending to investors. These lenders understand your financial goals and how this asset class works. They understand that you are using leverage to grow your wealth. They are less likely to be afraid of the risk and are eager to join in making money from your income-generating venture.

More than being a source of financing, the right lender can be a valuable member of your team. You should find a lender with whom you can talk about your plans for the future and your ultimate goals. This person is a sounding board for any issues with your financing or ideas for securing the next property. They will help you create a timeline for paying off existing mortgages and finding new ones. A great lender can function as an advisor in growing your business.

Growing your wealth quickly with real estate investing requires financing multiple properties at once. While the traditional lending system doesn’t seem conducive to this method, the option is available to investors like you. All you need is a bit of preparation and research.

How Many Mortgages Can You Have With One Lender?

Part of finding the right lender includes asking them how many mortgages can you have with them.

Some lenders are restrictive and will limit you to a single mortgage though them while others may allow you to have up to five. There are also lenders who do not have a limit on the number of mortgages they will give you as long as it makes sense to them from a business standpoint.

How Many Mortgages Can You Have? Let Us Show You

So, how many mortgages can you have? The truth is the there are plenty of factors that can influence that answer, but if you want to qualify for multiple mortgages to grow your portfolio, we are here to help you.

All you need to do is book a free strategy call at the link below and we will get started helping you to qualify for as many mortgages as you can.