Real Estate Investing In Ontario

Investing in Canada is an interesting proposition due to the diversity and number of provinces and territories that spread across our country. These provinces create several compelling opportunities since what works in one province might not necessarily work (or be permitted) in another.

Familiarizing yourself with these province standards, and how they could differ from those of other provinces or the nation as a whole, should be the first job of any investor. In this post, we’re going to explore our largest province—Ontario—and take you through some of the opportunities and challenges that exist for the Canadian real estate investor. Investing in Ontario real estate can be beneficial for several reasons, and we’re going to take you on a tour to prove why that’s the case.

But first, before we dive into the specifics of investing in Ontario real estate, if you would like to connect with financing options from the best Ontario real estate lenders, click the link below for a free strategy call with our team at LendCity today.

Demographics of Ontario

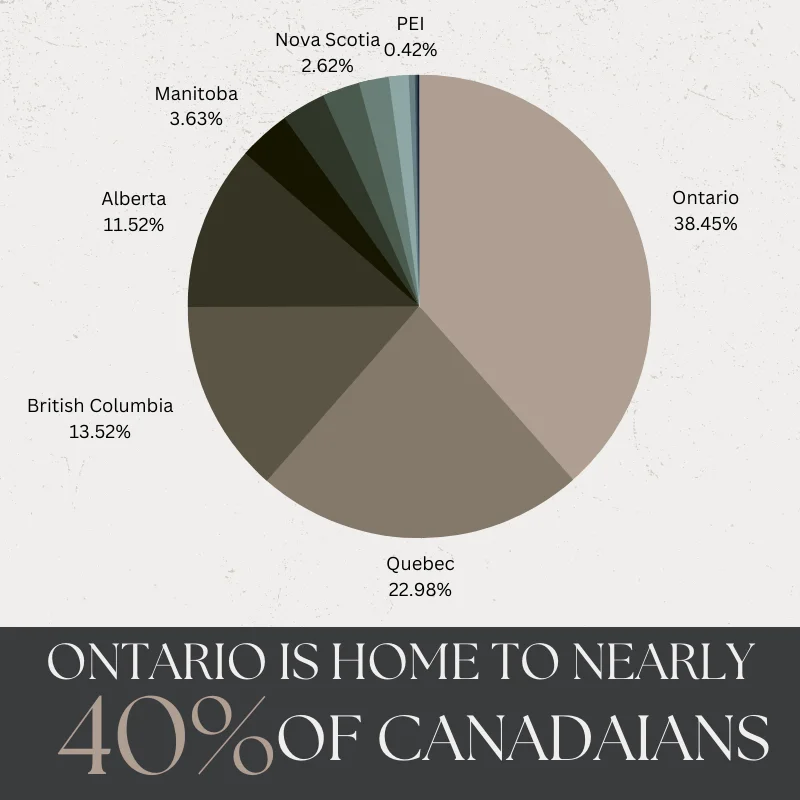

Before diving into more detail, it’s important to gain an understanding of the bigger picture of Ontario, starting with its population and people. As was previously mentioned, Ontario is far and away Canada’s largest province by population, containing almost 40 percent of the population of the entire country. Additionally, since it’s not the largest province by land area, that means that it’s one of the country’s densest areas as well. This means that some urban areas exist in Ontario with opportunities that might not necessarily be there in every part of the country.

Ontario is also a place that sees many people come and go—while the province enjoys one of the highest population growth rates in all of Canada, it has also historically seen one of the largest interprovincial emigration rates in the entire country. Much of its growth is due to immigration from outside the country—more than half of Toronto’s population was born outside of Canada, for example, but 97 percent of Ontario’s residents still speak English, indicating a strong willingness by newcomers to settle into their new home.

The demographics of Ontario suggest a province that is full of newcomers and long-time residents alike, creating a dynamic area that could be ripe for the right Ontario real estate opportunities. The city of Toronto is the linchpin of the Golden Horseshoe, the biggest stretch of populated areas in the entire country: a bustling urban metropolis with a lot of potential thanks to its high population that’s always evolving. With all that said, if you’re an investor looking for a dynamic marketplace, then investing in Ontario might just be the ticket for you.

