Using Rent Payments to Improve Credit - Important Credit Reporting Impacts in 2023

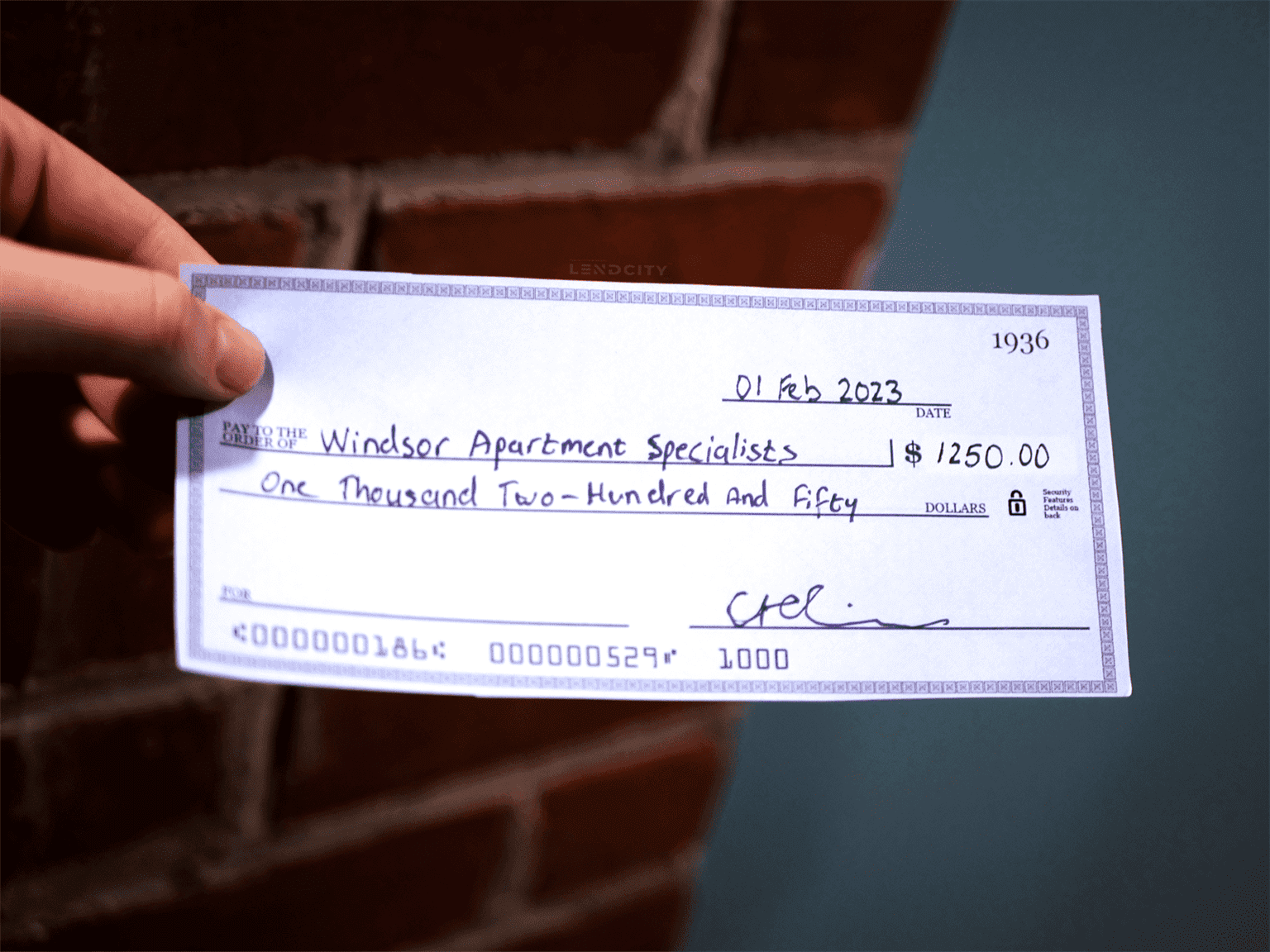

Housing makes up a huge portion of the average Canadian household’s budget and rent payments tends to be an even bigger percentage. In fact, rent is the biggest monthly expense for Canadians who don’t own their own home. Paying rent is a big responsibility, and the fact that consistent on-time payment hadn’t been seen as a positive towards someone’s credit rating was an oversight for many years.

