You Need Great Investment Property Insurance on a Fix-and-Flip in 2023

When you’re breaking into real estate investment in Canada, one of the most likely points of entry is the fix-and-flip. For those people who don’t feel willing to take on the long-term duties associated with buying a home and renting it out to someone, purchasing a fixer-upper and then reselling it for a higher price is the next best thing.

But is is necessary to get property insurance for these projects? Almost certainly. Flipping is already so risky, going in without property insurance is asking for something to go wrong.

So, if you would like to hear first-hand the benefits of insuring your flips, click the link below for a free strategy call today.

Finding your fix-and-flip

Finding the right house to purchase for a profit is more challenging than ever before in Canada. The robust housing market has spawned several motivated, educated buyers. That means finding the right home can be tricky. Here are some basic steps:

- Look for up-and-coming areas, like those with new businesses.

- Find a home that requires maintenance and is priced accordingly.

- Scout the average cost of surrounding homes.

- Fix the damage, add new fixtures and price the home at or around the same price as your surrounding homes.

That boils the process down to a few simple steps, but in truth, finding the right house, making the repairs and getting to the point you want to sell the thing can be enormously challenging. More than that, it requires a sizable capital investment.

A lot of novice investors make the mistake of believing their capital investment is a risk they’re taking without backup, like walking a tightrope without a net. That’s far from the case. When you invest in a rental property, you can also purchase what is known as landlord’s insurance.

Protecting your investment

Investment property insurance, or landlord’s insurance, is designed to cover your losses in the event that things don’t go according to plan. It comes in two primary types: replacement coverage and actual price value. Actual price value insurance is cheaper but only reimburses you for the costs you initially paid. Replacement insurance costs more, but it covers the costs of replacing whatever you’ve lost, up to and including the complete rebuild of a home.

“Actual price” and “replacement” are umbrella terms that apply to the types of payout you’ll receive for whatever property insurance you get. In practice, several different types of property insurance cover all manner of property investment.

Discover How To Flip A House With This Step By Step Guide

But wait: I won’t be a landlord

All this begs the question: do you really need landlord’s insurance if you’re planning on sprucing up the property and then selling it as soon as possible? The term “landlord’s insurance” is a misnomer. There are plenty of types of investment property insurance that benefit fix-and-flippers, too. Here are some of the most critical.

Liability insurance

When you put your fix-and-flip on the market, you will need to stage the home to get the best reaction from potential buyers. While beneficial for your sales strategy, staging the house also opens up the possibility that some criminals will walk into your investment property and grab anything that isn’t nailed down. In these cases, liability insurance can be a lifesaver.

Loss of income insurance

Ideally, you’ll purchase your rental property, add the necessary improvements, put it back on the market and sell it without a hitch. As you’re probably aware, life doesn’t often play out so smoothly. When you find that your home is on the market for longer than you intended, loss-of-income insurance can bridge the gap between now and your payday.

Hazard insurance

No one ever expects a tornado to touch down or a flood to roll down the street, but it happens. And with recent patterns of erratic weather documented, the occurrence of disasters is only likely to increase. For those investors who want to protect their property from fire, flood, wind and rain, there’s hazard insurance.