Discover How To Buy Unlimited Rental Properties With This Step By Step Guide

Income statistics of Ontario

When evaluating the potential of Ontario real estate markets, it’s important to take a look at the income statistics there. This can help you figure out which level of property you could be looking into. For example, you don’t want to be stuck with a lot of affordable units in an area where people might make more money and be looking for something a bit more upscale. In the case of Ontario, income statistics can be fairly revealing. The entire province’s economic output is roughly equivalent to that of the entirety of Vietnam, so there is some power packed into this area of Canada.

Residents of Ontario are also slightly better off than your average Canadian—the median after-tax income here for families of two persons or more is about $76,700 at the time of writing this article—just over the median income of $75,400 for all of Canada. This might be a good place to look into if you’re interested in economical investments that can also accommodate people who make a bit more than average. Investing in Ontario can mean that you’re acquiring several properties that can appeal to people across the income spectrum and feel reasonably confident that you can appeal to most or all of them.

Taxes in Ontario

Another factor that you should consider before investing in Ontario (or any province) is the tax rates there. Ontario is one of the lowest-taxed provinces in the entire country, surpassed only by Nunavut and British Columbia, which could help inform your investing decisions. Rates are lower than Canada’s average in every income bracket, so it’s important to factor this into your decisions. Additionally, sales tax rates here are right in the middle of the pack, if not towards the lower end, so you can feel reasonably confident that your pool of potential of buyers and tenants is not being excessively taxed—which could, of course, influence their real estate decisions (and yours).

Average home costs

When looking into investing in Ontario, it helps to have a good understanding of what prices are like across the country. Home prices in Canada fluctuate over time, meaning the different provinces ebb and flow in popularity and price when compared with each other. Since Ontario has so many different areas, including some of the most compact urban areas in the country, prices can fluctuate widely. You can be sure that prices for homes and condos will be quite a bit higher in Toronto than in more rural areas of Ontario, for starters.

As a result, looking at an average price for the province is not a reliable way to plan investments. Instead, you should just Ontario real estate sub-markets based on their own merits.

Even as Canada has seen significant increases in price across the entire country, Ontario has outpaced even that brisk rate of growth. Additionally, Ontario’s rents are some of the highest in the entire country. Out of the top 33 most expensive rental markets across the country, 16 of them are located in the Ontario real estate market. This can make investing in Ontario rental properties an enticing proposition, especially in urban areas, as many investors can rest assured feeling that their investments will be reasonably expected to perform for them.

Ontario Real Estate market snapshot

Several factors contribute to the Ontario real estate outlook, and Ontario real estate is in good shape on many of these metrics. The Bank of Canada’s reduction of interest rates by a full point was done with the intent of creating much more demand in the market.

When this happens, homeowners can, of course, borrow more money at a lower rate, which can drive up prices, which is, of course, good news for sellers, but also buyers. Buyers can achieve lower rates that can give them real savings over the long term of their borrowing period. However, this should be coupled with the understanding that Ontario’s workers are currently experiencing wage growth that is lower than in any other province.

Inventory is typically one of the biggest challenges facing Ontario homebuyers, especially in areas like Toronto. The meteoric population growth that can occur here due to immigration has led to a reduced inventory in homes for sale, which of course will drive prices up.

This can be good or bad news for the Canadian real estate inventory, depending on how you look at it. Ontario’s population growth isn’t going anywhere anytime soon—the Ontario Ministry of Finance predicts it will increase by 38 percent by 2046—which could bode well for the long-term Ontario real estate market. Sellers can likely expect prices to only climb over the coming years and decades.

To be clear, COVID-19 has had an impact on the market, at least in the short-term. Buyers and sellers alike were notably hesitant to dive back into the market and treat it as business as usual—because it wasn’t. However, at the same time you have to look at how things have rebounded historically after financial hardships and the consistent recoveries that Ontario real estate has made and the trend we entered after the pandemic slowed down.

