Rent to Own Home Success in 2023: Step-by-Step Guide

The world of Canadian real estate is packed full of various investment strategies for you to generate meaningful returns on your investments. However, while rental properties are often a reliable investment, it is important to have an exit strategy in mind.

While most investors will settle for simply selling the property, there is an alternative I would like to share with you that allows you to continue collecting rent while letting go of a property at the same time - rent to own real estate.

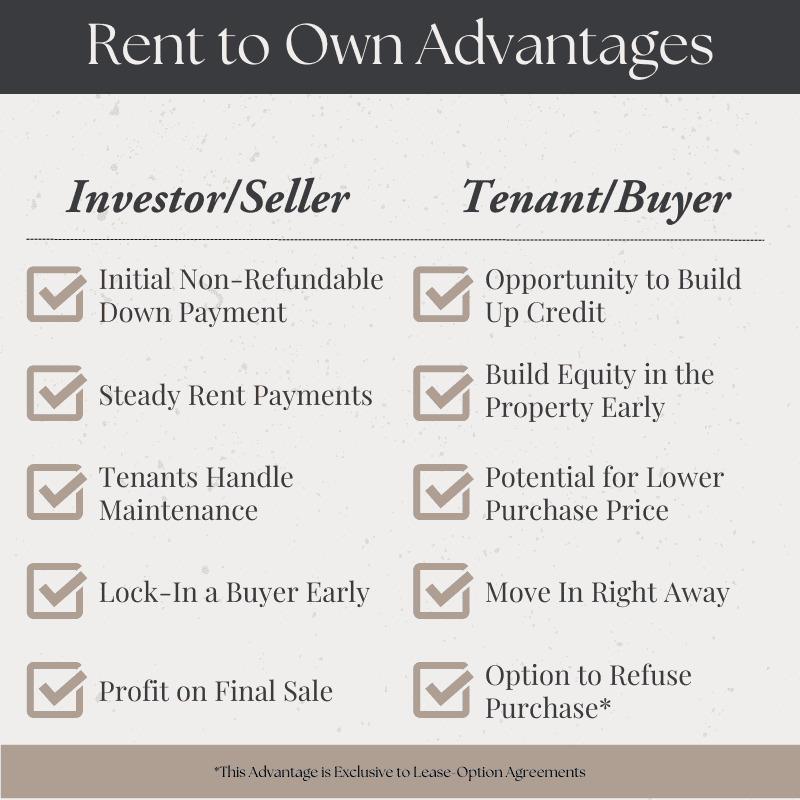

This unique investment strategy offers benefits to both the seller and the tenant who is purchasing the property from them.

Rent to owns are an amazing strategy to learn and utilize in your portfolio. What's important to know is that the mortgage financing can be different for you as an investor, and different for the tenant buyer. It's always best to get your mortgage from an experience lender like us that has supported investors in getting financing for their rent to own homes. (We can even help screen and set up prospective tenant buyers to help them eventually get their mortgage ) So, if you would like to get started on the right foot book a call with my team by clicking the link of the button below.

The Real Estate Market is Growing

Rent to own agreements used to be very rare in Canada. In recent years, however, they have become increasingly frequent. The reason for this issue is because of a prolonged phenomenon in the Canadian real estate market.

To understand, we have to rewind a bit. A little after the year 2000, the average cost of a home in Canada began to shoot upward. When the rest of the world entered an economic recession in 2007, Canada’s real estate market proved mostly bulletproof. Against all expectations, despite the initial hit, the cost for a home continued to grow. That trend hasn’t stopped. The average value of a home increased roughly $320,000 between 2008 and 2022.

While you might assume that these rising prices would make Canadian real estate less popular over time, but this simply is not the case. In fact, real estate investing in Canada is more popular than ever - especially with our constantly growing population. In 2021, nearly one-quarter of Canada's population was reported to have immigrated or obtained permanent residence in Canada. All that increased competition for homes has driven the price of a new home even higher.

Beyond that, strict regulations in several provinces keep new construction very slow, so it’s difficult for new buildings to be constructed at the pace required to meet the demand housing. And so, once more, home prices rise.

The Rise of Rent to Own Homes

As home prices continue to head upward, the Canadian government has been jealously guarding the security of the housing market by being slow to loosen the requirements to attain a mortgage. As late as June of 2020, the Canada Mortgage and Housing Corp announced that it would tighten the rules for getting a mortgage. Previously, people with a 600 credit score or above could qualify for a home loan. Now, that number has risen 680 or above for many lenders. Homebuyers who are unable to provide 20 percent of the home’s value as a down payment may also find it tricky to acquire a loan.

