Real Estate Debt vs. Equity: Should You Pay Down Your Mortgage or Purchase New Investments in 2023?

Choosing the right kind of mortgage to use as a real estate investment vehicle, as well as the safest way to pay it off, can be a difficult decision for potential investors.

Depending on your investing goals, you may want to see the advantages of leaving your capital as liquid as possible so that you can continue to develop your real estate portfolio. On the other hand, investors might choose to pay off their whole mortgage early to alleviate their real estate debt load.

While real estate debt may sound like a bad thing, the truth is it is a valuable tool that can be used in a variety of scenarios. To learn more and to get started, click the link below to book a free strategy call to discuss real estate debt with our team today.

What is the Most Appropriate Option for You?

In the end, whether or not you can pay off your mortgage quickly is determined by the personal situation and the terms of your loan. Before considering whether to pay off their mortgage in advance or use their liquid resources for further investments, investors should weigh six factors. There are some of the variables:

- Inflation expectations

- Your tax tariffs

- Your expected rate of return

- Your mortgage interest prices

- Local Real Estate Appreciation

Your choice can also be influenced by the kind of mortgage you have. For example, if you have a closed mortgage on your investment property, you may want to stop paying it off too quickly to avoid paying unnecessary bank fees.

If you have a high-interest open mortgage, you can intend to pay it off as soon as possible or minimize the amount you owe on principle to boost your bargaining position when it is time to refinance.

When deciding whether to pay off your real estate debt or retain your liquidity, it is important to weigh both of these factors. In addition, when determining how to pay off your real estate debt, you can also consider personal considerations such as your investment goals.

Advantages of Paying Down on Mortgage

There are clear advantages of actively paying off a mortgage. Specifically, you will increase your wealth and total net worth by doing so. Here are only a few of the most compelling causes to think about paying off your investment property's debt as soon as possible:

Saving Money on Your Interest

One of the many advantages of paying off your real estate debt early is that you will save a lot of money on interest and bank fees. As long as you don't exceed the prepayment limit specified in your mortgage terms, even marginally raising your monthly contributions will save you thousands of dollars in interest payments over time.

Living a healthier debt-free life

The role of real estate debt in many people's lives becomes a psychological health issue. Try paying off the mortgage more quickly if you are concerned with having so much debt and how it is affecting your lifestyle decisions and decision-making ability. You may gain more internal insight as a result of doing so.

A Guaranteed Income

When it comes to handling the residential home, interest payments are often the highest operating cost. You will be much more likely to make a consistent income from your rental property once you pay off the real estate debt. When you manage a paid-off asset, you will be bringing far more money into your wallet rather than into the bank's coffers.

Eliminating Mortgage Insurance

If you buy several homes or put less than 20% down on your investment home, you are probably covered by mortgage insurance. So, when you pay off your real estate debt, you would not have to worry about continuing to pay this monthly bill, which may be cutting into your profit margins.

Discover How To Buy Unlimited Rental Properties With This Step By Step Guide

Advantages of Keeping Your Mortgage

There are some disadvantages of paying off the real estate debt, despite all the advantages. It may be surprising to hear that keeping a mortgage rather than paying it off in full has benefits.

Lacking Liquidity

Having cash on hand is still a brilliant idea. If you put your entire money into paying off an ongoing mortgage, you would not be able to make necessary maintenance if anything goes wrong with the house. You would not be able to take advantage of fresh investing prospects if the funds are locked up in rough investments.

Value is not affected by Mortgages.

The fact that you have a mortgage on your house does not have any impact on its value. This ensures that you can still reply to your investment asset to continue value appreciation regardless of whether you are carrying debt on your financial vehicle. In addition, nobody will care if you already owe on your mortgage when it is time to sell your home.

Savings are Reduced by Inflation

When you pay a fixed interest for your investment property, you pay the same payment per month for the duration of the life of the loan. This means when there is inflation in currency – that it will certainly happen over the course of 30 months, your monthly payments would begin to be felt smaller and smaller, while your interest rate may seem negligible because of the future devaluations of the currency.

Difficulty in Diversifying

If you have heavily invested in a single stock, you will not be able to distribute your investments through other investment options. Any intelligent investor would warn you that putting your all-available resources into a single investment, including one as safe and dependable as real estate, is risky. If the worst happened and the local economy collapsed, you are more likely to lose all your money and have nowhere to turn to for wealth creation.

At the end of the day, whether you want to pay off your debt actively or not entirely depends on your financial status, investment targets, and mortgage terms.

