Renting Your Home: Step By Step Guide - New

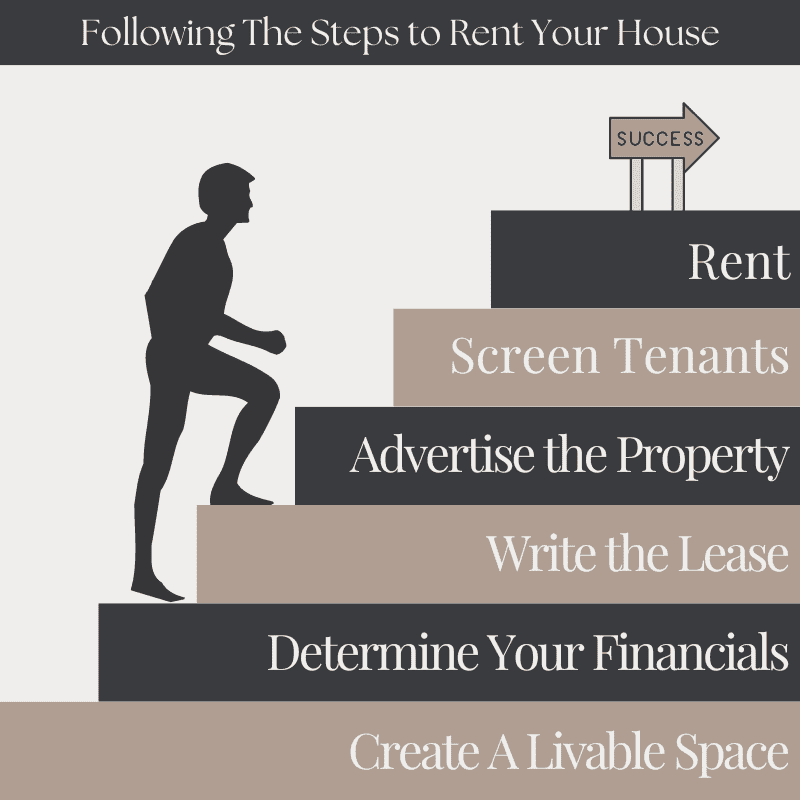

One of the most daunting obstacles any new investor faces is renting your home. You spend so much time planning for the purchase of the house, you don’t realize you eventually need to fill it with a tenant. Purchasing a home might seem like a monumental task but getting ready to follow the steps to renting your house is even more extensive.

There are plenty of steps to renting your home that you will need to follow, but do not get intimidated. After all, there are plenty of ways to streamline and get help along the way.

Remember that taking the time to properly follow the steps to renting your house is crucial to finding long-lasting real estate success. As well, with each new home you rent, the process of finding a tenant will become easier. If you’re just getting starting renting your home, here’s a quick guide for getting up and running.

However, before you start renting your home, it may be worth your time to give my team a call to ensure that your home's financing is properly structured for rental property investing. All you need to do is click the link right here and book your free call today.

Steps to Renting Your House

If you are getting ready to follow the steps to renting your home for the first time, do not worry. While the market may feel intimidating at first, the truth is that as long as you keep things organized and remain proactive, the process it much smoother than it may sound.

So, before we get into all of the steps to renting your house, let's establish an honorary step one - do not panic. You have all of the skills you need, now it is simply time to put them to work.

Create a livable space

This is one of the first steps to renting your home that you will need to think about, but it is still just as important as the others.

Once you own the home, you’ll need to start updates and renovations before renting. In some cases, this is as easy as changing the locks and patching up the drywall. In extreme cases, you might’ve taken out a cost-plus-improvements mortgage ahead of major renovations, like roofing and foundation work.

Most often, the work will lie somewhere in-between. Record everything you do to fix up the house and figure in the costs—they’ll be important when it comes time to determine the financials.

If you are unsure of where to start working on a property, remember one of the biggest rules for renting your home is to avoid making a property you want to live in. Your job is to make a home that other people would like to rent.

Determine the financials

Once the home is physically ready for tenant occupation, spend time running the numbers to figure out what you need to charge.

Start by determining the cap rate of the home. How long will it take you to recoup the cost of your investment through various rent cost models? Next, look at local markets for comparables. How much are similar buildings renting for? Look at similar rental listings and aggregate different price points into your rent planning. Factor in the cost of your mortgage, any improvements made and premiums for management companies or ongoing maintenance.

When you have a number, run it through cost models to make sure it stacks up with your investing approach.

Download your FREE Printable Excerpt for this Step By Step Guide

Get a Rental-Friendly Mortgage

This will not apply to properties you own outright, but if you are trying to learn how to rent out a house with a mortgage, you need to start by getting a rental-friendly mortgage.

Ideally, if you want to operate a successful, cash-flowing rental, you want to keep your monthly mortgage costs low.

That means that one of the first things to do before renting your home is to make sure your mortgage financing is set up in order to support the rental.

This can be done through a variety of means such as extending your amortization period in order to reduce your monthly payments, or being strategic with the lender you work with.

If you are interested in getting rental-friendly mortgages for your investment portfolio, my team and I are here to help you. All you need to do to get started is click the link here to book a strategy call or click the button below.

