Rental Property Cash Flow Analysis: Step by Step Guide

There are a lot of factors that go into any real estate investor’s decision to pursue and purchase a rental property. However, one of the most important ones to keep in mind if you are looking to build a profitable real estate portfolio is a property's cash flow.

I find that most of the time, investors are looking for properties that bring in meaningful amount of cash flow each month. Sometimes people look for other things, but cash flow is certainly one of the most common things to look for.

However, while investors are constantly searching for properties that bring in cash flow, there are often conflicting opinions on the right way to do it. So, in order to help you calculate your profits, let me show you how to complete a rental property cash flow analysis.

What is cash flow?

It’s important to first have an understanding of the terminology. First and foremost, the concept of cash flow is more or less means “profit after expenses” —that is, it’s the income that’s left over for you once all of the expenses are paid. It’s important to remember that cash flow isn’t just “rent paid to me minus the mortgage payment that I’m responsible for.” There is far more to cash flow than this, and property owners need to understand the expenses that can come along with a property.

In my experience cash flow is one of the main motivating factors for investors to enter the world of real estate investing. That is because cash flow is the 'passive income' that investors are constantly on the hunt for. Of course in reality, real estate is a very hands-on industry so your 'passive income' may feel a bit more like actively seeking cash flow at the beginning.

Controlling Your Mortgage To Manage Your Expenses

If you are looking to cut down on your expenses and maximize your cash flow, your mortgage can be a great place to start. Often, it is possible to lower your monthly mortgage payments through extending your amortization or refinancing the property to a lower available rate. This frees up more of your rental income for sweet cash flow. Also, mortgages tend to be the largest property expense, so it's important to save money here.

That is why whenever I am working with an investor who is looking to maximize their rental property profits, I will take the time to look over their mortgage options in order to help them find the one the offers the most flexibility at the best rates.

If you would like to learn more about how controlling your mortgage payments can help you manage your expenses better, book a call with a member of our team by clicking the previous link or the button below and we will gladly assist you.

What are some common expenses?

There are a variety of expenses you need to consider when you are completing a rental property cash flow analysis. Some of them are easy to remember such as your mortgage payments, taxes, and insurance payments. However, there are a few more I encourage you to consider.

Some of the other common expenses you should include in your analysis are:

- Vacancy Rates/Expenses

- Leasing Fees

- Property Management

- Maintenance Costs

- Repairs and Renovations

- Professional Fees (Cleaners, Realtors, Inspectors, Etc.)

- Utilities (Unless Paid By The Tenant)

- Marketing and Advertisement

There are also other hidden or situational costs that can impact your cash flow if they apply to you. These include:

- Home Owners Association (HOA) Fees

- Appliance Replacement

- Business Licensing

- Property Depreciation

Even if you are not spending money directly on these expenses month-to-month, it can be valuable to keep them in consideration on your rental property cash flow analysis so that you do not find yourself in a tough position after a high-expense month.

Download your FREE Printable Excerpt for this Step By Step Guide

Did you pay cash?

While most investors typically need to secure financing in order to purchase a property, some investors are capable of buying a property in cash and living mortgage-free.

In this case, your properties cash flow and net operating income (NOI) will be the same. This is where things can get a bit confusing because NOI and cash flow are still two different things. As a result, you rental property cash flow analysis may look a bit different than it would on another property.

NOI is income minus expenses but assumes that you have no expenses in the form of debt service (mortgage, etc.). Cash flow does factor in the money that goes along with debt service, so whether you’re paying cash or not will affect which one of these metrics you will find most useful.

Similarly, if you are calculating cash flow on a property you have already paid off the mortgage, your cash flow will match up with your NOI.

However, if you were to take out a line of credit, mortgage or secure a loan against the property, you would need to begin factoring those costs into your rental property cash flow analysis.

