Increase Your Profit Margin by Controlling Your House Flipping Costs - 6 Key Tips

House flipping is a popular (and exciting) form of real estate investing. House flippers buy houses for below market value, give them a little love and quickly resell them at a decent profit margin. Done correctly, house flipping is an excellent investment. But, you should know it's nothing like on TV, in reality the profit margins are going to be thinner.

Before we dive in, if you would like to learn more about how to expand your profit margins by managing your mortgage costs, click the link below for a free strategy call with our team at LendCity.

Look for hidden value when flipping a home

Finding hidden value simply means getting a house for less than it’s worth. Making money flipping houses is all about upfront cost and nothing affects your bottom line more than this initial cost.

You should be looking for houses that are selling for at least 20% less than they would appraise for. It’s critical to note that this doesn’t mean 20% less than they'd be worth with a new kitchen or a new roof. This means 20% less than what you think you could sell it for in the next few months.

It might take some looking, but these houses are out there—especially at auction. They don’t call it “hidden” value for nothing!

Don't try to add value through rehabilitation

On television, house flippers take run-down houses and perform dramatic renovations. This is almost always for the sake of pure entertainment. In reality, house flippers prioritize reselling the house quickly, above all other considerations.

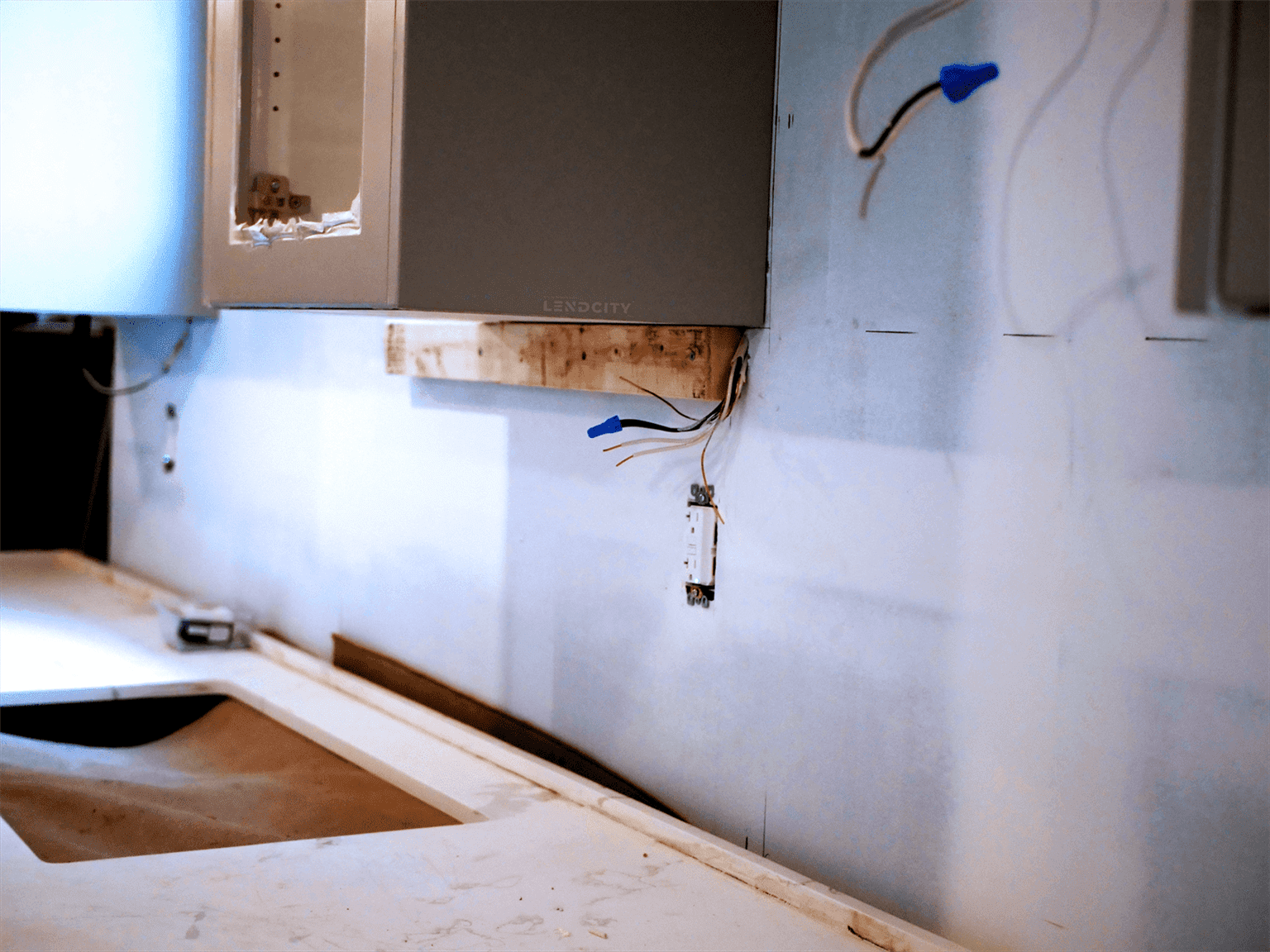

Rehab kills profit margins, as paying a contractor does not usually add value. A $30,000-kitchen job is not worth $30,000 in sale price. The same goes for almost any complex fix. If you buy a property to rehab, make sure you can do most of the work yourself. Keep it simple.

The ideal rehab is to slap a coat of paint on. Presto! The place looks like a million bucks!

You need to flip as quickly as possible To maximize Your profit Margins

People who flip houses often use interest-only mortgages. This means every mortgage payment is sunk cost. Completely gone. Not a great way to make a profit! Unless, of course, you sell the home.

The ideal house can be flipped quickly. The whole process, from purchase to resale, should take no more than three months. This makes house flipping more speculative than other forms of real estate. You need many factors to work together to guarantee your success. You need a house:

- With latent value

- In a good and desirable neighbourhood

- That doesn't require much work

Unfortunately, houses meeting these criteria tend to sell quickly on their own. This is why many people disregard their common sense and take bigger risks. They buy a total junk home in a ritzy neighbourhood, without a plan. They overpay for the house upfront and all their profits are eaten up in fees.