Fortunately, this was recently corrected, and responsible rent payment will begin to have a positive effect on the credit ratings of millions of Canadian residents. As a real estate investor, this will affect you in a few different ways, so it’s important to explore how this development could prove beneficial for your investments and for your business.

While tenants are capable of reporting their rent payments themselves, if you would like to learn about how you can do it for them and how that will impact your financing, click the link below to book a free strategy call today.

Fairness in housing

Owning a home is becoming increasingly difficult for many people, and this disparity between renters and owners was a large factor. A homeowner could accumulate massive credit card debt for years, while a renter could make on-time rent payments for a decade, and the impact on their credit ratings would be virtually the same. This served as a significant roadblock to people looking to attain the dream of homeownership, but these new rule changes requiring the Landlord Credit Bureau (LCB) to share rent payment data with Equifax will go a long way towards levelling the playing field.

These changes will benefit two groups that have traditionally fallen behind in homeownership rates – young people and recent immigrants. By their very nature, credit histories are constructed to favour people who have had a long time in a particular country. They’ve had the chance to open credit cards and make consistent payments on them and had the opportunity to buy a car and faithfully make the monthly payments. They may even have had a mortgage or two, which has given them an even strong credit history. Immigrants and young people haven’t usually had these same advantages.

Because these demographics have not had the time to build up an appreciable credit history, they’ve traditionally been left behind when it comes time to buy a home. The fact that renting is now seen as a responsible mark in their favour will help them build a credit history that makes them much more appealing to lenders.

Landlord responsibilities to report rent payments

As a property owner and landlord, you do have a role to play in these developments. Data about rent payments does not get forwarded automatically, so you need to be proactive and report on-time payments to the LCB. Only with your cooperation can your tenants reap the rewards of responsible payment habits. So far, the LCB reports that the overwhelming majority of records that they get from landlords are positive in nature, so the system is already working well for all parties.

You also need to build this language into your lease agreements. You are sharing personal data, so some legal caveats need to be addressed. The LCB has several sample clauses on their website that you can easily work into leases so that tenants know and agree to the fact that their payment history is being shared with a credit bureau like Equifax.

The effects of COVID-19

The COVID-19 pandemic has wrought havoc on the real estate market for a variety of reasons. Inventory has shrunk and prices plummeted in many places, but things are starting to rebound. One effect that the disease has had is that many Canadians were left struggling to make rent, and many understanding landlords struck deals for reduced or forgiven payments as we all worked through this situation the best that we could.

Renters who have come to these sorts of agreements will benefit from these new credit reporting rules. Even though their payments might not be for the exact amounts that were originally in the lease, they still represent faithfully keeping their end of the arrangement. As a landlord, you have some responsibility if you’ve entered into such a deal. It’s up to you to faithfully report this data and keep rendering positive tenant reports. This will go a long way towards fostering trust and ensuring that you can continue to attract high-quality and loyal tenants.

Furthermore, this benefits tenants because it means the COVID-19 pandemic hasn’t caused their lives to grind to a complete halt. They have enough to worry about, so it’s a positive development that their credit history can continue to strengthen even amid such uncertainty. It never hurts to be seen as a fair and benevolent landlord, either.

Discover Residential Property Management With This Step By Step Guide

Final thoughts

The LCB has long been a useful tool for tenants and landlords alike. Property investors can use it to search the Tenant Records database, which helps you avoid disruptive or delinquent tenants. The organization has also helped landlords collect payment from non-paying tenants – a valuable resource to have on your side.

Overall, the fact that making a rent payment on time can now affect credit history can have a few impacts on you as a real estate investor. If you own rental properties, you can participate in this data exchange program and help demonstrate to your tenants that you’re willing to help them by any means necessary, which builds trust. Advertising the program and your participation in your rental ads can be an eye-catching hook for potential tenants.

If you’re an investor who prefers to sell or flip houses, the pool of potential buyers is expanded significantly thanks to these changes that make a mortgage more attainable for millions. People who might never have dreamed of having the credit background to own a home will now have much more data on their side. While this is more of a long-term goal, a rising tide lifts all boats. Tenants who now have the confidence and satisfaction that their positive behaviour will be justly rewarded will be much more likely to demonstrate the loyalty and respect that all parties deserve.

Once again, while tenants are capable of reporting their rent payments themselves, if you would like to learn about how you can do it for them and how that will impact your financing, click the link below to book a free strategy call today.