However, it is important to note that it is still possible to qualify for a mortgage with as little as five percent down. In fact, my team and I are constantly working to bring you the best available mortgage products your each of your investments by working with a network of experienced lenders with unique products tailored to your needs. If you would like to learn more, simply book a call with us and we can begin exploring your options today.

In short, the average Canadian is finding it more challenging to acquire the credit score and get the money they need to get a mortgage. Enter the rent to own agreement.

How Do Rent to Own Agreements Work?

The phrasing “rent to own” is suspiciously complex. What may first seem like a straightforward rental arrangement is very much an animal all its own.

When a seller has a property that they would like to sell, but they’re having trouble securing a buyer who can get a mortgage, they can opt for a rent to own agreement.

Once you have found a reliable tenant, you can offer them a chance to buy the property from you through a rent-to-own agreement. As part of this agreement, the tenant agrees to pay a portion of the home's down payment up-front (usually between one and five percent) in order to lock in the purchase contract. Then, at the end of the rental agreement, the buyer will have the right to purchase the property from you at the agreed upon price.

Rental periods in a rent to own agreements are subject to each party’s specific needs, but they usually range from one to three years. The amount of time you determine as your rental period is generally intended to give the buyer time to improve their credit rating so they can secure a mortgage at the end of the rental period. This is why its important to get your tenant buyer to expert mortgage lenders like LendCity Mortgages. We can screen them and let you know how long they need until they qualify to purchase.

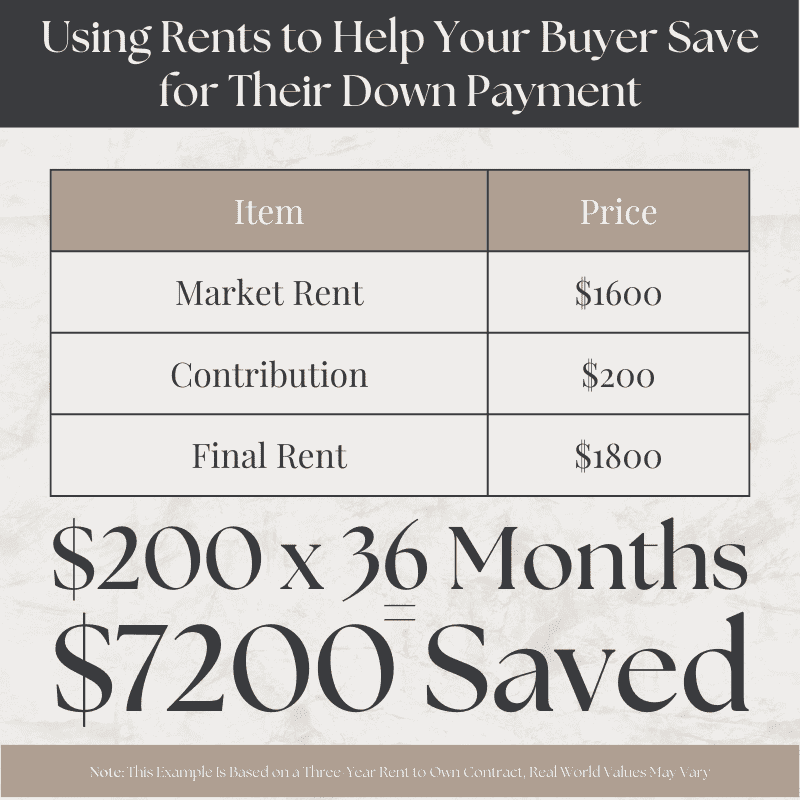

Throughout the rental period, most landlords put a portion of the monthly rent aside as principal on the home purchase. Of course, monthly rent is often noticeably higher than market value to help offset these costs. For example, let’s say the average local rent for my property was $1,600 a month. If I'm operating on a rent to own option, I would charge $1,800 a month and set aside $200 of that monthly fee for the home buyer to use for their down payment when they secure a loan at the end of the rental period.

Once the agreed-upon rental period is up, the renter is faced with two options. They can approach a bank or mortgage broker and tout both their improved credit rating (since they’ve been paying rent steadily for the last year or three), and their increased equity in the home they intend to purchase. At this point, the lender can offer them a mortgage that they can use, in turn, to buy the house. The other option is simple: the potential buyer can refuse to buy the home, and the seller can start the process over again if the agreement allows it.

Lease-Option vs Lease-Purchase Agreements

There are two primary types of rent to own agreements: lease-option and lease-purchase.