Builder’s risk insurance

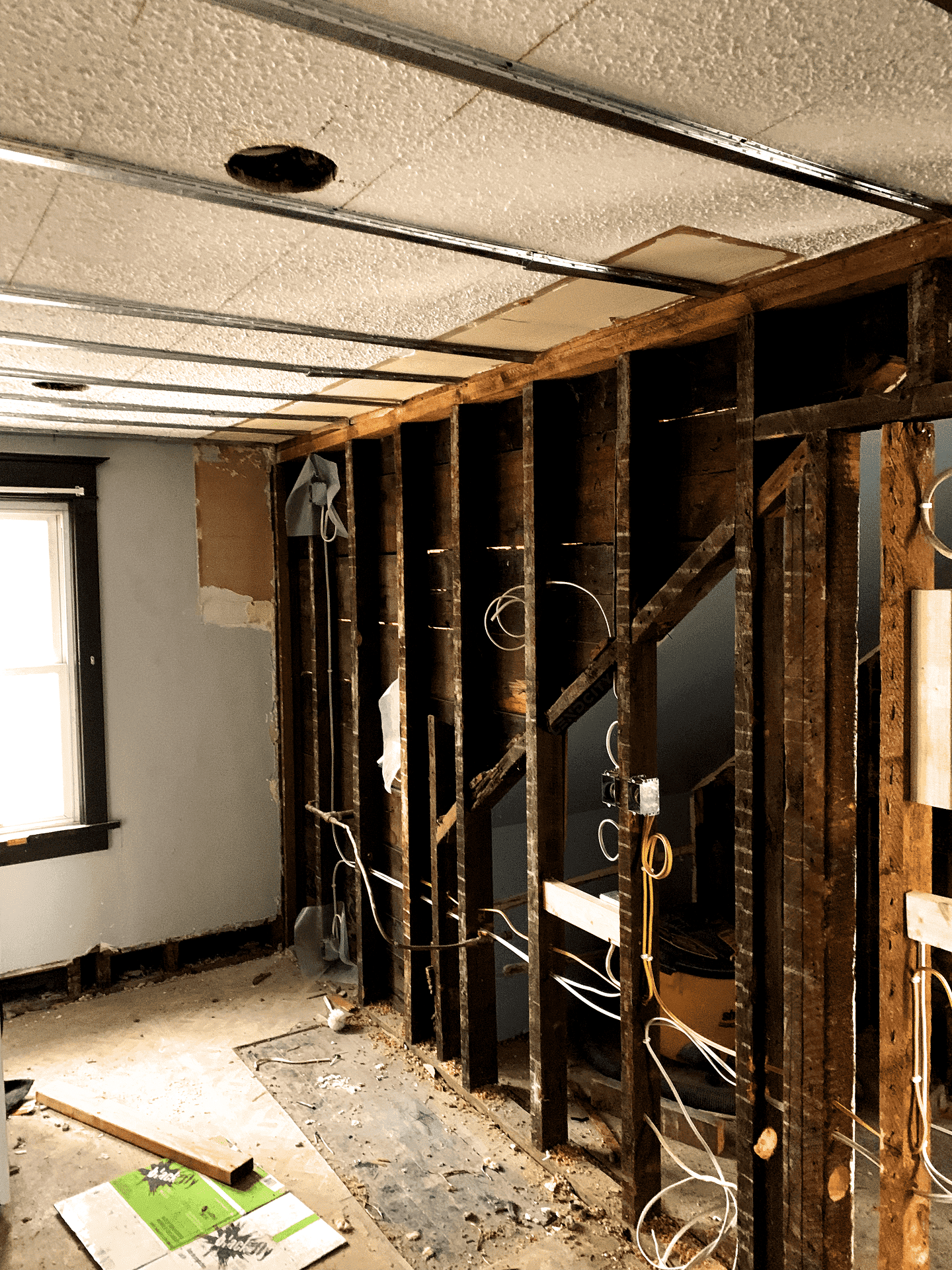

Unless you are a professional contractor, the odds are good that you will require the skills of an experienced technician at some point during your fix-and-flip. After all, “fix” is right there in the name. When you invite a contractor onto your property, you’re also inviting the possibility of accidents, or damage to the structure of your property, of loss of equipment and so much more. Builder’s risk insurance is designed to cover those expenses.

Vacancy insurance

Yes, you don’t want to be a landlord. Here’s the thing, though: more and more experts are suggesting that investors hoping to improve their profits while performing a fix-and-flip on a house should consider dipping a toe in the landlord water. As one RE/MAX agent explained, “I think for flips, in a lot of cases, unless you get an absolute steal, you’ve got to hold it for a while, otherwise, you won’t get your full profit margin out of it.” In the event, you enlist a short-term renter, and they decide to skip out on the bill, you can count on vacancy insurance to cover some of the costs.

Bundle your property insurance

Put simply, you’re going to require some form of investment property insurance if you want to make sure that you don’t run the risk of losing your stake in your investment property. It’s possible that you won’t require every kind of investment property insurance on offer. Those are so numerous we didn’t have the space to list them all here. That said, you will likely enjoy the security of insurance if and when something goes wrong.

What’s more, you will probably need more than one type of investment property insurance to properly cover yourself. In these cases, insurance providers can offer bundles of various types of insurance. If you’re willing to sit down and work alongside an insurance broker, they can provide a customized bundle that can maximize your coverage and decrease your overall costs.

It’s never a bad idea to set aside some of your capital and make sure that, even in the event your investment experience doesn’t turn out the way you’d hoped, it won’t be a total loss.

If you would like to hear first-hand the benefits of getting property insurance for your flips, click the link below for a free strategy call today.