House flipping is a good investment when done right

The secret to flipping houses is patience. If you're patient and willing to do the detective work, there's plenty of value to be had. In any super-competitive market, there are just a few ways to get an edge. One is to out-work and out-research everyone else. Another is natural talent and insider knowledge. The third is plain old luck. If you've got the first two working for you, luck will follow.

Expert house flippers can turn a gross profit of $60,000 to $80,000 per property. But margins of 15% are still considered very good. With potential profit margins like that, you can see why it's worth doing the research!

A super low-maintenance option

The simplest way into the flipping game is to buy bank-foreclosed properties. If you shop around, you can purchase homes at steep discounts. Buy the home for 30% off its real value, then resell it at a 10% to 20% discount. Your buyer's still getting a great deal and you can turn the property around in a jiffy. It's a win-win.

Plus, winning at the foreclosure market is a skill in itself. Any market that requires someone to have a requisite skill is a great place to prove yourself. Your skills will make a real difference on your bottom line. And, you'll get better and better at it over time.

Flipping with a partner

Often when you're flipping a home by yourself, you can become overwhelmed. Instead of taking the project on yourself, you could partner with a fellow investor. Not only can partnering help ease the frustrations you may face, but it can also help lower your costs.

If your flipping partner is in the HVAC trade, you may be able to get a new furnace at a reduced cost.

If you have a partner that is a window installer, you may be able to get cheaper windows through one of their connections.

Always consider if a partner will help you. From our experience, we do find partners can help increase your gross profit margin.

Discover How To Set Up A Joint Venture With This Step By Step Guide

Some parting advice

House flipping requires a steep initial investment and it's riskier if you're relying on loans. It's not uncommon for even simple rehab jobs to go over budget, or for properties to take longer than expected to sell. But, if you can find hidden value right from the get-go, you’ll be in a good position even if things start to go off the rails.

Begin with bank auctions. Often, auctions of smaller homes in less-desirable parts of town are a good value. They're sold at a deep discount and can be resold at a discount (as long as it does not eat away at your profit margins too much)—especially in areas that are up-and-coming or gentrifying. Once you've figured out the process and have some real money to work with, you can jump in with both feet.

Once again, if you would like to learn more about how to expand your profit margins by managing your mortgage costs, click the link below for a free strategy call with our team at LendCity.