A lease-option agreement consists of two contracts. The first is the residential lease that determines the overarching time period of the rental agreement. The second contract is known as an option agreement, which allows the homebuyer the—you guessed it—“option” to walk out of the deal at the end of the rental period.

A lease-purchase agreement also consists of two contracts. The first, the residential rental agreement, is identical to that of a lease-option deal. The second contract, however, is a contract for sale. This agreement obligates the buyer to purchase the home at the end of the rental period. A lot of times, a lease-purchase agreement is set up to ensure that if the buyer breaches one contract, both are breached.

A Strong Option for Buyers

A rent to own agreement may seem heavily slanted toward the landlord at first, but it’s also good solution for a lot of homebuyers. One of the most common types of buyers who opt for a rent to own agreement is families with rough credit histories. A rent to own agreement allows these buyers to get a jump on owning a home and repairing their credit score.

I find that locking in a home purchase price two years before purchasing it is also an excellent way to make sure that buyers can save for a set amount without worrying about the Canadian real estate market inflating the price of the home by more than four percent each year on average.

In the meantime, homebuyers can put their personal touch on a new home. They can repaint and buy accent furniture. They can hang pictures and truly make the place their own. That’s something magical for prospective buyers because they’re investing emotionally as well as financially in their new home. Of course, that’s good news for the seller or real estate investor, too, because the more invested a renter/buyer is, the more likely they are to carry through with the agreement.

Why Should I Invest in a Rent to Own Agreement?

In addition to the goodwill you’ll garner in the community, there are plenty of financial reasons to opt for a rent to own agreement.

First, the investor’s patience is rewarded with the bonus payment at the beginning of the arrangement, Then, there is a steady stream of income throughout the rental period. Finally, when and if the house does sell via a traditional mortgage, it will often do so for the above-market value. In other words, if you’re willing to bide your time, a rent to own agreement can be extremely lucrative.

A nice fringe benefit of being a rent to own landlord is that a lot of the day-to-day maintenance costs are covered by the renter/buyer. After all, the assumption is that they are working to purchase the home, so why shouldn’t they start taking care of the place? The amount you’ll save on upkeep to your property could be enormous. The exception here is a lease-option agreement. During those rent to own setups, the landlord is often expected to take care of maintenance costs until the buyer officially makes an offer on the home.

So, it seems that for the right investor, a rent to own agreement can be extremely profitable. It just comes down to one major consideration. To make a successful go of a rent to own deal, you need to find the right tenant.