Write your lease agreement

Before you start advertising renting your home to potential tenants, make sure you have a lease agreement prepared. This is the code by which your tenants will abide and will outline the responsibilities of both you and your tenant. Include the essentials, such as:

- Names of tenants

- Address of the property

- Lease term length

- Rent amount

- Security deposit amount

- The move-in condition report

- Provisions (smoking, utilities, maintenance)

While you are writing your lease agreement, I suggest that you have a lawyer review your lease—especially if you model yours on a template. That way you can rest assure that your lease is completely legal and enforceable. Otherwise, you may find yourself in trouble further down the line.

Keep two copies of the lease handy—one for your records and one for your tenant.

Typically, out of all of the steps to renting your house, this one will look the most similar between properties. After all, you are likely going to maintain the same rules between most of your properties.

Advertise that your renting your home

You can put up an advertisement just about anywhere and get rental inquiries, but that doesn’t mean you’ll draw good candidates. You want to attract tenants with good rental histories, the means to pay rent and people who will respect your property. To appeal to these types of people, you need to advertise in the right places.

I find this to be one of the most fun steps to renting your house because it allows you to be creative with how you advertise. Take the time before listing to take creative photos or create a video walkthrough of the property. These will help you stand out amongst other properties on the market.

Place your ad on popular listing sites like Zillow and Kijiji. Use plenty of pictures, a well-written description and a thoroughly listing of amenities. Keep in mind that most people are browsing by price and area, looking for locations that stand out. Catching their eye with your photos will help attract more prospects and a wider range of applicants.

Another popular online listing option I have seen expand in recent years is Facebook Marketplace. As one of the leading social media platforms, Facebook's rental listing system has excellent visibility and can help you find potential tenants rather quickly.

Outside of online listings it’s always smart to put up a yard sign and leave hang-ups on local bulletin boards. Your flyer in a coffee shop might attract a tenant combing the board, just as easily as a yard sign might grab someone’s attention as they pass.

Alternatively, if you would like to learn how to rent your house privately, I would suggest calling a property manager. Often they are aware of renters in search of accommodations, or private groups for tenants to search for rentals.

Evaluate prospective tenants

Once the applications come flooding in, you’ll need a yardstick for evaluating them. Eliminate anyone who does meet the basic qualifications of being able to provide proof of employment, stable income or record of good tenancy. Pull a full background report and evaluate the following factors:

- Income and job history

- Criminal record (including felonies)

- Financial history (including bankruptcies)

- Proof of employment

- Prior evictions

You’re not necessarily looking to qualify someone—you’re looking for red flags that might disqualify them. Be wary of people with black marks on their record or lack of history. Remember, you can always ask for a guarantor on the lease, but it’s still worth disqualifying people who may not have the history or means to be good renters.

I also suggest getting an impression about a tenant's personality during a screening. That way you can get a clear impression on who your tenant is and how easily you will be able to work with them. Sometimes a tenant who looks great on paper can still be incredibly troubling, this step should help you avoid that problem.

For tenants who pass the background, you’ll want to further inquire about current proof of employment and the number of people who’ll be renting your home. Income should be two to three times more than rental fees and there should be no more than two people per bedroom.

Out of all the steps to renting your house, this is the one where you need to be the most cautious. Otherwise you may allow a neglectful and destructive tenant into your rental.

Important Tip: If you get the employment info and the tenant stops paying rent or damages your property, you could garnish their wages through small claims court.

Sign the lease agreement

Finding the right tenant might take a little time, but it’s worth it. A responsible, stable tenant is the key to positive cash flow when renting your home. When you do find this person, it’s time to sign the lease agreement.

As part of this process, you’ll need to do the property condition walk-through. Take the tenant through the house and document anything out of the norm—scuffs, scratches, appliance problems, exterior issues and anything else. This protects the tenant from liability and gives you a standard to match up to future inspections. You’ll also need to get the security deposit before move-in and set the move-in date.

I also suggest that you use this time to also answer any tenant questions before they move-in. It can help clear up any confusion that might arise from the rental agreement.

Once this step is completed, take a moment to congratulate yourself and let out a sigh of relief. After all, you have completed the primary steps to renting your house and can now move on to the fun stage of collecting rents and making money.

Manage your home

Now your tenant has moved in and is paying rent! The last thing to consider is upkeep. I like to consider this the one of the final and ongoing steps to renting your home.

From living in your house to renting your home

A popular investment method among people looking to get started in real estate is house hacking.

This is the process of using your own home as a rental property by renting out individual rooms, separate units or even the entire property as a short-term or long-term rental.

In other words, you can use the steps to renting your home to rent your own home as well.

By doing this, you can reduce your own living expenses by sharing those costs with your tenant. As a result, you should have more money available to save up for future investment properties.

I have seen many real estate investors use this method to kickstart their careers by leveraging their home into their portfolio.

How to Secure Reliable Rental Property Financing

Naturally, before you can start following the steps to renting your house, you need to be able to purchase one and that starts by securing financing for your property.

However, between finding the right lender and locating the correct mortgage products, it can be a lot to manage while you are focused on your portfolio.

Instead, let me and my team simplify the process by handling the shopping and negotiations for you to get the best rates so that you can spend more time building your investments.

To get started today all you need to do is book a strategy call at the link here.