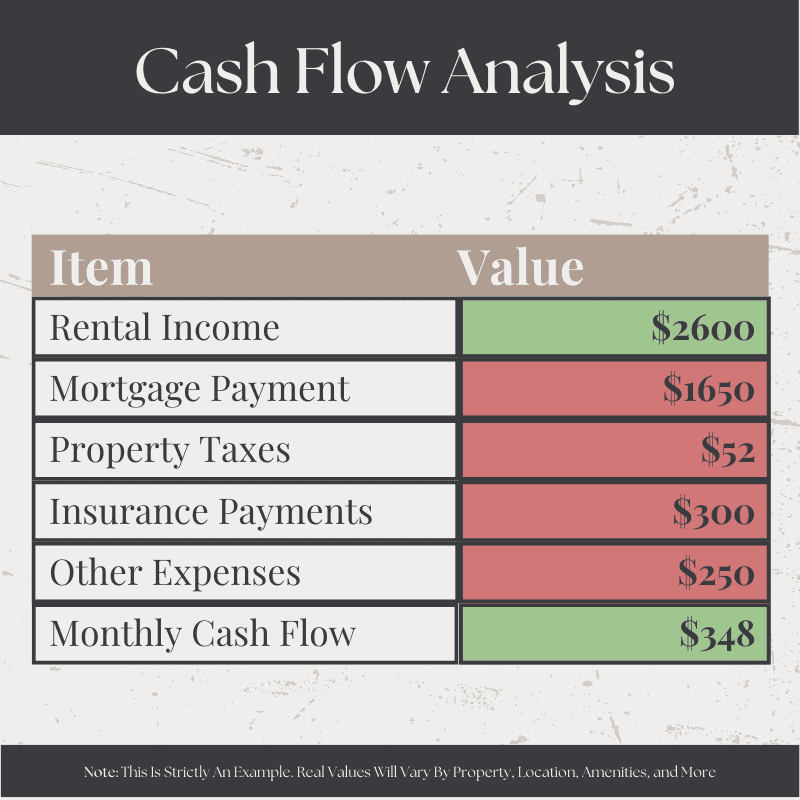

Completing a Rental Property Cash Flow Analysis

When you are looking to analyze the cash flow potential, it is important to complete a rental property cash flow analysis.

Typically, I will do this for properties I already own to get a clear picture of how much each property cash flows. However, you can also complete an analysis of properties you are looking to buy by using fair market rent and estimated expenses or data from comparable properties to give you a reliable estimate.

There are a variety of ways to calculate cash flow, but in order to make the process quick and simple for you, I would like to share a special tool - our free rental property cash flow spreadsheet.

By using this simple cash flow property calculator, you can get an estimate for your properties cash flow potential. However, for the sake of transparency, is the calculator is not a replacement for a full analysis from an accountant.

Here is the Rental Property Cash Flow Calculator we use!

Mortgages make a difference

It goes without saying that if you have a mortgage taken out on a property, your cash flow is going to be less. Your monthly mortgage payments bite directly into your profits, so when you are looking for a cash flowing property, it is important to look for properties where you can maintain a manageable mortgage payment that you can reliably afford.

I know I have seen investors walk away from properties that held a ton of potential because their financing ate away too much at their cash flow to make the investment worthwhile. So, in order to prevent that from happening my team is dedicated to bringing the best available financing to investors like you. All you need to do is simply book a call with a member of my team by clicking the previous link, or by clicking the button below and we'll start started today.

Building equity

Once you’ve established your cash flow potential, it’s possible to then figure out how quickly you’re building equity in the rental property. All you need to do is take your monthly cash flow and then add the principal portion of your mortgage payment to this figure. That will give you the total amount of cash going into your pockets, either now or in the future when you eventually sell the property.

When you arrive at this number, you can multiply that figure by 12 (12 months in a year) to give you your annual return figure—a useful number to know, as it tells you how much money is coming back to you in a typical year.

Calculating the rate of return

Another metric that you can calculate is the rate of return. This is also known as the return on investment or ROI, and it needs to be calculated for any investment, from stocks to bonds to real estate. Your rate of return is how your cash flow relates to the cost of your investment (also known as your “basis”) —expressed mathematically, this is cash flow divided by investment basis.

To determine if you’re getting into a solid investment or not, it’s worth understanding some comparable figures in other common investments. The stock market historically has returns of 8-10 percent annually, while a high-interest savings account can be more like 2-5 percent. A certificate of deposit (CD) is usually somewhere in the middle at around 5 percent. If your rate of return is going to be something like 1 or 2 percent, you likely should look into finding another rental property to purchase or look into another investment opportunity that can offer more consistent bang for your buck.

Frequently Asked Cash Flow Questions

How Much Cash Flow is Good For a Rental Property?

While the average rental can be expected to earn $200-$300 per month in cash flow, some investors only pursue rentals that generate more.

Alternatively, many big-city investors in markets such as Toronto will willingly take properties that make a negative cash flow - or lose money - because the potential for appreciation and viable equity is so great.

Is Cash Flow The Only Way to Profit On a Rental?

Another common way to make money on a rental property is to find ways to encourage appreciation and build equity in the property.

As well, many investors will use their rental properties to take advantage of various tax incentives and benefits that are designed to help them make money.

Should I Use An Accountant To Complete My Cash Flow Analysis?

If you are simply gathering an estimate for personal reference, you may be fine simply using a rental income calculation worksheet or a cash flow calculator.

However, if you are looking for a precise number in order to work on a deal or organize your finances, an accountant's assistance can be invaluable.

Which Properties Cash Flow The Most?

However, multifamily and commercial properties often have some of the highest cash flow yields when managed properly.

In summary

There are several guides and math equations that will help you figure out exactly how much you can earn on a rental property in a given amount of time. Understanding exactly what you can afford and how tightly you’ll be stretched on a mortgage is the first step towards figuring out your cash flow.

If your mortgage payments are more than you can afford, then that will affect all of your other decisions. We also believe that it’s never a bad idea to work with a qualified financial professional if you feel that calculations like this can be a bit out of your depth. It is always a good idea to seek the expertise of as many resources as possible. Since real estate investment requires a good deal of capital and serious time commitments, you’re wise to do as much research as possible before signing on the dotted line.

So, if you are ready to start investing in cash flowing rental properties, let my team get you started by helping you secure the best available mortgage financing for your next investment property. To get started, simply book a call with us and we will gladly begin searching for you.