Remember: You Need to Put the Work In

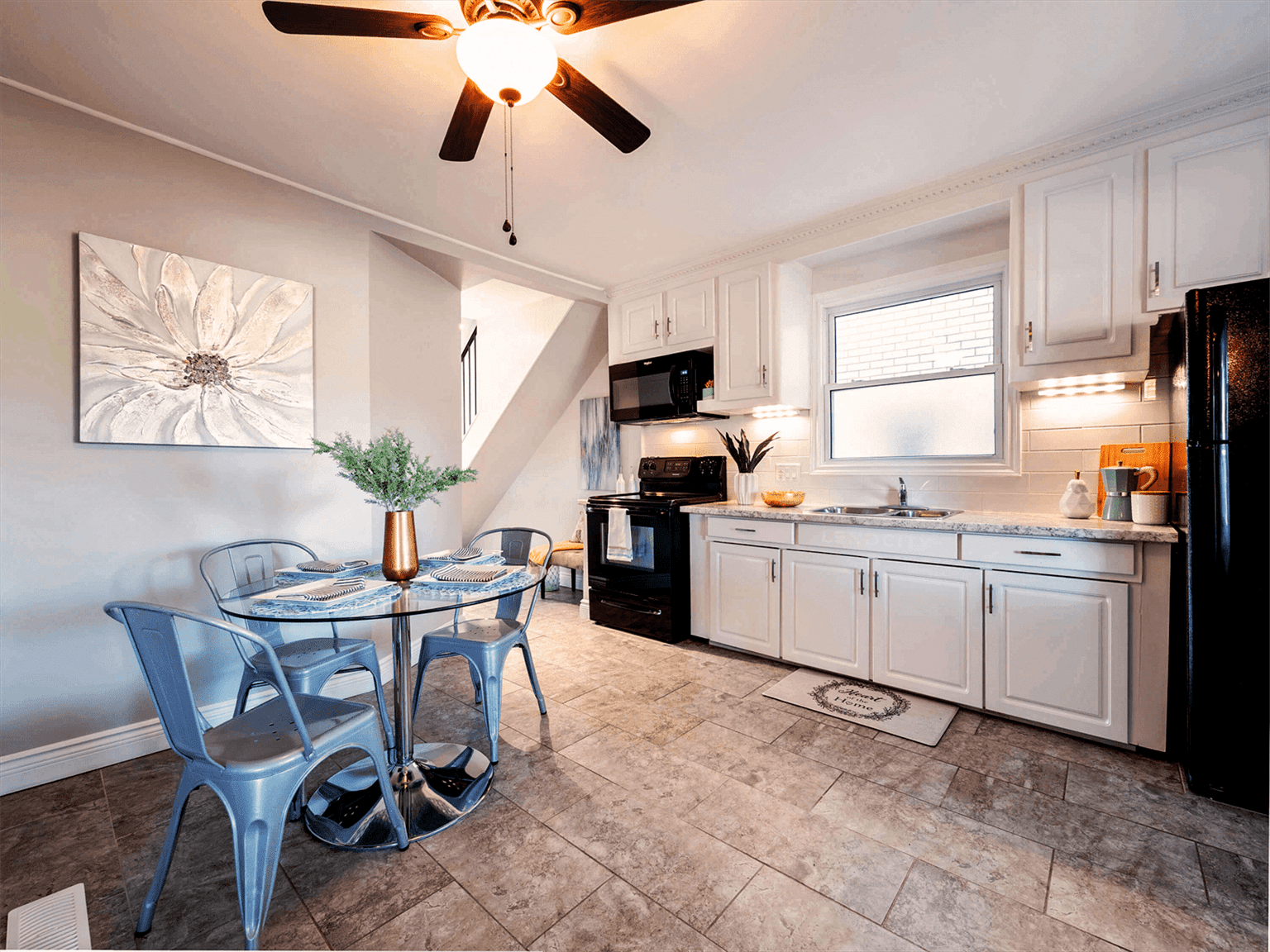

One of the most critical parts of securing a great rent to own tenant is attracting the right rent to own tenant. As a result, it’s important to make sure that you are keeping the property in good shape and making any necessary updates. A rigorous schedule of preventative maintenance is essential if you’re hoping to draw in someone willing to put the time, money and effort into maintaining a rent to own agreement.

Check Your Buyers Employment and Income

Just because a renter has a poor credit rating doesn’t mean that they aren’t making decent money. Before you move in a potential rent to own buyer, make sure that they have an established source of regular income that can cover their monthly rent, and that has been steady for at least the last six months.

If your renter is working on improving their rating to a point where it can qualify for a mortgage, you may also inquire as to whether or not they’ve taken steps to improve their credit score outside of paying regular rent to you.

Download your FREE Printable Excerpt for this Step By Step Guide

Check All Buyer References

A renter who wants to buy their own home may have the best of intentions when they begin a rent to own agreement, but intentions don’t cover your back if the renter defaults on one or both contracts. As a result, it’s important to check their references (contact their employer and other provided references) so that you can be confident that they can cover their part of the bargain.

Ask For a Letter From The Buyer

Typically, this is a move reserved for only the most competitive real estate markets. Fortunately, if you’re living in pretty much any Canadian province, you are more than likely investing in an extremely competitive real estate market. If you want to get a feel for the kind of person you’re dealing with, you can ask for a letter from the buyer. You can ask for a bio or a few reasons they are hoping to buy the home, for example, but you can make the topic anything you want. The goal is to ask a buyer to provide insight into their personality.

Typically, a motivated buyer will have their excitement and motivation reflected in their letter. I find this helps to reassure that the buyer is going to put in the necessary work to raise their credit and secure a mortgage at the end of the agreement.

What Stage of Life is the Tenant In?

Finally, while you’re getting to know your prospective renter/buyer, you should consider what point they are at in their lives. For example, statistics indicate that expectant families are more likely to settle into their current surroundings for a long time to come. (So are pet-owners, incidentally.) Knowing these facts about a potential buyer can determine the plausibility that they will go through with the home purchase.

However, it is important to ensure that you do not use the tenants family-status, pet ownership, or stage in life to determine their viability as a tenant. Using these as the deciding factor against a tenant can be perceived as discriminatory and illegal.

Unlock Your Investment Potential

If you are ready to unlock your investment potential and generate meaningful wealth, let us help you get started. Book a strategy call with me and my team today and we can help you build a real estate portfolio that can stand the test of time through rental properties, real estate development, rent to own real estate and more.