Even during the current financial hardships facing Canadians today, the coolest point of the market in 2022 was still considerably better than the market during the pandemic.

The Toronto market

Toronto, the province and the nation’s biggest city by population, is one of the meccas of Canadian culture and life. It is always a popular destination for immigrants to the country, so you know that there will always be a lot of dynamism and activity here.

The city boasts some of the most popular sports teams in Canada, including the Maple Leafs and the Blue Jays, as well as the Hockey Hall of Fame. It also boasts some of the country’s premier performing arts venues and a host of restaurants and shopping options that reflect its status as a booming city populated by a diverse and exciting population. Toronto has historically been a popular destination for renters and buyers alike, so it can be a great destination for those looking at investing in Ontario real estate.

The Toronto market did stall somewhat in the face of COVID-19, but it still holds a significant amount of promise today even after those impacts took hold. After all, not even a pandemic could change the fact that Toronto is one of the hottest and most competitive markets in Canada by a long shot. By many standards a slow period in the Toronto market is a busy season for plenty of other regions.

Currently, Greater Toronto boasts some of the highest home prices in the entire country, with average prices for home purchases being around $865,000. The city’s rental market is no less competitive—the average one-bedroom apartment rents for around $2,300 a month and two-bedrooms costing around $2,900. This can be a double-edged sword—Ontario real estate investors can rest assured that they will likely make money on a purchase in Toronto, but the city is unaffordable for many of the potential buyers and renters who you’d be seeking to appeal to.

The Ottawa market

Canada’s capital city is nestled near the eastern end of the province and boasts such sights as the Rideau Canal, Chateau Laurier, the National Gallery of Canada and the Canadian Children’s Museum. As in most provinces, there are also a host of sports teams to follow, from the NHL’s Senators to the CFL’s Redblacks.

The city also hosts 130 embassies from nations around the world, giving the city a decidedly multi-cultural flair that makes it a very popular destination for younger generations interested in higher education as well—the city has two of the most popular universities in the entire country in Carleton University and the University of Ottawa.

The city is a magnet for those interested in working in the Canadian government and has the 10th most expensive rental market—a one-bedroom apartment can typically go for around $1,600 a month, while a two-bedroom will likely run around $2,100. Home purchases in Ottawa are quite a bit more affordable than they are in Toronto, for example—the average home price in Ottawa as of March 2020 was about $472,000.

However, historically the market in Ottawa has lagged behind Toronto despite being the nation's capital. Yet, since the COVID-19 pandemic, more eyes have turned toward the Ottawa market resulting in an increase in demand that has begun to make Ottawa real estate a genuine competitor for the GTA in some ways. However, at the time being it does not quite hold the same demand - which can be a benefit for many investors who want to get into a rising market.

Ontario Real Estate in Short

Investing in Ontario is an attractive option for many Canadian real estate investors due primarily to the province’s high population, low taxes and potential for growth. Its dynamism makes it a magnet for many key demographics, so investing in Ontario real estate could make a lot of sense here for the right investor.

The province is the gateway to many new Canadians every year, making for a high turnover that could bode well for the discerning Ontario real estate investor, and its status as the cultural and social hotbed of the entire country makes it a market that is almost sure to see steady and sustained growth. To network with other Ontario real estate investors, join the Ontario Real Estate Investors Association.

Now, if you are interested in getting the best financing available to invest in Ontario real estate, click the link below for a free strategy call today.

Ontario Real Estate Professionals

We have searched high and low for real estate investing professionals in Ontario. Below, you can find professionals we have researched and can confirm they specialize in working with Ontario Real Estate Investors.

To ensure the maximum success in Ontario real estate, or any city, you should always use professionals who understand and work with investors, your income depends on it.

This list may not fully list all the professionals in the area, but the ones we have personally investigated and that we would refer our clients to.

If you’re a Ontario real estate professional and would like us to consider adding you to the list, please contact us.

Mortgage Broker

LendCity Mortgages – Website – Click to Email – Click to Call

Alternatively, you can click the link below to learn more about the best Ontario real estate lending options and how you can leverage them today.