Make an Educated Decision

For certain first-time investors, continuing to make monthly payments on your closed mortgage makes sense as it allows you to use your current liquidity to fund additional future investments. It could make the most sense for you if the existence of the real estate debt is making your life difficult or if you have enough cash on hand to pay off your loan quickly while continuing to invest elsewhere.

Always ask an expert

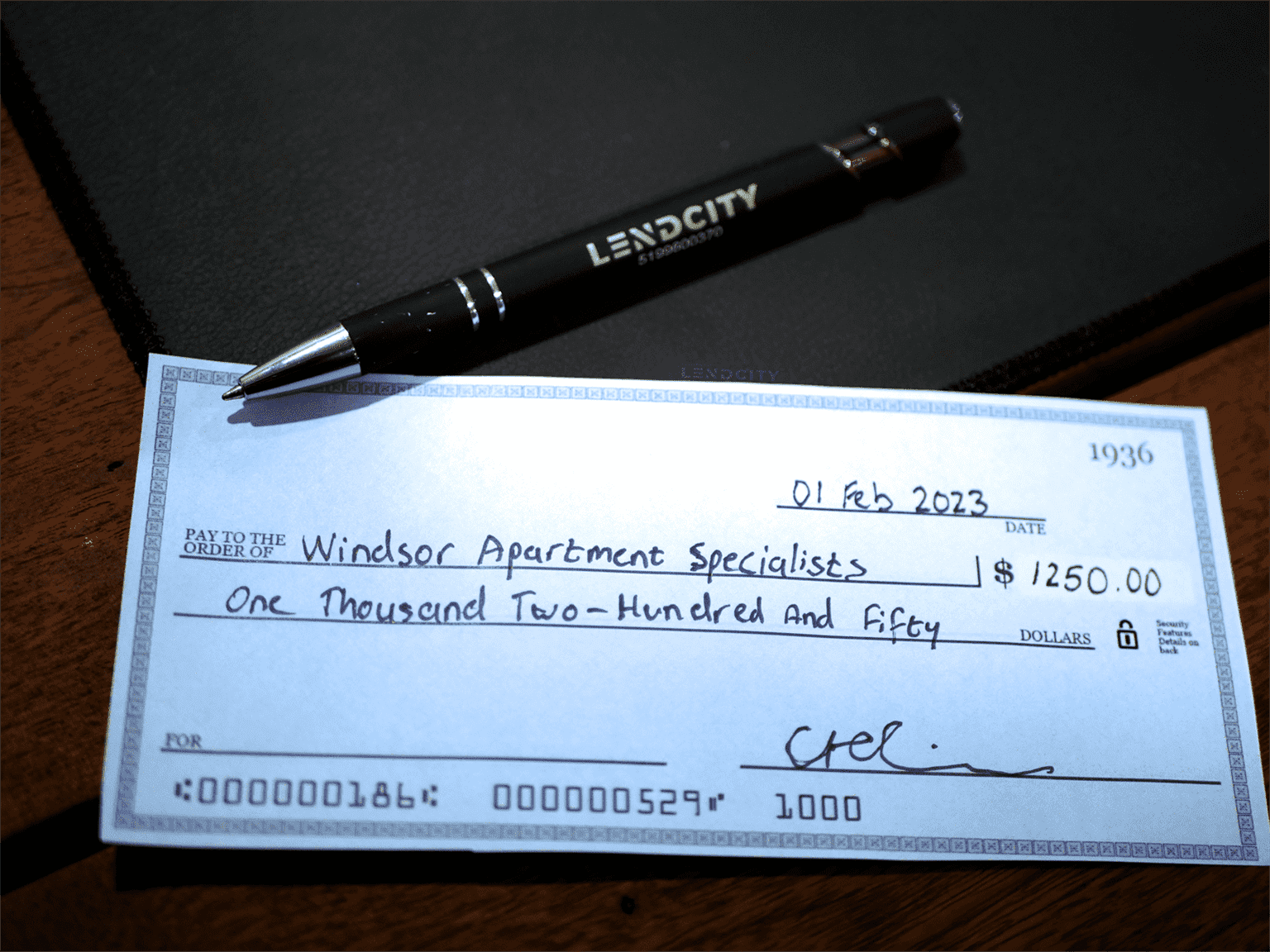

When in doubt, its best to speak to an expert mortgage broker. We recommend LendCity Mortgages. They can be reached at the link above or by calling them at 1-519-960-0370. Alternatively, click the link below to book a free strategy call today.